A Wyoming Post Bankruptcy Petition Discharge Letter is a document issued by the court, indicating that a debtor's bankruptcy case has successfully concluded, and they have been granted a discharge. This discharge releases the debtor from their obligation to repay certain debts, providing them with a fresh start and financial relief after going through the bankruptcy process. The Wyoming Post Bankruptcy Petition Discharge Letter serves as proof that the debtor is no longer legally responsible for the debts that were included in the bankruptcy filing. This document is crucial for the debtor, as it can be shared with creditors, lenders, and other parties as evidence of their discharged status. In Wyoming, there are two different types of bankruptcy petitions that individuals can file: Chapter 7 and Chapter 13. Therefore, the Wyoming Post Bankruptcy Petition Discharge Letter can vary depending on the type of bankruptcy case. 1. Wyoming Chapter 7 Post Bankruptcy Petition Discharge Letter: This letter is issued to debtors who have successfully completed a Chapter 7 bankruptcy case in Wyoming. Chapter 7 bankruptcy involves the liquidation of assets to repay creditors, and upon the completion of the process, eligible debts are discharged. 2. Wyoming Chapter 13 Post Bankruptcy Petition Discharge Letter: Debtors who have completed a Chapter 13 bankruptcy case in Wyoming receive this discharge letter. Chapter 13 bankruptcy allows individuals with regular income to restructure their debts and create a repayment plan spanning three to five years. Upon successful completion of the repayment plan, the remaining eligible debts are discharged. Both types of Wyoming Post Bankruptcy Petition Discharge Letters indicate that the debtor has met all the requirements set forth by the bankruptcy court and has been granted relief from their eligible debts. It is important for the debtor to retain this letter as proof of their discharged status and share it with relevant parties, such as credit bureaus, lenders, or potential landlords, to update their credit report and demonstrate their financial rehabilitation. In conclusion, the Wyoming Post Bankruptcy Petition Discharge Letter is a vital document for individuals who have successfully completed a Chapter 7 or Chapter 13 bankruptcy case in Wyoming. It signifies their release from eligible debts and provides them with the opportunity to rebuild their financial life.

Wyoming Post Bankruptcy Petition Discharge Letter

Description

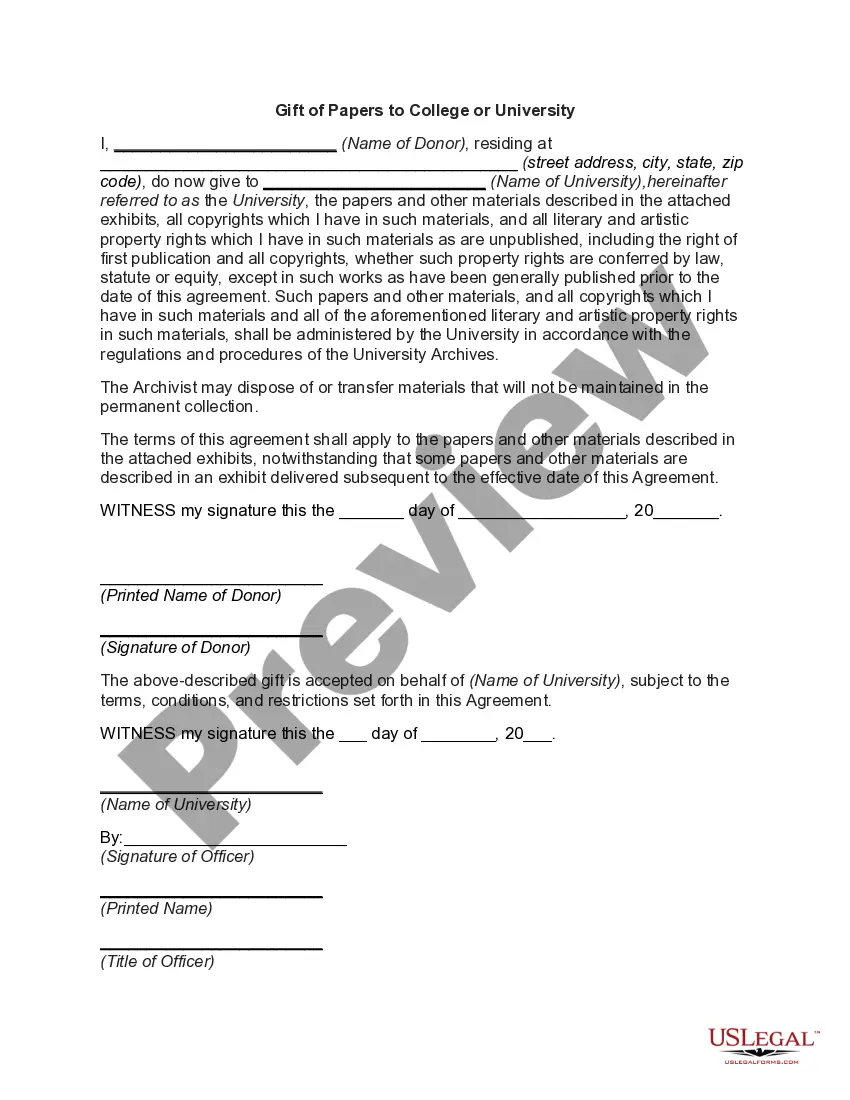

How to fill out Wyoming Post Bankruptcy Petition Discharge Letter?

Choosing the right lawful document web template might be a struggle. Needless to say, there are a lot of templates accessible on the Internet, but how can you find the lawful form you need? Use the US Legal Forms site. The support gives a huge number of templates, like the Wyoming Post Bankruptcy Petition Discharge Letter, that can be used for company and private requirements. Each of the types are examined by pros and satisfy federal and state needs.

When you are currently authorized, log in for your account and then click the Down load key to obtain the Wyoming Post Bankruptcy Petition Discharge Letter. Make use of your account to look from the lawful types you may have bought in the past. Go to the My Forms tab of the account and obtain another backup in the document you need.

When you are a new user of US Legal Forms, allow me to share straightforward instructions so that you can stick to:

- Initially, be sure you have chosen the appropriate form to your city/area. It is possible to look through the shape utilizing the Preview key and look at the shape description to make certain this is basically the best for you.

- In case the form does not satisfy your expectations, make use of the Seach area to find the appropriate form.

- When you are certain the shape is acceptable, click the Buy now key to obtain the form.

- Pick the pricing prepare you desire and enter in the needed information and facts. Create your account and pay money for the order making use of your PayPal account or bank card.

- Pick the file formatting and down load the lawful document web template for your device.

- Full, change and printing and sign the acquired Wyoming Post Bankruptcy Petition Discharge Letter.

US Legal Forms will be the most significant local library of lawful types for which you can find numerous document templates. Use the service to down load skillfully-created papers that stick to condition needs.

Form popularity

FAQ

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

For most filers, a Chapter 7 case will end when you receive your dischargethe order that forgives qualified debtabout four to six months after filing the bankruptcy paperwork. Although most cases close after that, your case might remain open longer if you have property that you can't protect (nonexempt assets).

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

Following a bankruptcy discharge, debt collectors and lenders can no longer attempt to collect the discharged debts. That means no more calls from collectors and no more letters in the mail, as you are no longer personally liable for the debt. A bankruptcy discharge doesn't necessarily apply to all of the debt you owe.

Closing a Chapter 7 Bankruptcy After DischargeA Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.