Wyoming Certificate of Secretary of Corporation as to Commercial Loan

Description

How to fill out Certificate Of Secretary Of Corporation As To Commercial Loan?

Have you been in the place the place you need to have documents for possibly enterprise or individual reasons almost every time? There are tons of lawful record templates accessible on the Internet, but getting versions you can rely on is not simple. US Legal Forms delivers a large number of kind templates, just like the Wyoming Certificate of Secretary of Corporation as to Commercial Loan, which can be published in order to meet state and federal specifications.

When you are currently acquainted with US Legal Forms site and also have your account, merely log in. After that, you may acquire the Wyoming Certificate of Secretary of Corporation as to Commercial Loan web template.

Should you not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Find the kind you need and ensure it is to the correct town/county.

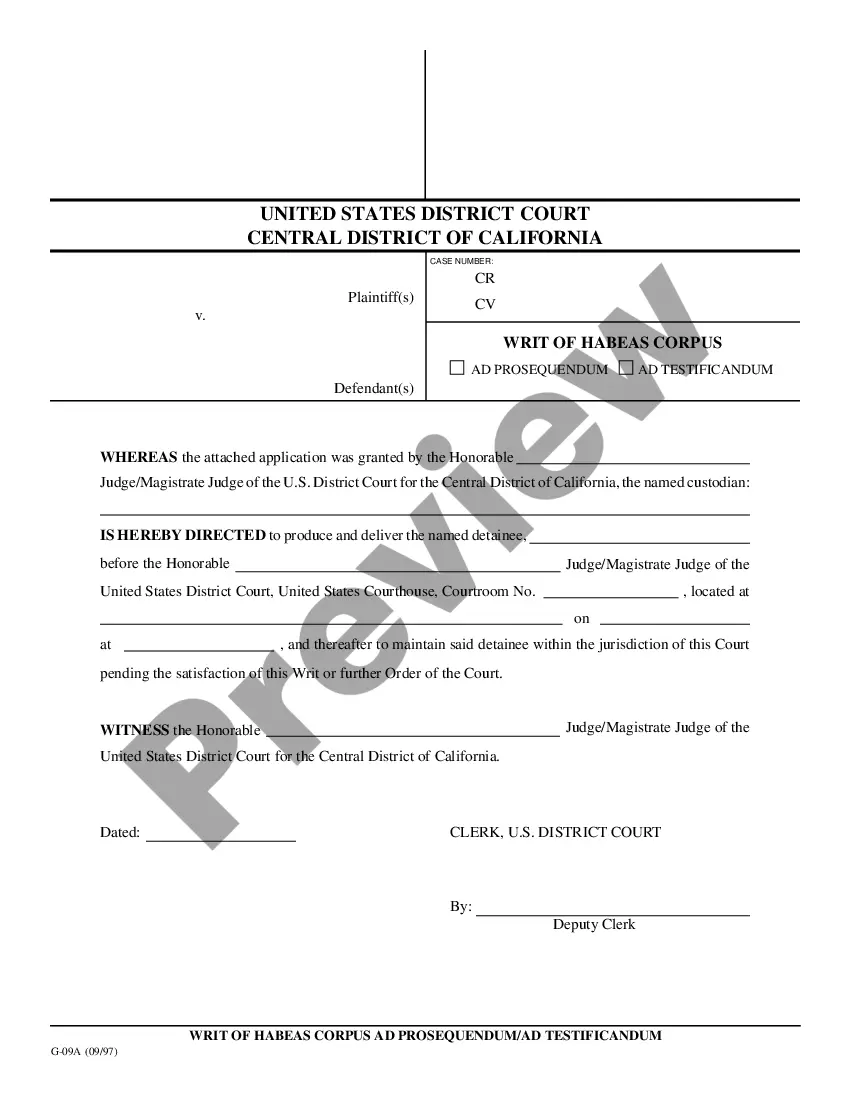

- Utilize the Review option to check the shape.

- Look at the description to ensure that you have selected the appropriate kind.

- If the kind is not what you`re trying to find, take advantage of the Lookup area to discover the kind that suits you and specifications.

- When you get the correct kind, just click Purchase now.

- Opt for the rates strategy you need, submit the specified details to create your bank account, and buy the transaction using your PayPal or bank card.

- Pick a convenient file structure and acquire your copy.

Discover each of the record templates you might have purchased in the My Forms menu. You can aquire a further copy of Wyoming Certificate of Secretary of Corporation as to Commercial Loan at any time, if necessary. Just click on the required kind to acquire or print the record web template.

Use US Legal Forms, by far the most extensive assortment of lawful forms, to save lots of time as well as stay away from faults. The assistance delivers professionally made lawful record templates which you can use for a selection of reasons. Create your account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Wyoming State Business License Fee The main Wyoming business license you'll need is the Sales and Use Tax License which costs $60. It is a one-time fee, no renewals are needed. Cost to Start a Wyoming LLC - Northwest Registered Agent northwestregisteredagent.com ? llc ? cost northwestregisteredagent.com ? llc ? cost

A certificate of good standing certifies that a company is properly registered with the state, is up to date on all state registration fees and required document filings, and is legally permitted to engage in business activities in the state. What is a certificate of good standing? | .com ? articles ? what-is-a-certific... .com ? articles ? what-is-a-certific...

To receive a certificate of good standing, contact the Wyoming Secretary of State's office. Wyoming offers options to complete the process online or by mail. The process is free if done online at the Secretary of State website. By mail, the processing fee is $10.

To register a foreign corporation in Wyoming, you must file a Wyoming Application for Certificate of Authority with the Wyoming Secretary of State. You can submit this document by mail or in person. The Certificate of Authority for a foreign Wyoming corporation costs $150 to file.

C Corporation ? For a business to incorporate in Wyoming, the state requires filing Articles of Incorporation, along with a Consent to Appointment by Registered Agent form, and paying a filing fee of $100. Profit Corporations in Wyoming must also appoint a Board of Directors and adopt bylaws.

In Wyoming it is not mandatory to register a DBA name. However, you may register a DBA by filing an Application for Registration of Trade Name.

$10 How much does a Wyoming Certificate of Good Standing cost? Online processing is FREE. $10 for normal processing. Wyoming Certificate of Good Standing or Status or Existence Northwest Registered Agent ? wyoming Northwest Registered Agent ? wyoming

$60 Wyoming's LLC is required to pay an annual fee of $60 to the Secretary of State beginning the second year. There is again a $2 convenience fee for paying online. The annual report is technically calculated as the lesser of $60 or $60 for every $250k in assets in Wyoming. Wyoming LLC Annual Fees & Requirements wyomingllcattorney.com ? Form-a-Wyoming-LLC wyomingllcattorney.com ? Form-a-Wyoming-LLC