The Wyoming Promissory Note for Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a commercial loan agreement in Wyoming. Specifically, it pertains to loans where real property acts as collateral to secure the loan. This promissory note serves as evidence of a debtor’s promise to repay a loan received from a lender or creditor. It includes essential details such as the loan amount, interest rate, repayment schedule, and any fees or penalties associated with the loan. In Wyoming, there are several types of Promissory Notes for Commercial Loans Secured by Real Property, each designed to cater to different loan scenarios or borrower requirements. Some notable variations include: 1. Fixed-Rate Promissory Note: This type of promissory note maintains a constant interest rate throughout the loan term, ensuring predictable monthly payments. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate note, this type of promissory note allows the interest rate to fluctuate based on an agreed-upon index or benchmark. As a result, the borrower's monthly payments may change over time. 3. Balloon Payment Promissory Note: This note structure involves regular monthly payments for a specified period, followed by a larger "balloon" payment at the end. This payment is usually larger than the previous installments and is commonly used when the borrower anticipates a significant influx of cash. 4. Interest-Only Promissory Note: This type of note allows the borrower to make monthly payments solely towards the accrued interest for a predetermined period. The principal loan amount is paid off either in full at the end or through subsequent installments. 5. Installment Promissory Note: This note requires the borrower to make equal monthly installment payments comprising both principal and interest until the loan is fully repaid. When executing a Wyoming Promissory Note for Commercial Loan Secured by Real Property, both the lender and borrower must sign and date the document. It is crucial for both parties to read and understand the terms thoroughly, ensuring clarity and a mutual agreement regarding the loan and its repayment. Remember that legal advice from an attorney can be invaluable when drafting or signing promissory notes to ensure compliance with Wyoming's laws and regulations.

Wyoming Promissory Note for Commercial Loan Secured by Real Property

Description

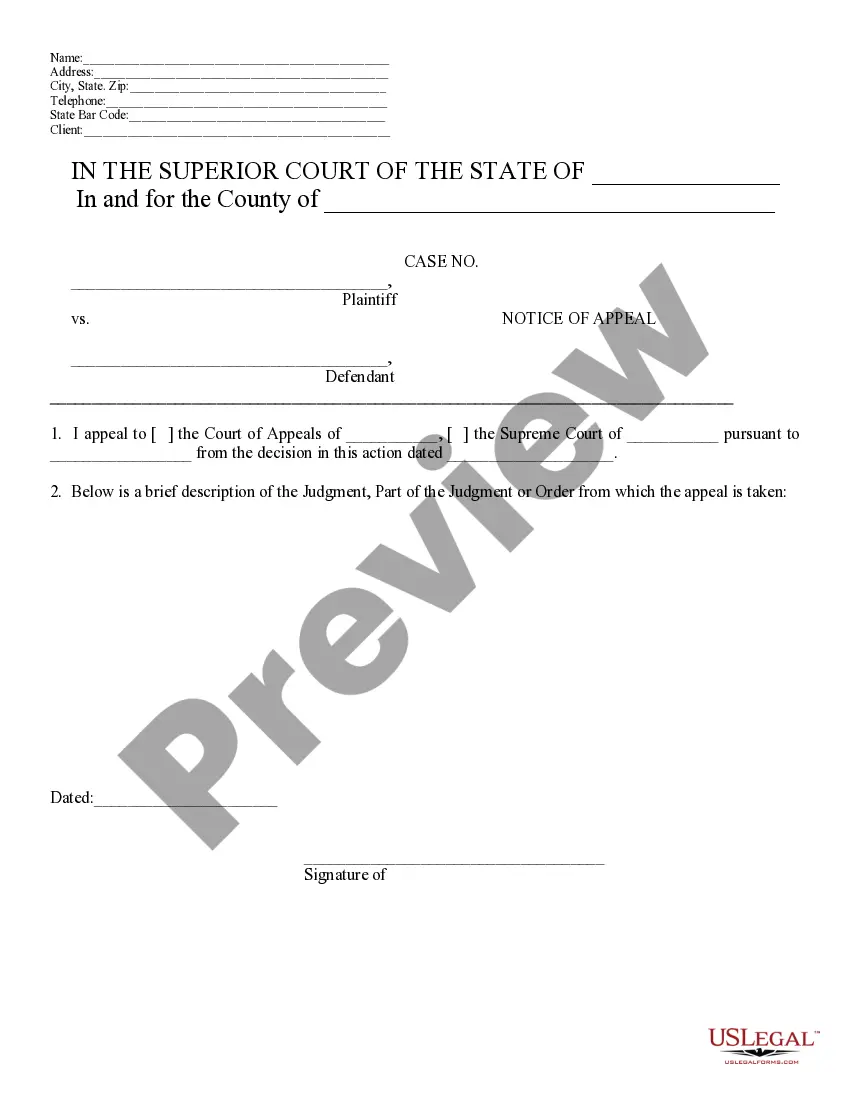

How to fill out Wyoming Promissory Note For Commercial Loan Secured By Real Property?

Choosing the right authorized papers format could be a battle. Obviously, there are plenty of layouts available online, but how would you obtain the authorized kind you will need? Take advantage of the US Legal Forms web site. The assistance provides 1000s of layouts, such as the Wyoming Promissory Note for Commercial Loan Secured by Real Property, that can be used for business and personal requirements. Each of the varieties are inspected by experts and meet up with state and federal needs.

In case you are presently listed, log in in your accounts and then click the Obtain option to find the Wyoming Promissory Note for Commercial Loan Secured by Real Property. Use your accounts to check with the authorized varieties you might have purchased in the past. Visit the My Forms tab of the accounts and get an additional version of your papers you will need.

In case you are a brand new customer of US Legal Forms, here are basic recommendations so that you can stick to:

- Initial, ensure you have chosen the appropriate kind for the town/region. It is possible to examine the form utilizing the Review option and look at the form information to ensure it is the best for you.

- In case the kind fails to meet up with your preferences, make use of the Seach area to get the right kind.

- When you are certain the form would work, click on the Purchase now option to find the kind.

- Pick the prices program you would like and enter in the needed details. Design your accounts and pay for your order making use of your PayPal accounts or Visa or Mastercard.

- Select the data file formatting and download the authorized papers format in your gadget.

- Complete, modify and print and indication the obtained Wyoming Promissory Note for Commercial Loan Secured by Real Property.

US Legal Forms is the greatest catalogue of authorized varieties where you will find numerous papers layouts. Take advantage of the service to download expertly-made paperwork that stick to express needs.

Form popularity

FAQ

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.