Wyoming Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee

Description

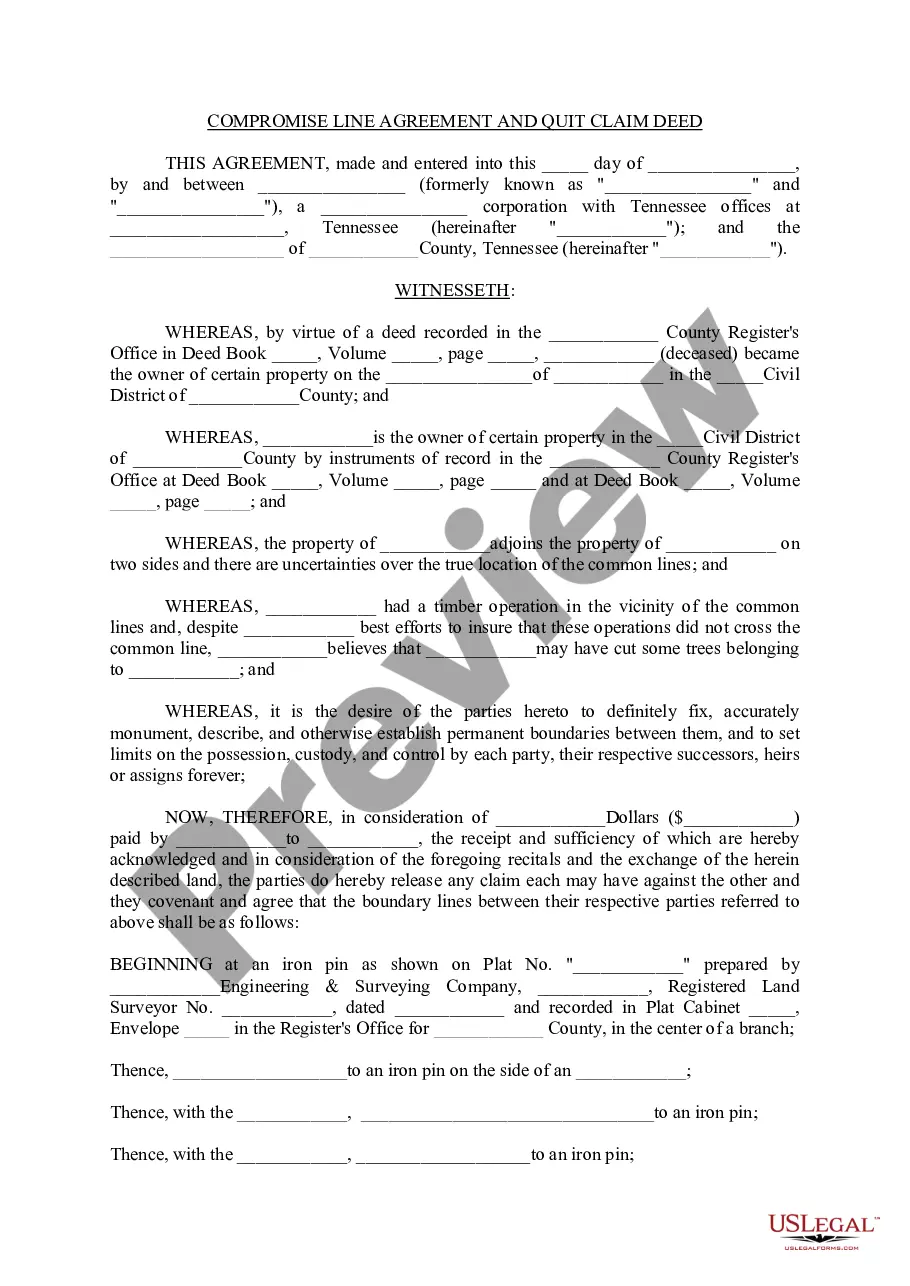

How to fill out Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee?

Choosing the right legitimate file format might be a battle. Naturally, there are tons of layouts available online, but how do you get the legitimate type you want? Utilize the US Legal Forms site. The support gives thousands of layouts, such as the Wyoming Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee, that you can use for company and personal demands. Every one of the forms are examined by experts and meet up with state and federal demands.

In case you are already signed up, log in to the account and click the Acquire key to find the Wyoming Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee. Use your account to look from the legitimate forms you might have ordered previously. Check out the My Forms tab of the account and obtain another duplicate in the file you want.

In case you are a brand new customer of US Legal Forms, listed below are basic directions so that you can adhere to:

- Initially, make sure you have selected the proper type for the area/area. You can look through the form utilizing the Preview key and study the form description to make sure this is the best for you.

- When the type does not meet up with your expectations, utilize the Seach field to obtain the right type.

- When you are certain the form is proper, select the Acquire now key to find the type.

- Choose the costs prepare you want and type in the required info. Create your account and purchase your order making use of your PayPal account or charge card.

- Pick the file formatting and obtain the legitimate file format to the product.

- Complete, edit and printing and indication the obtained Wyoming Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee.

US Legal Forms is definitely the largest library of legitimate forms in which you will find different file layouts. Utilize the service to obtain appropriately-produced files that adhere to state demands.