Wyoming Jury Instruction — 4.4.3 Rule 10(b— - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning — Violation of Blue Sky Law and Breach of Fiduciary Duty Keywords: Wyoming, jury instruction, Rule 10(b), Rule 5(c), fraudulent practice, course of dealing, stockbroker churning, violation, Blue Sky Law, breach of fiduciary duty. Description: Wyoming Jury Instruction — 4.4.3 Rule 10(b— - 5(c) addresses the issue of fraudulent practice or course of dealing related to stockbroker churning, which violates both the Blue Sky Law and the fiduciary duty owed by the stockbroker to their client. This instruction provides guidance to the jury in determining the elements necessary for a finding of fraudulent practice or course of dealing, as well as the violation of relevant laws and breach of fiduciary duty. The term "stockbroker churning" refers to the practice where a stockbroker excessively buys or sells securities in a client's account, generating excessive commissions or fees for the stockbroker while providing little benefit to the client. This behavior can lead to financial losses for the client and violates the duty of the stockbroker to act in their client's best interest. In the context of this jury instruction, Rule 10(b) and Rule 5(c) of the Securities Exchange Act of 1934 are relevant. Rule 10(b) prohibits fraudulent practices in connection with the purchase or sale of securities, and Rule 5(c) pertains to misleading statements or omissions of material facts. Violation of these rules can occur when a stockbroker engages in churning, as it involves deceptive practices and the withholding of relevant information from the client. Furthermore, the violation of Blue Sky Law is an important aspect covered by this instruction. Blue Sky Laws are state-level securities regulations enacted to protect investors from fraudulent activities involving securities. If a stockbroker's churning practices are found to violate Blue Sky Laws, it further strengthens the case against the broker. Lastly, breach of fiduciary duty is another element mentioned in this instruction. A stockbroker has a fiduciary duty to act in the best interest of their clients and provide suitable investment advice. Engaging in churning practices represents a breach of this duty as the broker's actions primarily benefit themselves rather than the client's financial goals. In conclusion, Wyoming Jury Instruction — 4.4.3 Rule 10(b— - 5(c) outlines the elements necessary to establish fraudulent practice or course of dealing in cases involving stockbroker churning. It highlights the violation of Rule 10(b) and Rule 5(c), the breach of fiduciary duty, and the importance of complying with Blue Sky Laws. Identifying and proving these elements would support a claim against a stockbroker engaged in fraudulent practices, protecting the rights and interests of investors.

Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

US Legal Forms - one of many biggest libraries of lawful forms in the States - offers a variety of lawful file themes you are able to down load or produce. While using internet site, you will get thousands of forms for company and individual reasons, categorized by categories, says, or keywords.You will find the latest versions of forms just like the Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty within minutes.

If you already have a subscription, log in and down load Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty from your US Legal Forms library. The Acquire key will show up on every single kind you view. You gain access to all earlier saved forms within the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, allow me to share straightforward directions to help you started off:

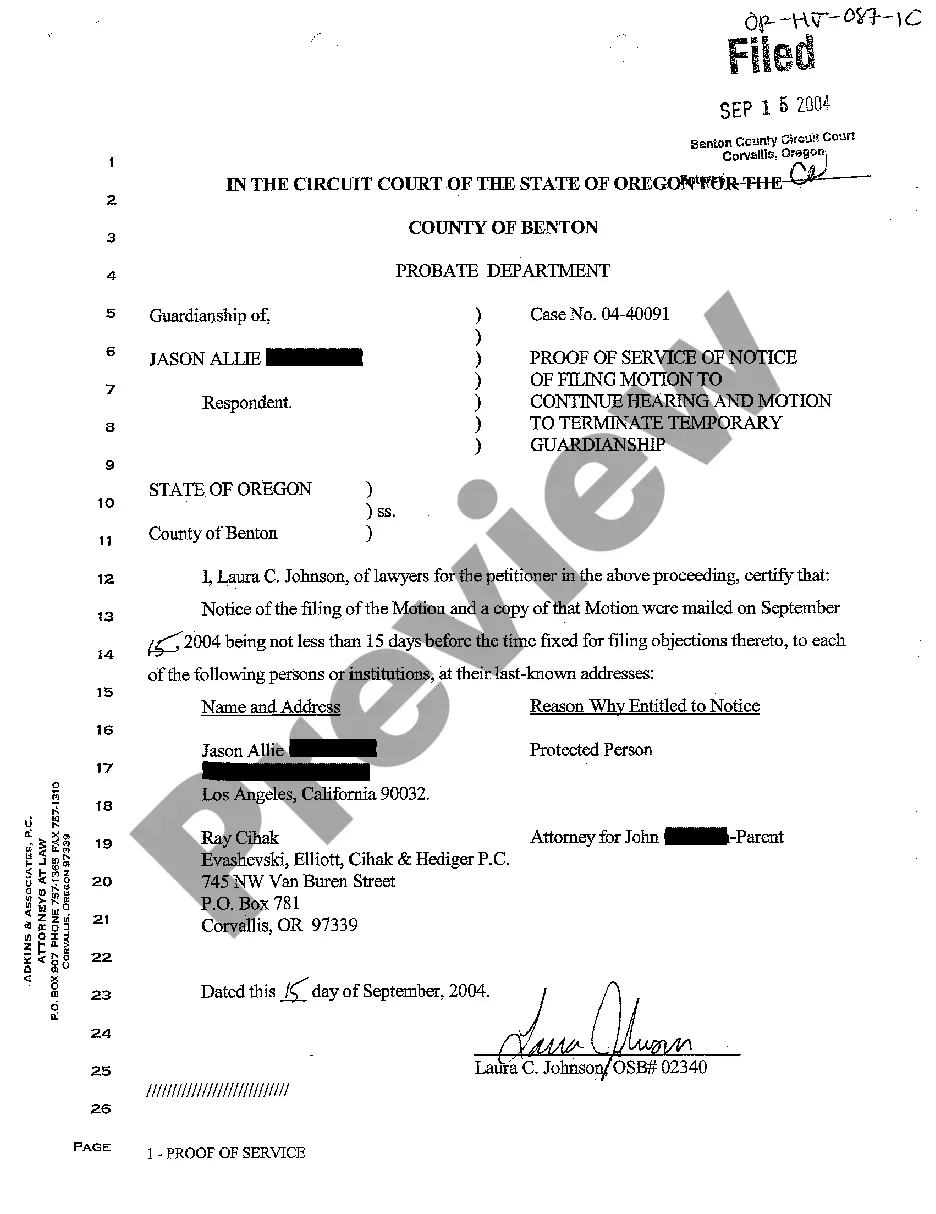

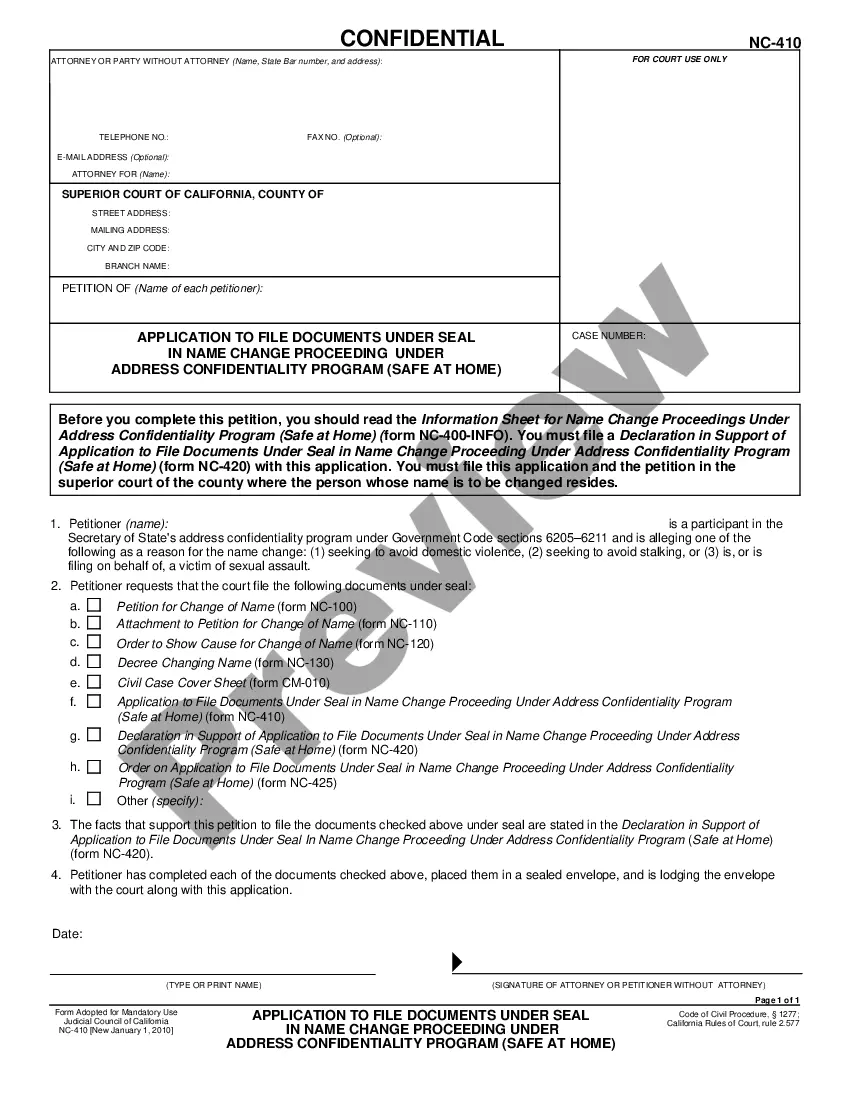

- Ensure you have selected the proper kind for your metropolis/state. Click on the Preview key to analyze the form`s content. Look at the kind information to ensure that you have chosen the right kind.

- In case the kind does not fit your requirements, utilize the Lookup field towards the top of the display screen to get the the one that does.

- In case you are content with the form, validate your decision by simply clicking the Get now key. Then, opt for the rates strategy you like and offer your qualifications to register on an accounts.

- Method the transaction. Use your credit card or PayPal accounts to accomplish the transaction.

- Choose the formatting and down load the form on your own device.

- Make modifications. Fill out, revise and produce and indication the saved Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Each web template you included in your account does not have an expiry day which is your own eternally. So, if you wish to down load or produce yet another copy, just proceed to the My Forms portion and then click in the kind you need.

Get access to the Wyoming Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty with US Legal Forms, one of the most considerable library of lawful file themes. Use thousands of skilled and condition-particular themes that meet your organization or individual needs and requirements.