Title: Understanding Wyoming Exchange Agreement and Brokerage Arrangement: Types and Features Introduction: In the realm of real estate and commercial transactions, Wyoming Exchange Agreement and Brokerage Arrangement play vital roles. These contractual arrangements enable parties to engage in property exchanges and ensure smooth facilitation of brokerage services. This article aims to dive into the details of the Wyoming Exchange Agreement and Brokerage Arrangement, exploring the types, features, and key elements related to these transactions. 1. Wyoming Exchange Agreement: A Wyoming Exchange Agreement, also known as a Like-Kind Exchange Agreement, is a contractual arrangement governed by the Internal Revenue Code (IRC) Section 1031. It allows taxpayers to defer capital gains taxes on the sale of qualified properties by exchanging them for other like-kind properties. This agreement offers tremendous benefits for investors looking to reinvest capital while preserving their tax-deferred status. Key Features: — Tax Deferral: The primary advantage of a Wyoming Exchange Agreement is the ability to defer capital gains taxes by reinvesting sale proceeds into similar property types, also known as "like-kind" properties, within a specified timeframe. — Flexibility: Wyoming Exchange Agreements provide flexibility in terms of the type, kind, and value of properties involved. The properties can be of any value, as long as they are qualified under the IRS guidelines. — Identification and Exchange Periods: The agreement stipulates specific timeframes during which the taxpayer must identify potential replacement properties and complete the exchange. — Qualified Intermediary: To ensure compliance with IRS regulations, a Qualified Intermediary (QI) acts as a neutral third party, facilitating the exchange of properties and holding the funds between transactions. — No Cash Receipt: In a Wyoming Exchange Agreement, the taxpayer relinquishes the right to receive cash or other "boot" as part of the exchange, to maintain the tax-deferred status. Types of Wyoming Exchange Agreements: a) Simultaneous Exchange: The most straightforward type of exchange, wherein the sale and purchase of properties occur simultaneously. b) Delayed Exchange: A more common type, allowing taxpayers to sell their property first and then acquire a like-kind replacement property within a specified period. c) Reverse Exchange: A less common but helpful type, where the taxpayer can acquire the replacement property first and then sell their property within the defined exchange timeframe. 2. Brokerage Arrangement: A Brokerage Arrangement refers to the contractual relationship between a broker and a client, outlining the terms and conditions related to property buying, selling, or leasing. It establishes the roles, duties, and obligations of both parties involved in the real estate transaction. Key Elements: — Agency Relationship: The brokerage arrangement defines whether the broker will act as a seller's agent, buyer's agent, dual agent, or transactional agent, each with distinct responsibilities towards their client. — Compensation: The agreement outlines the commission structure, payment terms, and any additional fees that the client must provide to the broker upon successful completion of the transaction. — Services Provided: The arrangement describes the specific services the broker will provide, such as property marketing, negotiations, due diligence, paperwork, and guidance throughout the transaction process. Types of Brokerage Arrangements: a) Exclusive Right to Sell: The most common type, wherein the seller grants the broker the exclusive right to represent and market the property for a specified period. b) Exclusive Agency: The seller grants exclusivity to a single broker, but reserves the right to sell the property independently without paying a commission. c) Open Listing: The seller can engage multiple brokers simultaneously, and only the broker who successfully procures a buyer receives a commission. Conclusion: Understanding the Wyoming Exchange Agreement and Brokerage Arrangement is crucial for individuals engaging in real estate transactions in Wyoming. Whether considering a tax-deferred exchange under IRC Section 1031 or seeking professional real estate brokerage services, knowing the various types, features, and key elements will help navigate these transactions successfully. It is advisable to consult legal and tax professionals to ensure compliance and maximize the benefits of these agreements.

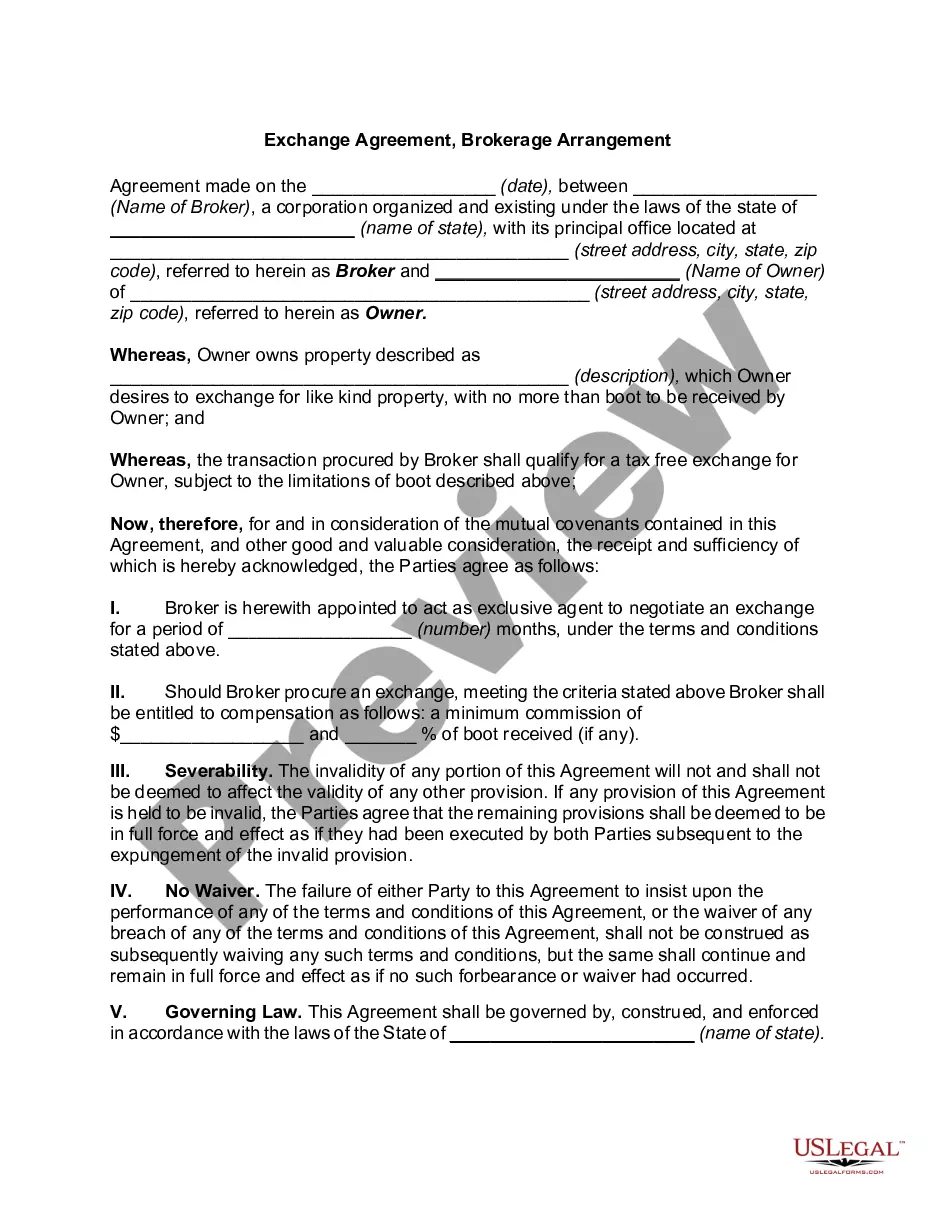

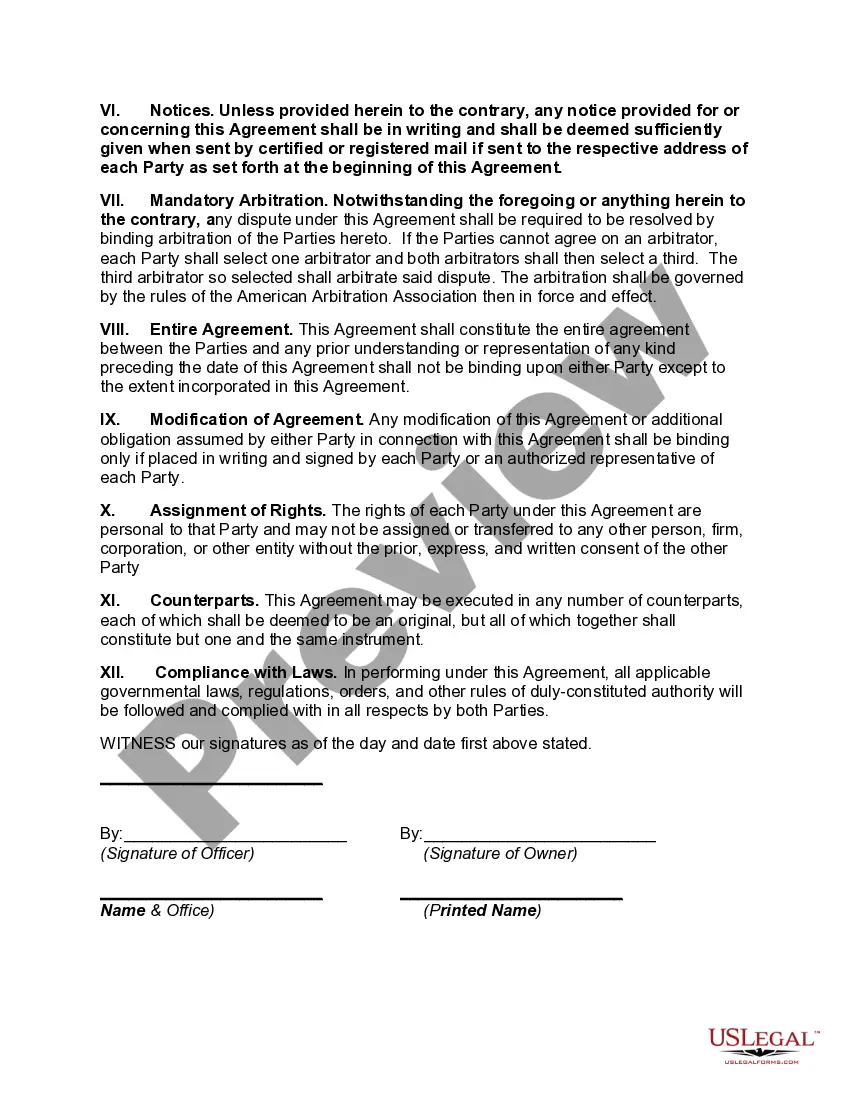

Wyoming Exchange Agreement, Brokerage Arrangement

Description

How to fill out Wyoming Exchange Agreement, Brokerage Arrangement?

If you want to complete, down load, or print lawful papers web templates, use US Legal Forms, the greatest selection of lawful varieties, that can be found on-line. Make use of the site`s easy and hassle-free lookup to obtain the papers you want. Various web templates for organization and individual purposes are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Wyoming Exchange Agreement, Brokerage Arrangement within a number of click throughs.

In case you are previously a US Legal Forms buyer, log in in your bank account and click on the Down load option to have the Wyoming Exchange Agreement, Brokerage Arrangement. You may also accessibility varieties you earlier delivered electronically within the My Forms tab of your respective bank account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form to the right area/nation.

- Step 2. Utilize the Preview option to examine the form`s articles. Don`t forget about to see the outline.

- Step 3. In case you are not happy with all the type, take advantage of the Research area towards the top of the display to find other types in the lawful type web template.

- Step 4. Upon having found the form you want, click the Acquire now option. Opt for the rates prepare you favor and add your qualifications to register to have an bank account.

- Step 5. Method the transaction. You should use your bank card or PayPal bank account to finish the transaction.

- Step 6. Pick the formatting in the lawful type and down load it on the device.

- Step 7. Full, revise and print or indication the Wyoming Exchange Agreement, Brokerage Arrangement.

Every single lawful papers web template you acquire is your own for a long time. You may have acces to each and every type you delivered electronically in your acccount. Click the My Forms portion and choose a type to print or down load once again.

Contend and down load, and print the Wyoming Exchange Agreement, Brokerage Arrangement with US Legal Forms. There are thousands of expert and status-certain varieties you can use to your organization or individual needs.