Wyoming Guaranty with Pledged Collateral is a legal agreement commonly used in business transactions, providing additional security for lenders or investors. The guarantee ensures that the borrower will repay the loan or fulfill their contractual obligations, backed by the pledged collateral. In different types of Wyoming Guaranty with Pledged Collateral, various assets or properties can be used as collateral, including real estate, vehicles, equipment, stocks, and bonds. These collateral options provide lenders with a means of recovering their investment in case of default or non-payment by the borrower. When a borrower enters into a Wyoming Guaranty with Pledged Collateral, they agree to put their assets at risk, which will be used as a repayment source in case they fail to meet their obligations or default on the loan. The pledged collateral acts as a security measure for the lender, reducing the risk involved in the transaction. The primary purpose of the Wyoming Guaranty with Pledged Collateral is to protect lenders or investors from potential financial losses. In the event of default, the lender has the legal right to seize and liquidate the pledged collateral to recover the outstanding debt. This guarantees lenders a higher level of assurance that their funds will be recovered. By using the Wyoming Guaranty with Pledged Collateral, both parties involved in the agreement are protected. Borrowers can receive lower interest rates or higher credit limits, as they provide the lender with confidence in their ability to repay the loan. Lenders, on the other hand, are reassured by the collateral, which mitigates the risk associated with lending money or investing in a business venture. Wyoming Guaranty with Pledged Collateral is commonly used in various industries, including real estate, business financing, and asset-based lending. It is especially beneficial for start-ups or borrowers with limited credit history, as it offers an alternate method of securing funds. In summary, Wyoming Guaranty with Pledged Collateral is a legally binding agreement that provides protection for lenders and investors. It offers borrowers the opportunity to secure funding or credit by utilizing their assets as collateral. Different types of pledged collateral can range from real estate to financial instruments, allowing lenders to enforce repayment through asset liquidation. This arrangement fosters trust and lowers the risk for lenders, often resulting in more favorable terms for borrowers.

Wyoming Guaranty with Pledged Collateral

Description

How to fill out Wyoming Guaranty With Pledged Collateral?

It is possible to invest several hours on the Internet searching for the legitimate document template that fits the federal and state specifications you will need. US Legal Forms gives a huge number of legitimate kinds which are examined by pros. It is simple to acquire or printing the Wyoming Guaranty with Pledged Collateral from your services.

If you have a US Legal Forms account, you may log in and click on the Download option. Following that, you may total, modify, printing, or indicator the Wyoming Guaranty with Pledged Collateral. Every legitimate document template you buy is your own for a long time. To have an additional copy of the obtained kind, proceed to the My Forms tab and click on the related option.

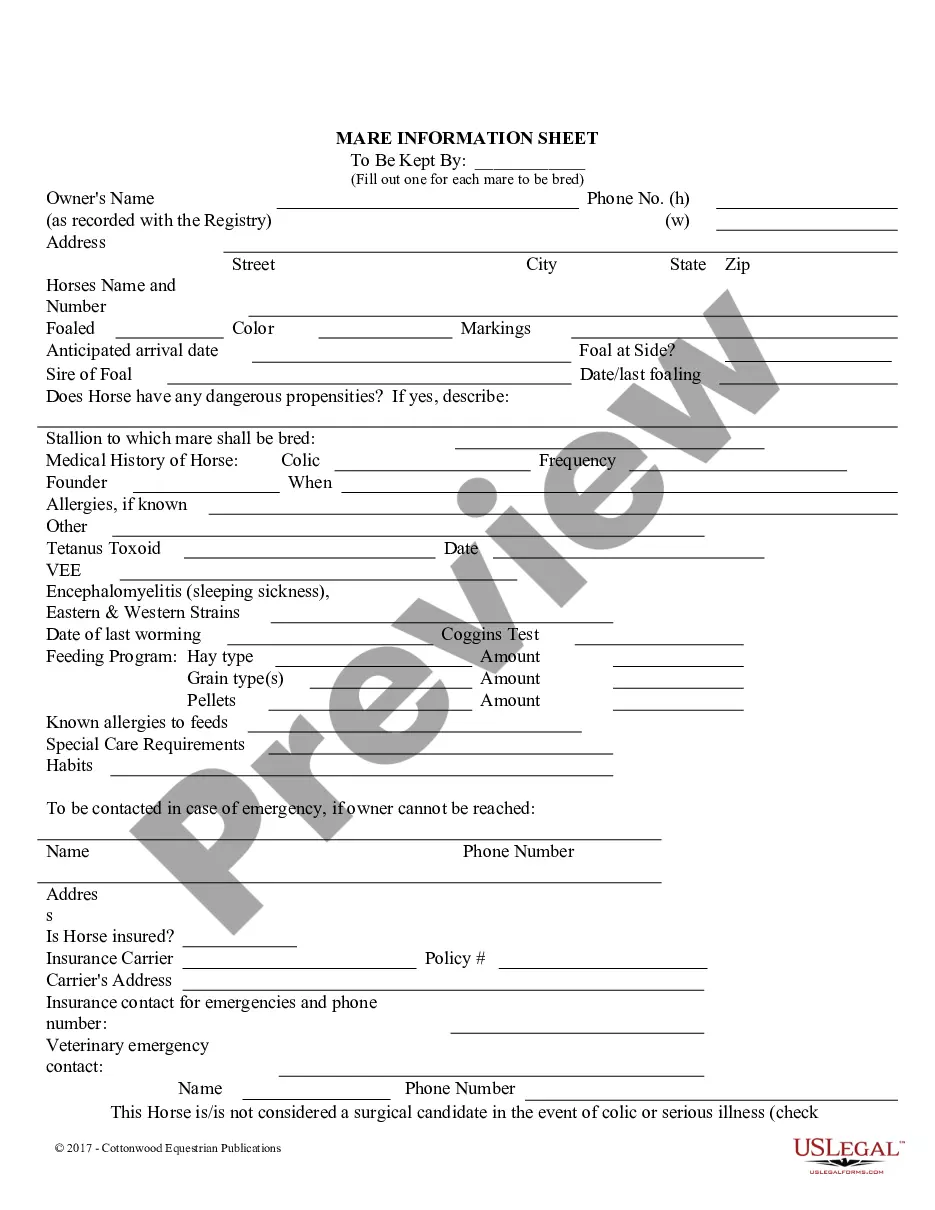

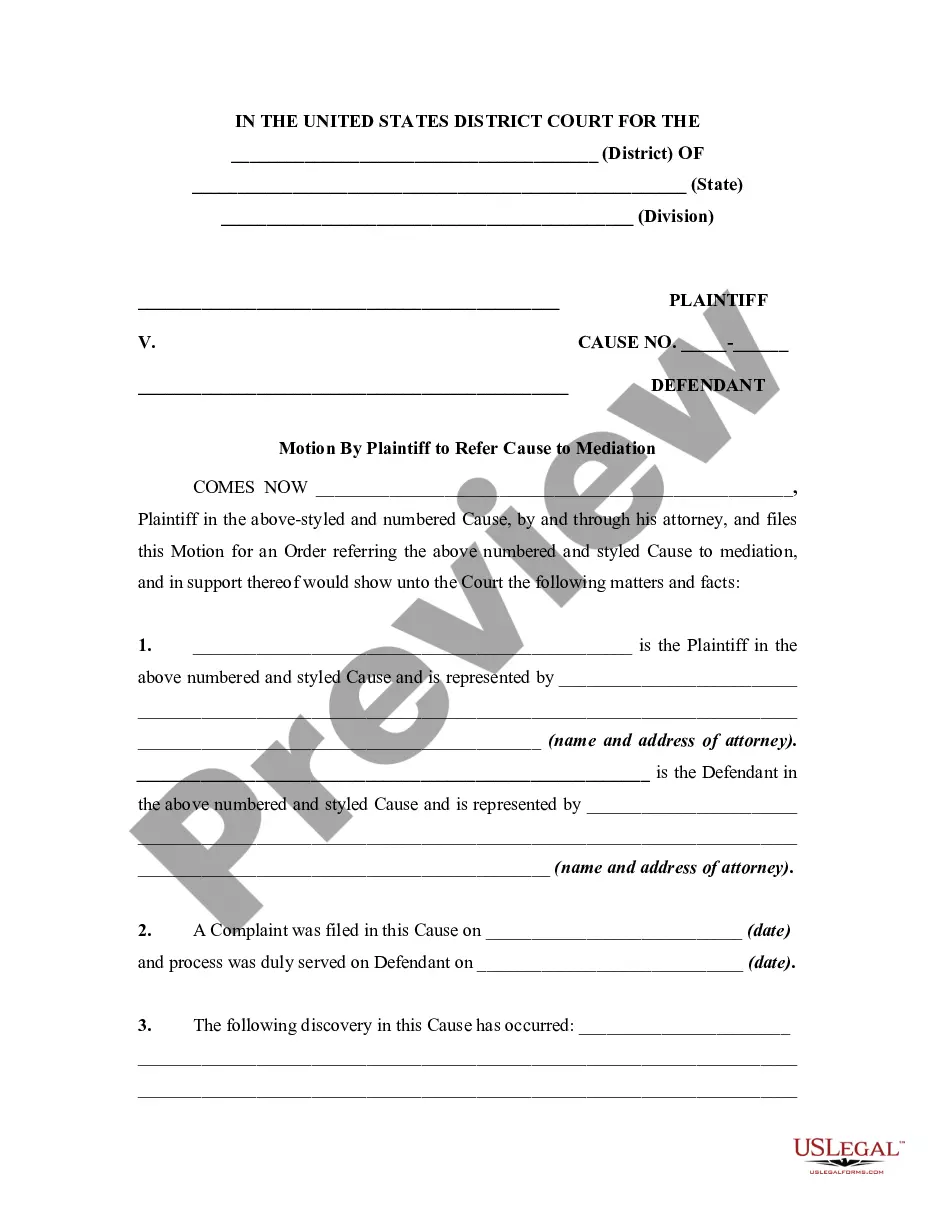

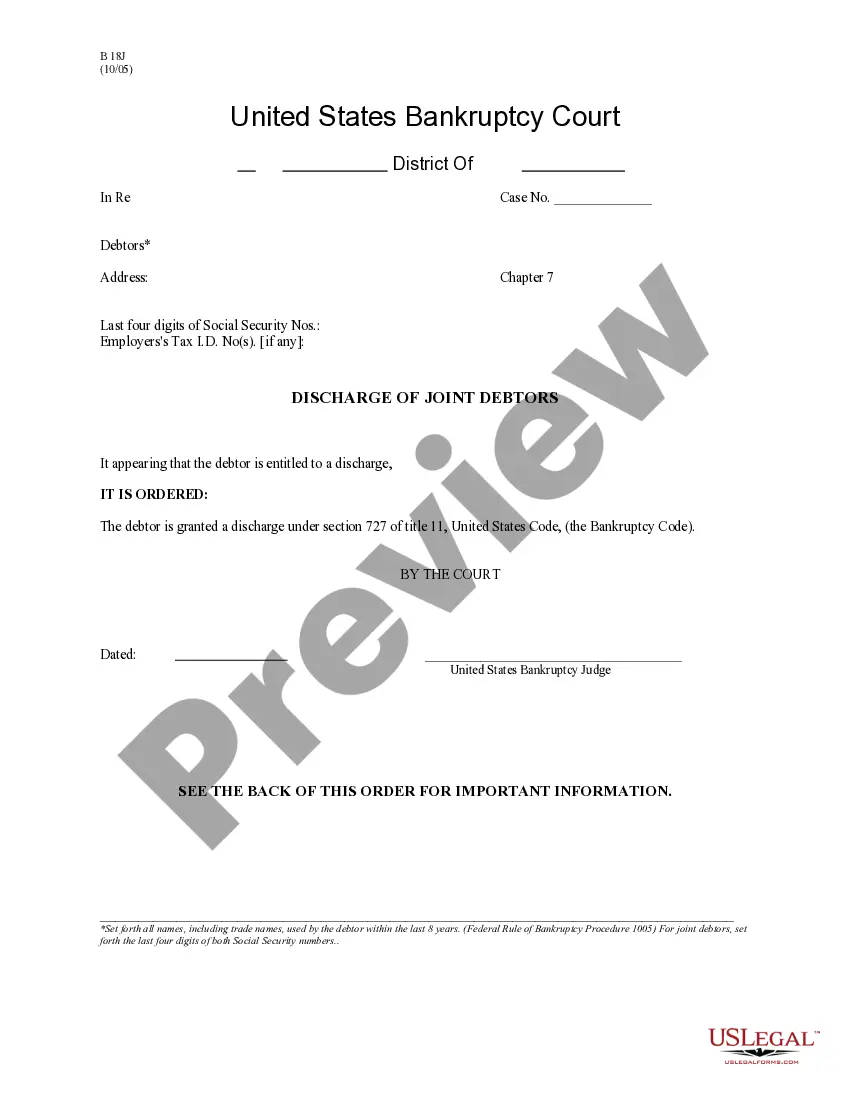

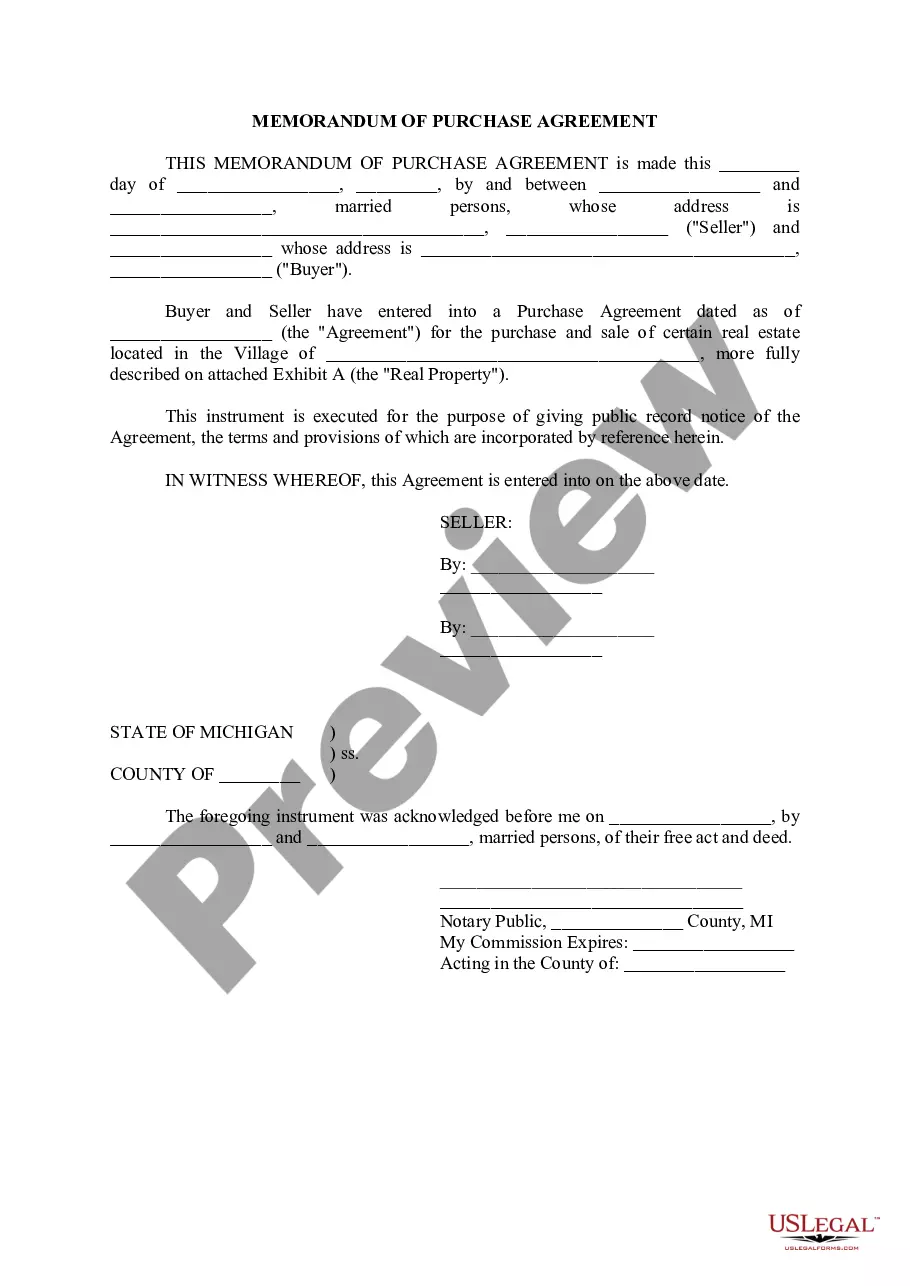

If you work with the US Legal Forms website initially, adhere to the easy guidelines below:

- Initially, make certain you have selected the proper document template for the region/town of your choosing. See the kind outline to make sure you have chosen the appropriate kind. If readily available, take advantage of the Review option to check through the document template also.

- If you want to locate an additional model of the kind, take advantage of the Look for area to discover the template that suits you and specifications.

- Upon having identified the template you would like, simply click Acquire now to carry on.

- Pick the rates strategy you would like, type in your credentials, and register for a free account on US Legal Forms.

- Total the purchase. You may use your charge card or PayPal account to pay for the legitimate kind.

- Pick the format of the document and acquire it to the product.

- Make adjustments to the document if necessary. It is possible to total, modify and indicator and printing Wyoming Guaranty with Pledged Collateral.

Download and printing a huge number of document themes making use of the US Legal Forms web site, that offers the largest assortment of legitimate kinds. Use professional and state-certain themes to take on your company or personal requirements.

Form popularity

FAQ

Collateral Guarantee means the irrevocable and unconditional limited liability guarantee of the Collateral Owner given or, as the case may be, to be in favour of the Bank, as security of part of the Outstanding Indebtedness and any and all other obligations of the Borrowers hereunder up to the Guaranteed Amount , in

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Legal Definition of collateral agreement : an agreement related to and consistent with but independent of a larger written agreement.

The pledging of collateral by a financial institution is necessary to protect the Federal Government against risk of loss.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

Types of Collateral You Can UseCash in a savings account.Cash in a certificate of deposit (CD) account.Car.Boat.Home.Stocks.Bonds.Insurance policy.More items...?07-Mar-2021