Wyoming Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

How to fill out Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

You may invest time on the web trying to find the legitimate file format that fits the state and federal requirements you need. US Legal Forms gives a large number of legitimate types which can be examined by professionals. It is possible to download or produce the Wyoming Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court from the assistance.

If you have a US Legal Forms accounts, you can log in and click on the Down load button. Next, you can comprehensive, modify, produce, or sign the Wyoming Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court. Every single legitimate file format you purchase is the one you have for a long time. To obtain another duplicate for any acquired form, visit the My Forms tab and click on the related button.

If you are using the US Legal Forms web site for the first time, adhere to the straightforward guidelines under:

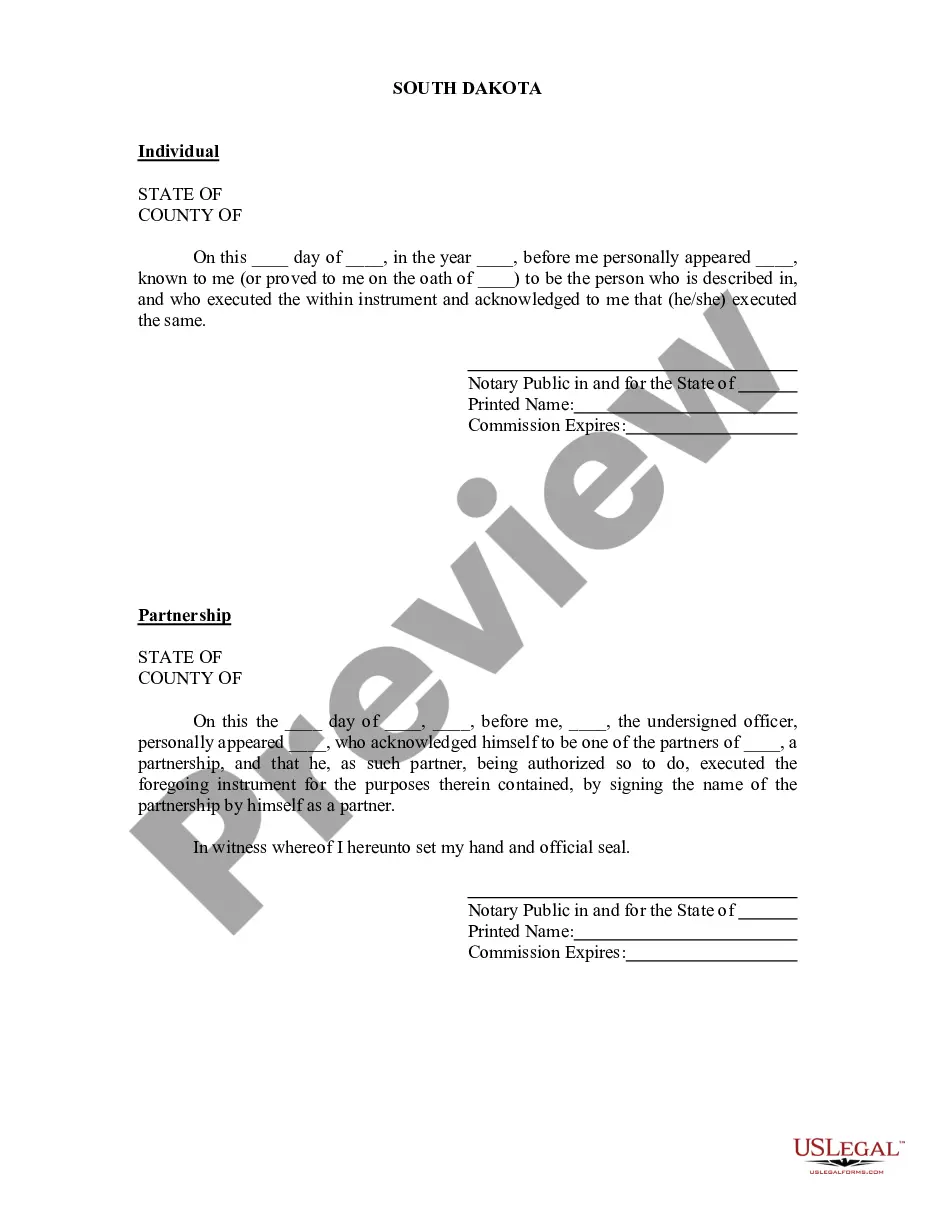

- Initially, ensure that you have chosen the correct file format for the region/town of your choice. Browse the form outline to ensure you have chosen the right form. If accessible, utilize the Preview button to appear with the file format at the same time.

- If you want to find another version of your form, utilize the Research industry to find the format that meets your needs and requirements.

- Once you have identified the format you desire, just click Buy now to carry on.

- Choose the rates prepare you desire, type your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal accounts to purchase the legitimate form.

- Choose the formatting of your file and download it for your device.

- Make adjustments for your file if necessary. You may comprehensive, modify and sign and produce Wyoming Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court.

Down load and produce a large number of file templates making use of the US Legal Forms site, that offers the greatest variety of legitimate types. Use specialist and state-distinct templates to deal with your organization or specific requires.