Wyoming Credit Memo Request Form

Category:

State:

Multi-State

Control #:

US-136-AZ

Format:

Word;

PDF;

Rich Text

Instant download

Description

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

How to fill out Credit Memo Request Form?

If you require to complete, acquire, or create official document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Utilize the site's simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is yours permanently.

You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

- Utilize US Legal Forms to obtain the Wyoming Credit Memo Request Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to retrieve the Wyoming Credit Memo Request Form.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for your correct city/state.

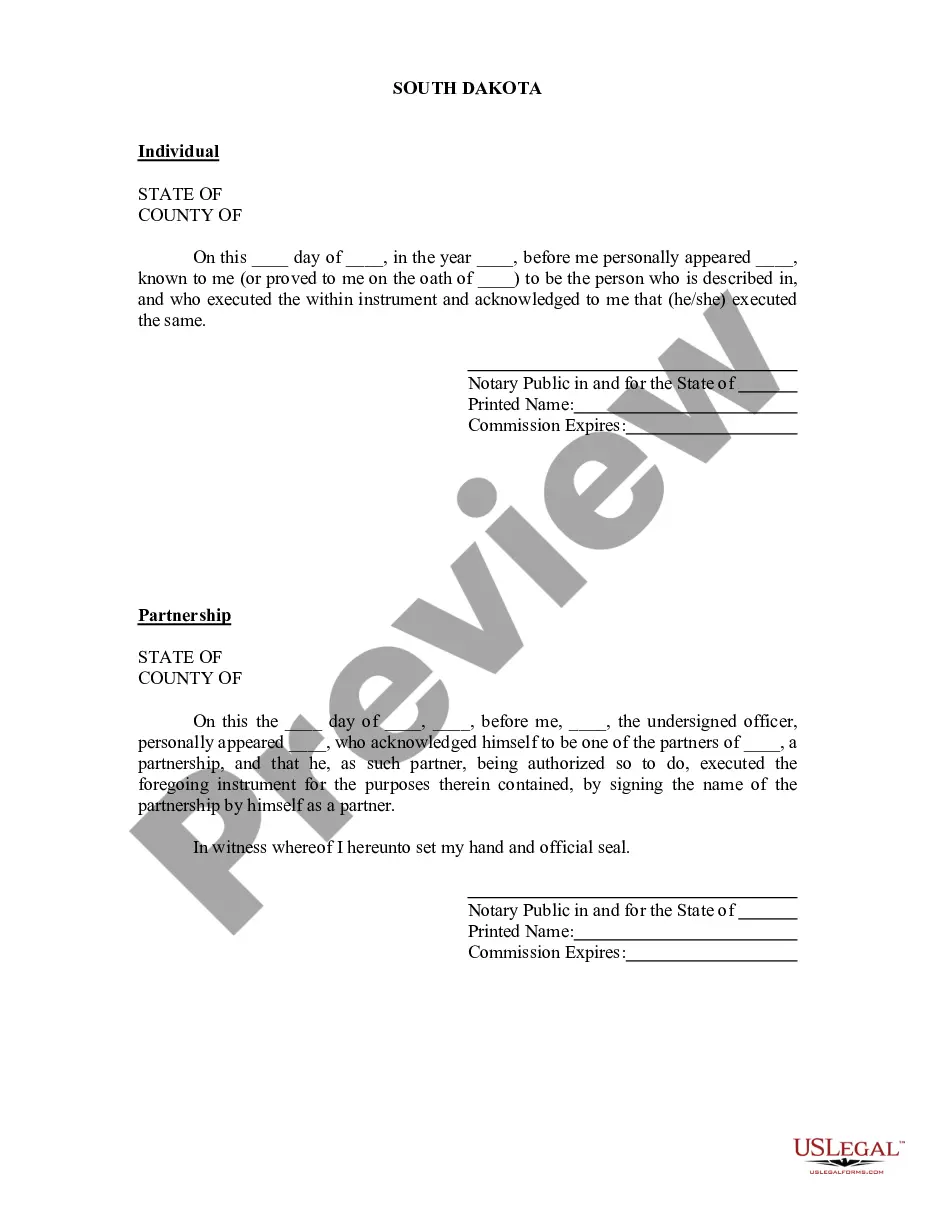

- Step 2. Use the Review function to examine the form's content. Don’t forget to read the details.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your desired pricing plan and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Wyoming Credit Memo Request Form.