Wyoming Shipping Reimbursement is a program that offers financial assistance to businesses and individuals residing in Wyoming for the shipping costs incurred while transporting goods or products. This reimbursement program aims to support and foster economic growth within the state by reducing the financial burden associated with shipping expenses. Businesses and individuals operating in Wyoming can take advantage of Wyoming Shipping Reimbursement to alleviate the costs of transporting their products to customers or distributors. The program provides reimbursement for a portion of the shipping expenses incurred, helping businesses to remain competitive and encouraging them to expand their operations within the state. There are various types of Wyoming Shipping Reimbursement available, catering to different business needs and sizes. Some of these reimbursement programs include: 1. Small Business Shipping Reimbursement: This program is specifically designed for small businesses operating in Wyoming. It offers financial reimbursement for a percentage of the shipping costs incurred by small businesses while delivering goods to customers or suppliers. 2. Rural Area Shipping Reimbursement: As Wyoming has vast rural areas, this program focuses on providing shipping reimbursement to businesses operating in remote or sparsely populated regions. It aims to ensure that businesses in these areas are not disadvantaged by higher shipping costs due to their geographical location. 3. E-commerce Shipping Reimbursement: With the rise of online businesses and e-commerce, this reimbursement program targets businesses that primarily sell their products online. It provides financial assistance for shipping costs associated with delivering goods to customers who purchase products through websites or online platforms. 4. Agricultural Shipping Reimbursement: Wyoming is known for its strong agricultural industry. This program caters specifically to farmers, ranchers, and businesses engaged in agricultural activities. It offers reimbursement for shipping costs related to transporting agricultural products, equipment, or livestock. By offering different types of Wyoming Shipping Reimbursement, the program aims to support a diverse range of businesses and industries within the state. These reimbursement programs can help businesses remain competitive, expand their customer base, and foster economic growth throughout Wyoming.

Wyoming Shipping Reimbursement

Description

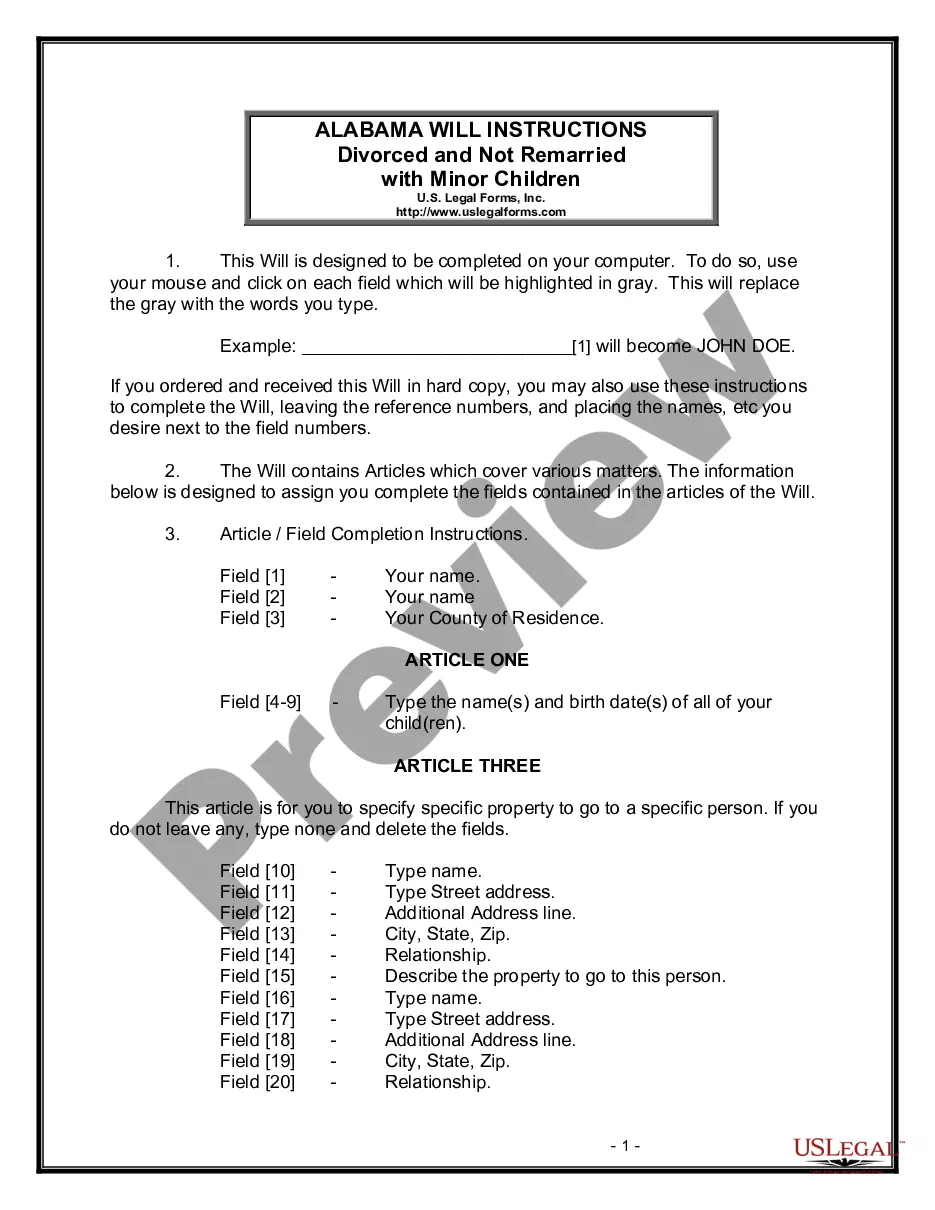

How to fill out Wyoming Shipping Reimbursement?

Choosing the right lawful document format could be a have difficulties. Obviously, there are plenty of templates available online, but how can you get the lawful develop you need? Use the US Legal Forms website. The assistance delivers thousands of templates, such as the Wyoming Shipping Reimbursement, which you can use for company and private requirements. Each of the varieties are inspected by specialists and fulfill state and federal demands.

In case you are presently registered, log in to your bank account and then click the Down load option to obtain the Wyoming Shipping Reimbursement. Make use of bank account to check from the lawful varieties you possess acquired previously. Visit the My Forms tab of your own bank account and have one more backup of the document you need.

In case you are a new user of US Legal Forms, listed here are simple guidelines that you should follow:

- Initial, make sure you have chosen the appropriate develop for the town/county. You can look through the shape using the Preview option and look at the shape information to make sure this is basically the best for you.

- When the develop does not fulfill your requirements, utilize the Seach discipline to get the right develop.

- Once you are sure that the shape is suitable, select the Get now option to obtain the develop.

- Pick the rates strategy you desire and type in the essential information and facts. Build your bank account and pay for an order making use of your PayPal bank account or charge card.

- Select the data file format and download the lawful document format to your gadget.

- Full, revise and produce and indicator the acquired Wyoming Shipping Reimbursement.

US Legal Forms is definitely the most significant local library of lawful varieties that you will find various document templates. Use the company to download professionally-created files that follow state demands.

Form popularity

FAQ

Taxable and exempt shipping charges In general, Wyoming sales tax does not apply to separately stated charges for shipping, handling, delivery, freight, and postage. However, if the charges are included in the sales price of a taxable item, the charges are taxable as well.

Are services subject to sales tax in Wyoming? The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. An example of taxed services would be one which sells, repairs, alters, or improves tangible physical property.

Goods that are subject to sales tax in Wyoming include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt. Some services in Wyoming are subject to sales tax.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

Handling charges can be combined with shipping charges; if stated separately, shipping and handling charges are exempt. However, shipping charges that exceed the actual cost of delivery are generally taxable.

There are several exemptions to the state sales tax, including but not limited to agricultural products, construction services, mining products, and manufacturing equipment. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Five states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not implement any sales tax, so shipping and handling will likewise not be taxable.

There are several exemptions to the state sales tax, including but not limited to agricultural products, construction services, mining products, and manufacturing equipment. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Separately stated postage, shipping, and transportation charges are generally exempt, but crating, handling, packaging, or similar charges are taxable whether separately stated or included in the sale price.