Wyoming Personnel Payroll Associate Checklist is a comprehensive and essential tool used by organizations to ensure accurate and efficient payroll processing for their employees based in Wyoming. This checklist is specifically designed to streamline the payroll operations and comply with the state's specific laws and regulations. With the aim of minimizing errors and avoiding penalties, a Wyoming Personnel Payroll Associate Checklist covers various tasks related to employee compensation, deductions, taxes, and reporting. The checklist typically includes key responsibilities such as verifying employee time and attendance, calculating regular and overtime wages, ensuring proper deductions for taxes, insurance premiums, retirement plans, and other authorized withholding. It also entails confirming accurate employee information, such as Social Security numbers, addresses, and direct deposit details. Compliance with state-specific laws related to employee benefits, minimum wage, and record-keeping is another crucial aspect covered in this checklist. Furthermore, the Wyoming Personnel Payroll Associate Checklist may encompass additional tasks depending on the organization's specific requirements. Some variations of this checklist might include steps related to handling pay advances, processing expense reports, managing employee leaves, handling wage garnishments, reviewing and reconciling payroll reports, and ensuring timely and accurate tax filings. By utilizing a Wyoming Personnel Payroll Associate Checklist, organizations can effectively organize and manage their payroll operations, minimizing errors, and fostering compliance with Wyoming's unique payroll regulations. It empowers payroll associates to navigate complex payroll tasks systematically, ensuring employee satisfaction and enabling businesses to run smoothly.

Wyoming Personnel Payroll Associate Checklist

Description

How to fill out Wyoming Personnel Payroll Associate Checklist?

US Legal Forms - one of many largest libraries of authorized types in the United States - delivers a wide array of authorized document templates you are able to obtain or produce. Using the internet site, you can find thousands of types for company and person reasons, categorized by classes, says, or key phrases.You can find the latest models of types just like the Wyoming Personnel Payroll Associate Checklist in seconds.

If you already possess a registration, log in and obtain Wyoming Personnel Payroll Associate Checklist through the US Legal Forms catalogue. The Obtain key will show up on every single kind you perspective. You have access to all in the past downloaded types inside the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed here are easy guidelines to help you started off:

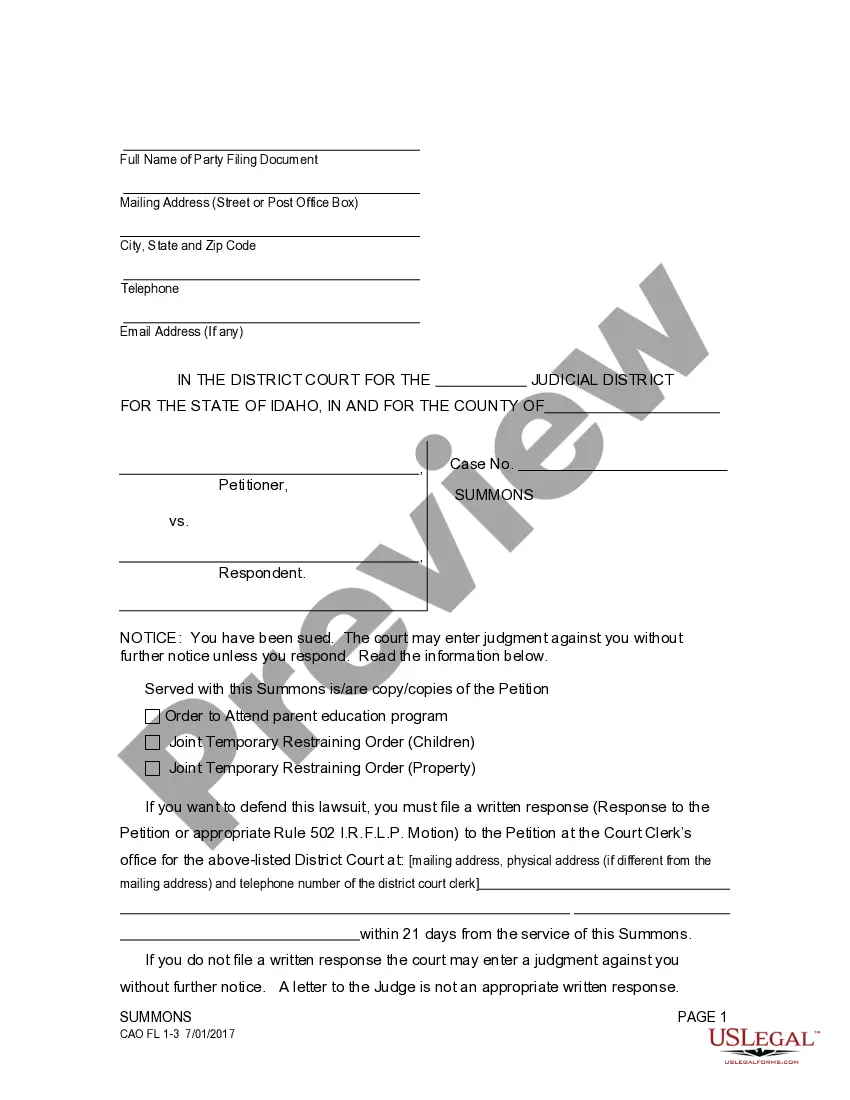

- Be sure you have chosen the correct kind for your personal town/state. Select the Review key to examine the form`s content material. Read the kind explanation to ensure that you have selected the appropriate kind.

- In the event the kind doesn`t fit your demands, use the Look for area on top of the display to obtain the one who does.

- When you are content with the shape, affirm your decision by visiting the Get now key. Then, pick the pricing program you prefer and offer your credentials to sign up to have an profile.

- Method the financial transaction. Utilize your charge card or PayPal profile to accomplish the financial transaction.

- Find the format and obtain the shape on your own product.

- Make changes. Fill up, edit and produce and signal the downloaded Wyoming Personnel Payroll Associate Checklist.

Each and every format you put into your bank account does not have an expiration date and is the one you have for a long time. So, if you would like obtain or produce another version, just check out the My Forms area and click on around the kind you want.

Obtain access to the Wyoming Personnel Payroll Associate Checklist with US Legal Forms, one of the most comprehensive catalogue of authorized document templates. Use thousands of skilled and condition-certain templates that fulfill your business or person demands and demands.