Wyoming Resolution of Meeting of Corporation to Make Specific Loan

Description

How to fill out Resolution Of Meeting Of Corporation To Make Specific Loan?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a selection of legal document templates that you can download or create.

By using this website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Wyoming Resolution of Meeting of Corporation to Make Specific Loan in just seconds.

If you already have an account, sign in and download the Wyoming Resolution of Meeting of Corporation to Make Specific Loan from your US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Edit. Fill out, modify, print, and sign the downloaded Wyoming Resolution of Meeting of Corporation to Make Specific Loan.

Every template you add to your account has no expiration date and is yours forever. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you require. Access the Wyoming Resolution of Meeting of Corporation to Make Specific Loan with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of specialized and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are some simple steps to get started.

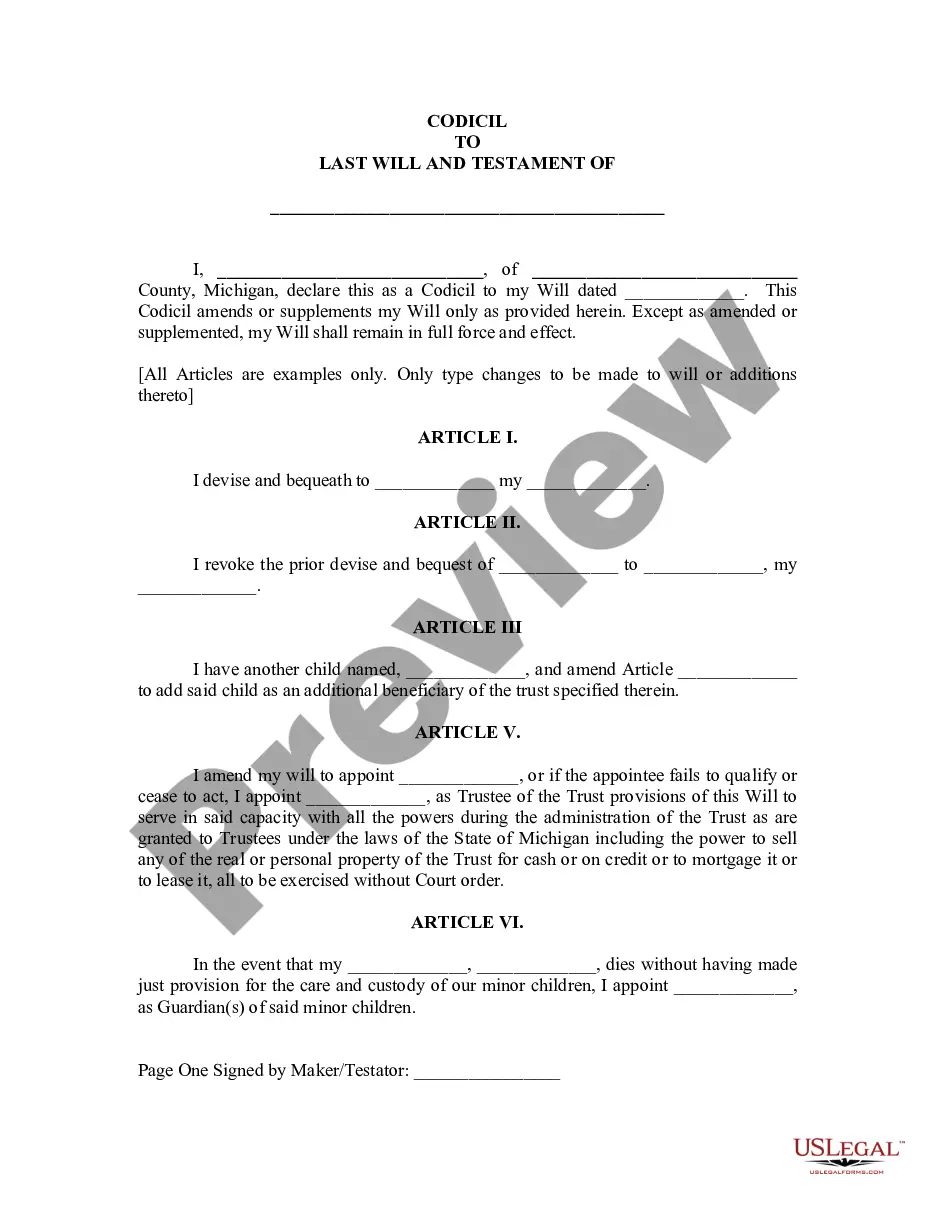

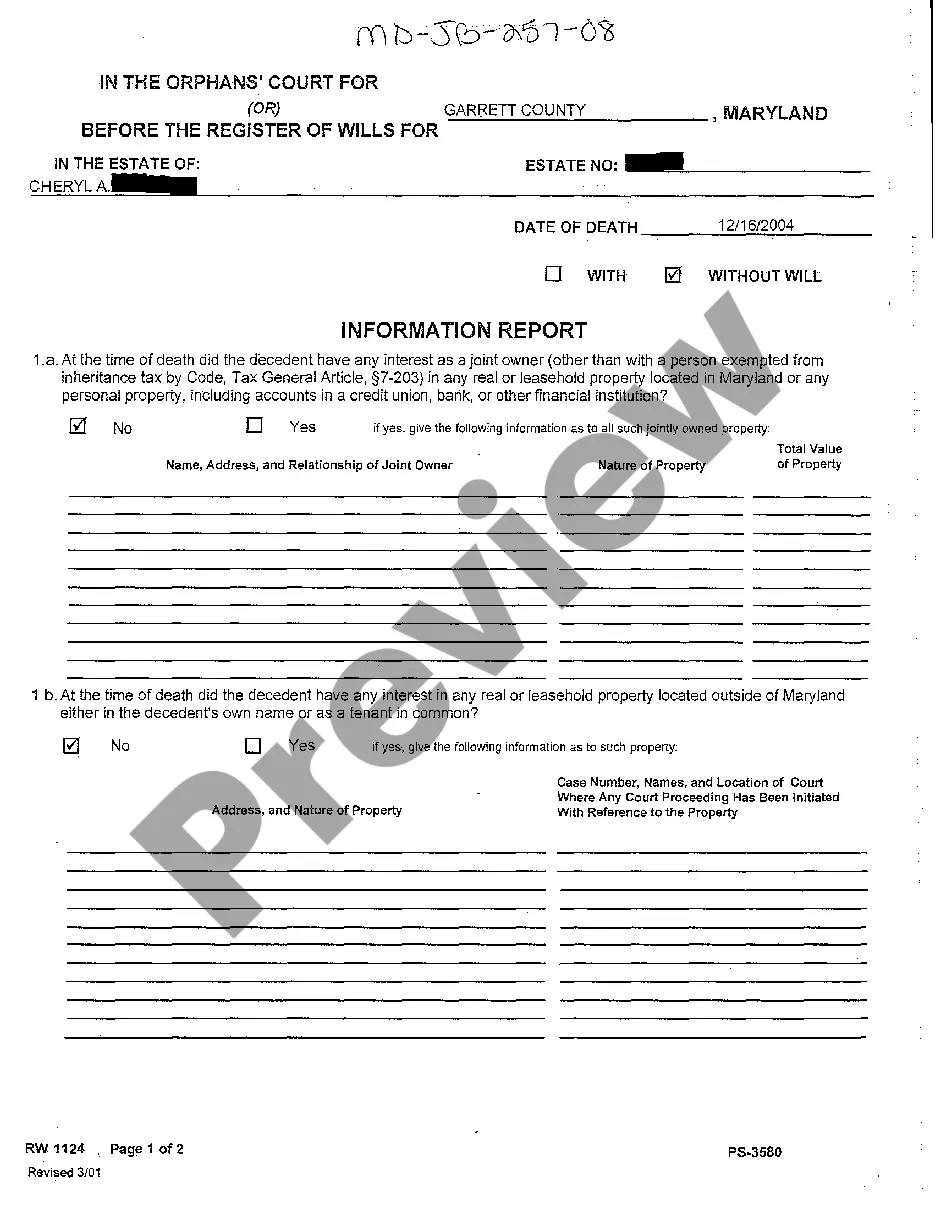

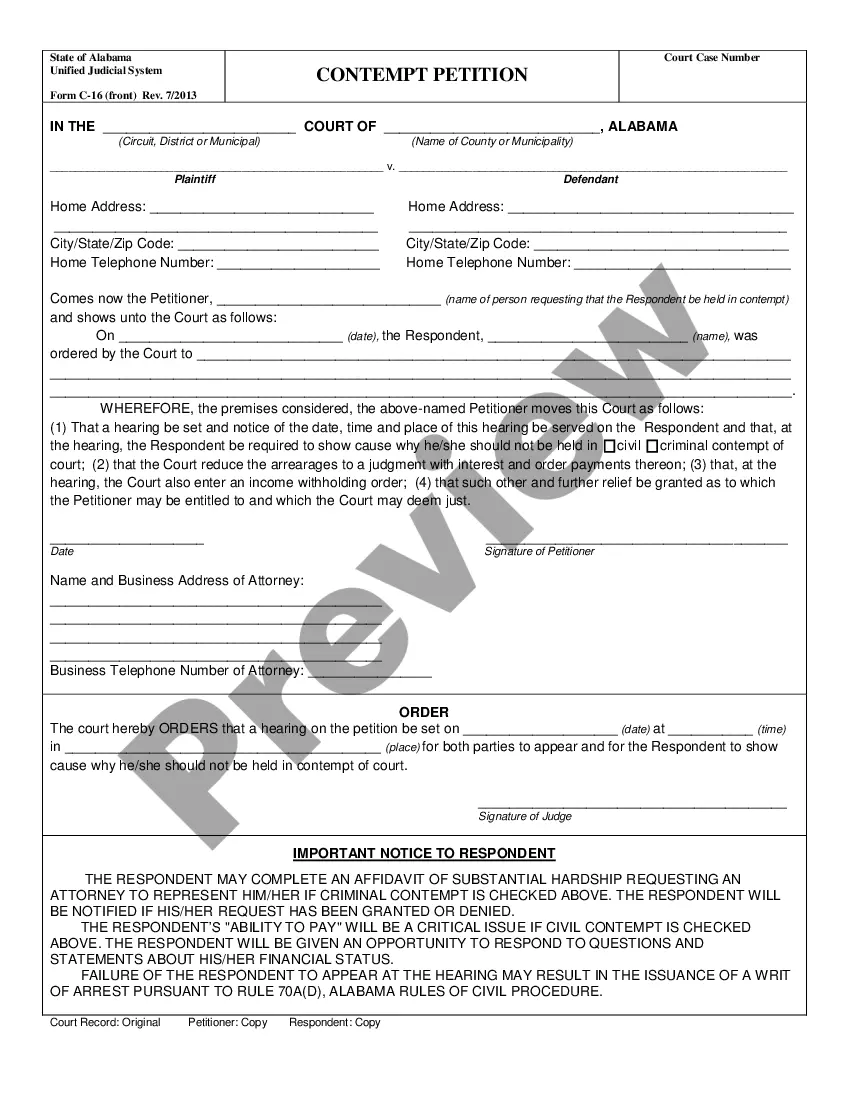

- Ensure you have selected the correct form for your area/state. Click the Review button to examine the content of the form. Read the form details to confirm you have chosen the right form.

- If the form doesn't meet your needs, use the Search bar at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred payment plan and provide your information to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

Elements of a Certified Board ResolutionExplanation of the action being taken by the board of directors and the reason for doing so. Name of the secretary. Legal name of the corporation and state of incorporation. Names of the board of directors voting for approval of the resolution.

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

Certified Resolution means a copy of a resolution certified by the Secretary or an Assistant Secretary of the Company to have been duly adopted by the Board of Directors and to be in full force and effect on the date of such certification.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.