Wyoming Self-Employed Independent Contractor Employment Agreement — Hair Salon or Barber Shop Description: A Wyoming Self-Employed Independent Contractor Employment Agreement specifically tailored for Hair Salons or Barber Shops is a legally binding document that outlines the working arrangement and contractual relationship between a hair salon/barber shop owner and a self-employed stylist or barber. This agreement is designed to establish the terms and conditions under which the self-employed stylist or barber will provide their professional services within the hair salon or barber shop. It ensures that both parties understand and agree upon key aspects such as compensation, responsibilities, use of facilities, client management, and compliance with local regulations. Key Elements of the Wyoming Self-Employed Independent Contractor Employment Agreement for Hair Salons or Barber Shops: 1. Name and Contact Information: Includes the full names and contact information of the hair salon/barber shop owner and the self-employed stylist or barber, as well as the official business name of the salon/barber shop. 2. Start Date and Duration: Specifies the date when the agreement comes into effect and mentions the duration of the contract, whether it is a fixed-term agreement or an ongoing arrangement. 3. Nature of Relationship: Clarifies that the self-employed stylist or barber is an independent contractor and not an employee of the hair salon/barber shop, highlighting their self-employed status. 4. Services Provided: Details the specific hairstyling or barbering services that the self-employed stylist or barber will be offering within the hair salon/barber shop. This may include haircuts, coloring, styling, extensions, shaves, etc. 5. Compensation: Outlines the agreed-upon payment structure, including the method of payment (e.g., commission, booth rental, or a combination of both), rate(s), and frequency of payment (e.g., weekly, bi-weekly, monthly). 6. Schedule and Availability: Specifies the working hours and days the self-employed stylist or barber will be available to provide services. It may also cover provisions for time off, sick leave, and holidays. 7. Use of Facilities and Tools: Addresses the use of salon/barber shop facilities, equipment, supplies, and products. It may mention whether the stylist/barber needs to bring their own tools or if the salon/shop provides them. 8. Client Management: Specifies how clients are assigned or obtained, whether the salon/shop provides marketing or advertising support, and any arrangements for managing appointments or walk-in clients. 9. Confidentiality and Non-Compete: May include clauses to protect the salon/shop's trade secrets and confidentiality of client information, as well as any non-compete provisions that limit the stylist/barber from working for competing establishments within a specified time or geographical area. 10. Termination Clause: Outlines the conditions under which either party may terminate the agreement, such as breach of contract, non-performance, or violation of salon/shop policies. Some variations of Wyoming Self-Employed Independent Contractor Employment Agreements for Hair Salons or Barber Shops may include specific provisions tailored to unique circumstances, such as: — Booth Rental Agreement: If the self-employed stylist or barber rents a booth or chair within the hair salon/barber shop. — Commission-Based Agreement: If the self-employed stylist or barber receives a percentage of the revenue generated from their services. — Partnership Agreement: If multiple self-employed stylists or barbers jointly operate a salon/barber shop as partners. Legal advice is always recommended when drafting or entering into any employment agreement to ensure compliance with Wyoming state laws.

Wyoming Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

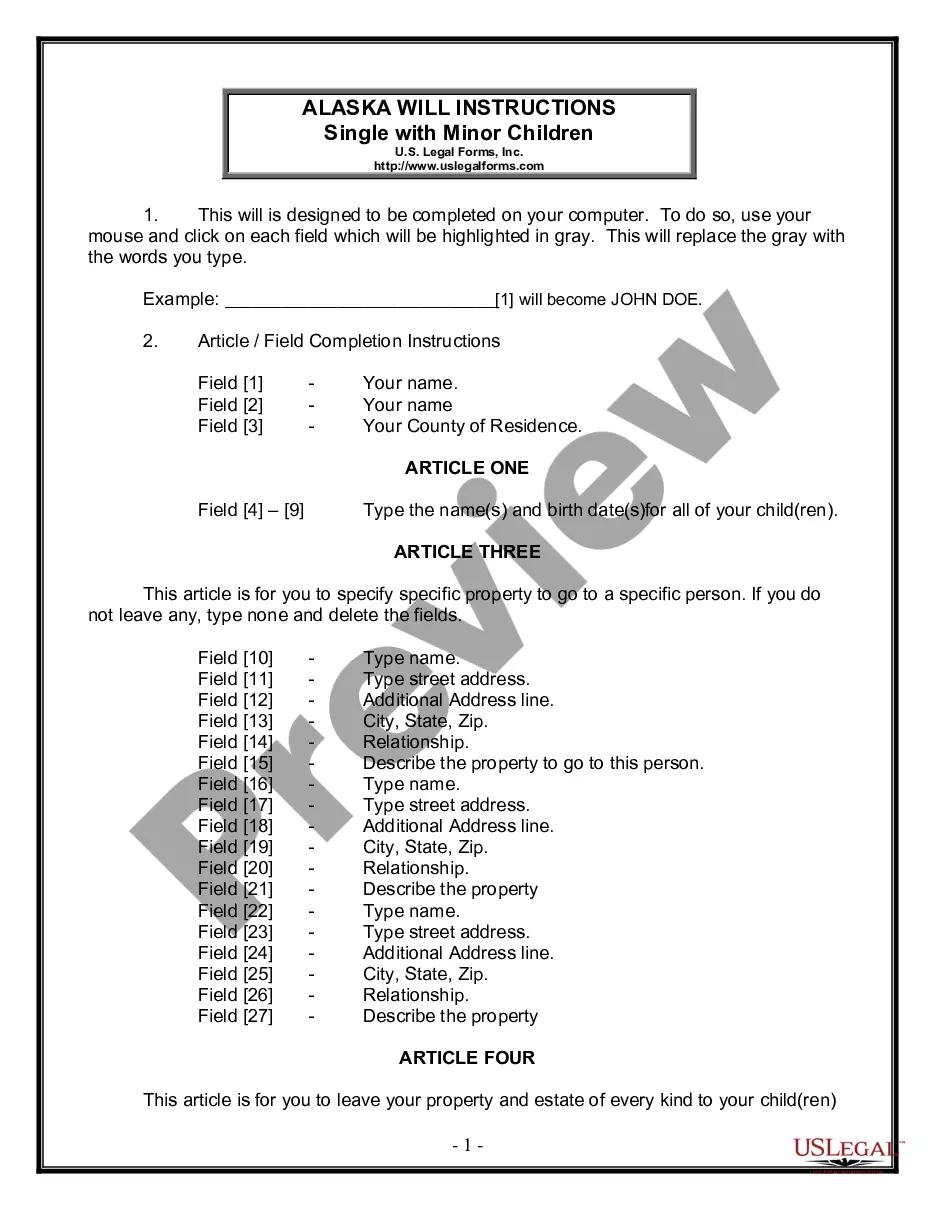

How to fill out Wyoming Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

Choosing the right legitimate document design can be quite a battle. Naturally, there are a lot of layouts accessible on the Internet, but how can you obtain the legitimate type you require? Use the US Legal Forms website. The services offers 1000s of layouts, like the Wyoming Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop, which you can use for company and personal requirements. Every one of the types are checked out by experts and meet up with state and federal specifications.

Should you be presently signed up, log in in your account and click on the Down load switch to obtain the Wyoming Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop. Make use of your account to look from the legitimate types you possess ordered formerly. Visit the My Forms tab of the account and obtain one more copy in the document you require.

Should you be a brand new end user of US Legal Forms, listed here are easy guidelines that you should stick to:

- Initially, make certain you have selected the appropriate type for the city/area. It is possible to look through the shape making use of the Review switch and study the shape outline to ensure this is the best for you.

- If the type is not going to meet up with your requirements, take advantage of the Seach discipline to find the correct type.

- When you are sure that the shape is suitable, go through the Acquire now switch to obtain the type.

- Select the prices prepare you would like and type in the required details. Create your account and buy the transaction using your PayPal account or credit card.

- Choose the file formatting and download the legitimate document design in your product.

- Complete, revise and print out and sign the attained Wyoming Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

US Legal Forms will be the largest library of legitimate types in which you can see numerous document layouts. Use the service to download skillfully-produced papers that stick to condition specifications.

Form popularity

FAQ

Barbers usually serve male clients for shampoos, haircuts, and shaves. Some fit hairpieces and perform facials. Hairdressers, or hairstylists, provide coloring, chemical hair treatments, and styling in addition to shampoos and cuts, and serve both female and male clients.

You earn money as a contractor, consultant, freelancer, or other independent worker. You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.

Under the new test for independent contractor vs employee status in California, it is illegal to classify a barber or hair stylist as an independent contractor unless the salon can prove that: (1) the hair stylist is free the hair salon's control; (2) the job of cutting or styling hair falls outside the salon's usual

LLC vs. Sole ProprietorshipBarbers who work as independent contractors will probably start out operating as a sole proprietorship. In fact, you don't have to do anything but earn extra income to operate as a sole proprietorship.

Hairdressers are Exempt from AB5 Because a hairdresser would normally be considered to be performing services that are within the usual course of a salon's business, the salon (or hiring entity) can never truly meet part B of the ABC test.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

California's contractor laws state that an independent contractor is a person or business who provides a specific service to another company in exchange for compensation. It further says that the independent contractor is under managerial control for results and not how he or she accomplishes the work.