A Wyoming Complex Guaranty Agreement to Lender is a legal contract that provides an additional layer of security for lenders in complex financing transactions conducted in the state of Wyoming. This agreement is primarily used when there are multiple borrowers or guarantors involved, and it ensures that the lender has recourse against all parties in case of default or non-payment. Key terms and components of a Wyoming Complex Guaranty Agreement to Lender may include: 1. Parties: The agreement typically includes the names and contact information of all parties involved, including the lender, borrower(s), and guarantor(s). 2. Guarantor's Obligations: The guarantor agrees to guarantee the payment and performance of the borrower's obligations to the lender. This includes acknowledging that the obligations may arise from various financing documents, such as loans, promissory notes, or security agreements. 3. Guarantor's Liability: The agreement outlines the extent of the guarantor's liability, which may be joint and several with other guarantors or limited to a specific portion of the debt. The guarantor may also agree to be personally liable for any deficiencies or costs incurred by the lender in enforcing the loan. 4. Security/Collateral: The agreement may specify any collateral provided to secure the loan, such as real estate, personal property, or other assets. It may also describe the process for perfecting and releasing liens on the collateral. 5. Representations and Warranties: The guarantor typically represents that they have the legal authority to enter into the agreement and that there are now pending legal actions or contractual obligations that could impair their ability to fulfill their obligations. 6. Events of Default: The agreement should include a list of events that would trigger a default, such as non-payment, breach of covenants, bankruptcy, or insolvency. It may also outline the lender's rights and remedies upon default. 7. Indemnification: The guarantor may agree to indemnify the lender against any losses, expenses, or damages arising from the borrower's default, including attorney fees and court costs. 8. Governing Law: As the agreement pertains specifically to Wyoming, it should clearly state that the laws of the state govern the interpretation and enforcement of the agreement. Types of Wyoming Complex Guaranty Agreements to Lender: 1. Unconditional Guaranty: This type of agreement makes the guarantor fully liable for the borrower's obligations, agreeing to pay the lender regardless of any defenses the borrower may have. 2. Conditional Guaranty: In this case, the guarantor's liability is contingent upon certain conditions, such as the borrower's default or bankruptcy. The guarantor is only responsible for the obligations if these conditions are met. 3. Limited Guaranty: This agreement limits the guarantor's liability to a specific portion or amount of the overall debt. The lender can only seek repayment up to the agreed-upon limit. In conclusion, a Wyoming Complex Guaranty Agreement to Lender is a comprehensive legal contract used in complex financing transactions, ensuring additional security for lenders. It defines the responsibilities and liabilities of the guarantors, outlines potential events of default, and specifies the lender's rights and remedies in case of non-payment.

Wyoming Complex Guaranty Agreement to Lender

Description

How to fill out Wyoming Complex Guaranty Agreement To Lender?

Are you in the placement in which you will need files for either company or person reasons virtually every day? There are a variety of legitimate document templates available online, but locating versions you can depend on is not easy. US Legal Forms delivers a large number of kind templates, much like the Wyoming Complex Guaranty Agreement to Lender, that happen to be composed to fulfill state and federal requirements.

In case you are presently knowledgeable about US Legal Forms internet site and possess a merchant account, simply log in. Next, you can acquire the Wyoming Complex Guaranty Agreement to Lender design.

Should you not provide an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is to the proper town/region.

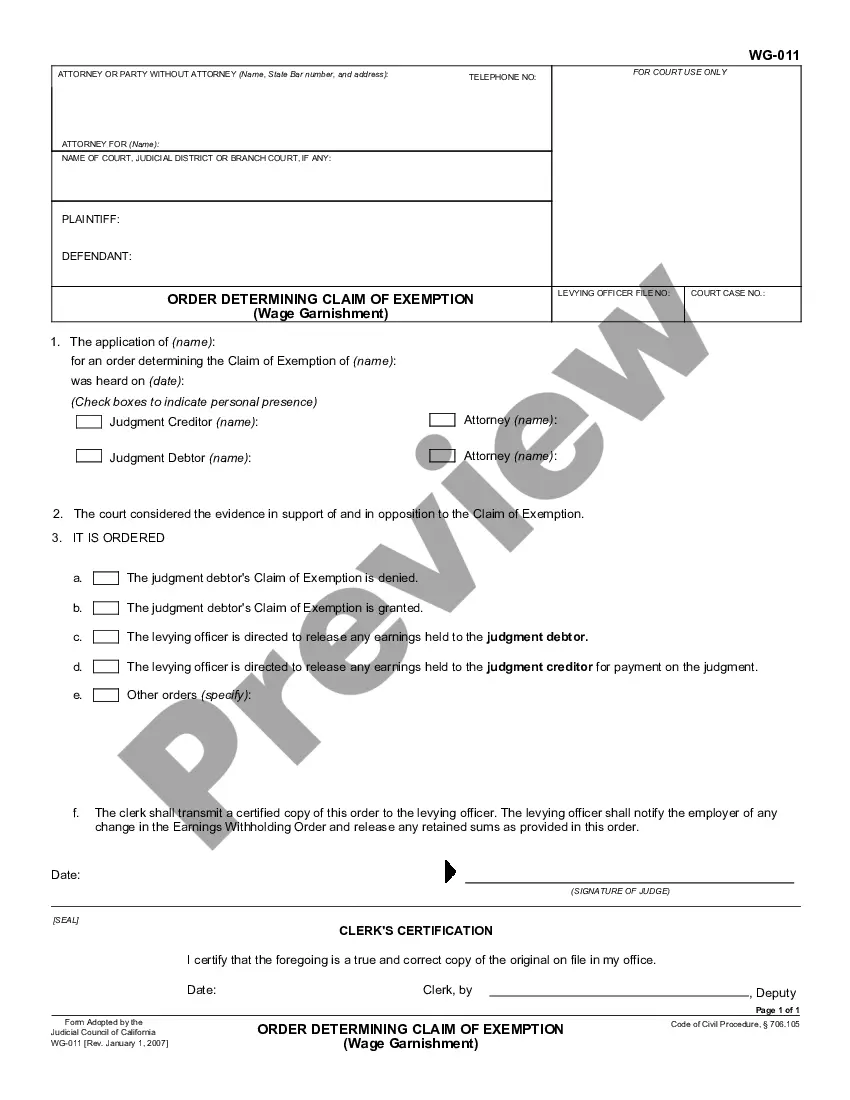

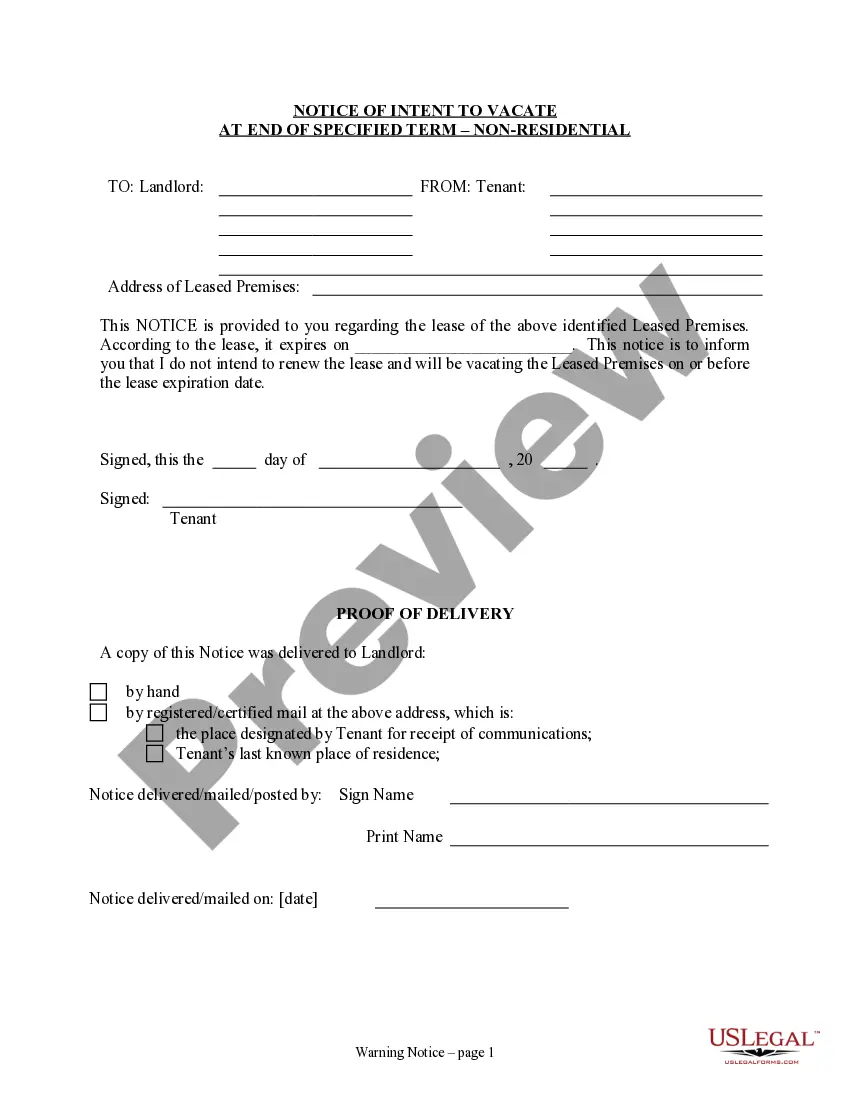

- Make use of the Review switch to analyze the shape.

- Read the explanation to actually have selected the proper kind.

- In case the kind is not what you`re looking for, make use of the Lookup area to obtain the kind that meets your requirements and requirements.

- If you find the proper kind, click on Buy now.

- Opt for the costs strategy you want, complete the necessary details to produce your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a handy paper file format and acquire your version.

Discover all of the document templates you may have purchased in the My Forms menu. You can get a more version of Wyoming Complex Guaranty Agreement to Lender whenever, if necessary. Just click the required kind to acquire or printing the document design.

Use US Legal Forms, one of the most comprehensive assortment of legitimate types, to save time as well as steer clear of blunders. The support delivers appropriately produced legitimate document templates that can be used for an array of reasons. Make a merchant account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

A Deed of Guarantee & Indemnity is a document signed by parties in order to confirm that one of the parties to a contract will guarantee the performance of one of the other parties.

The Guarantor(s) agree/s as a pre-condition of the credit facility granted by the Bank to the Borrower that in case any default is committed in the repayment of the loan/advance or in repayment of interest thereon or any of the agreed instalment of the loan on due date/s, the Bank and/or the Reserve Bank of India will ...

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

Section 4 of the Statute of Frauds (1677) requires a guarantee to be in writing and signed by the guarantor (or some other person lawfully authorised to sign on the guarantor's behalf). If a guarantee does not comply with Statute of Frauds (1677), s 4, it will be unenforceable.