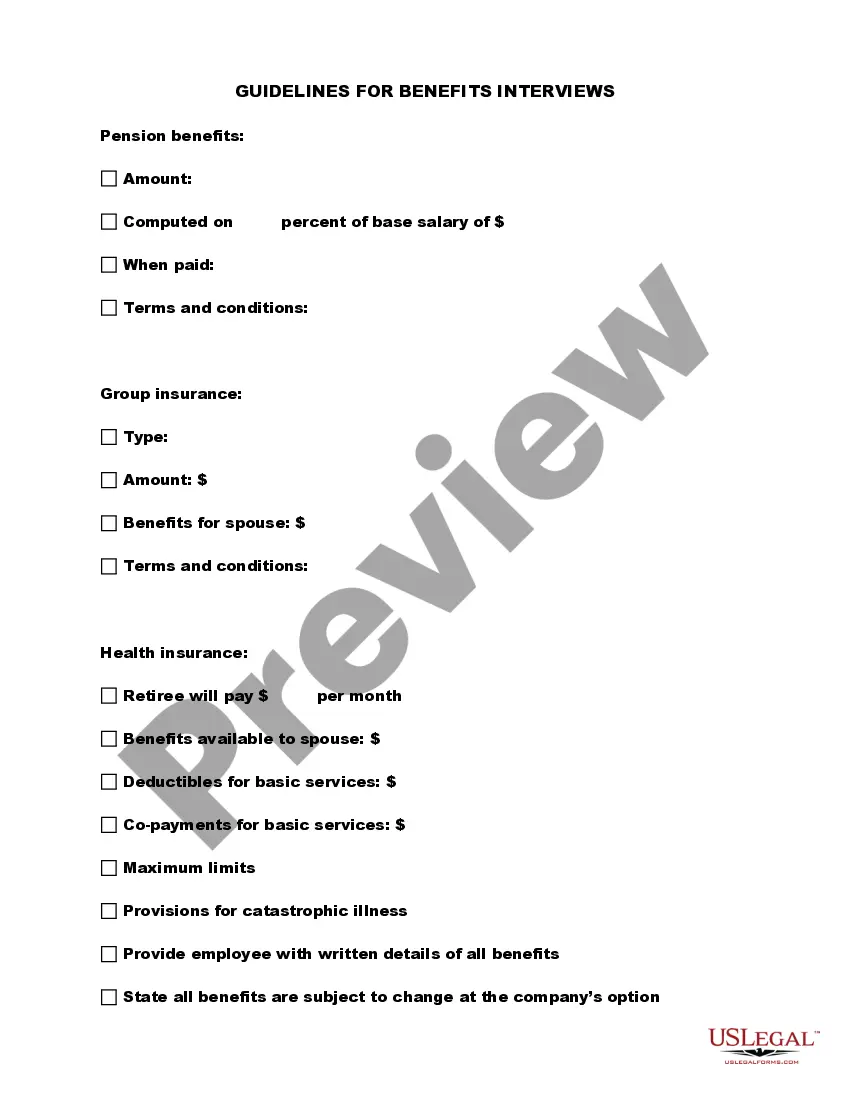

Wyoming Guidelines for Benefits Interviews

Description

How to fill out Guidelines For Benefits Interviews?

Finding the correct authentic document template can be a challenge.

Of course, there are numerous designs available online, but how do you obtain the authentic form you seek? Use the US Legal Forms website.

The service offers thousands of designs, including the Wyoming Guidelines for Benefits Interviews, which can be utilized for both business and personal purposes.

- All templates are verified by experts and comply with federal and state requirements.

- If you are already registered, sign in to your account and click the Download button to retrieve the Wyoming Guidelines for Benefits Interviews.

- Use your account to browse the legal forms you have previously acquired.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the appropriate form for your area/region.

Form popularity

FAQ

In Wyoming, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, Wyoming does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.

The form of communicating a change in rate or manner of pay is not mandated by law, however, an employer and empoyee may agree to a wage payment arrangement that is other than semimonthly.

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if you were fired for misconduct relating to your job, you will be ineligible for benefits.

If you're unemployed Usually, a person is considered unemployed if they're over 16 years of age and are actively seeking paid employment. Unemployment can happen either be due to being laid off, being fired or resignation from the company.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

You will not be paid benefits. for that week if your earnings equal or exceed your weekly benefit amount or if you work 35 or more hours that week. If you fail to report earnings or other compensations properly you could be disqualified from receiving benefits for 52 weeks.

For the most part: no, employers may not prohibit employees from discussing compensation according to the National Labor Relations Board (NLRB) and an April 2014 Executive Order from former President Obama.

Your weekly benefit rate is 4% of your earnings in the highest paid quarter of the base period. The maximum weekly benefit amount is $508. The minimum weekly benefit for this same time period is $32. These numbers can change each year; they are determined by a formula in the Wyoming statutes.