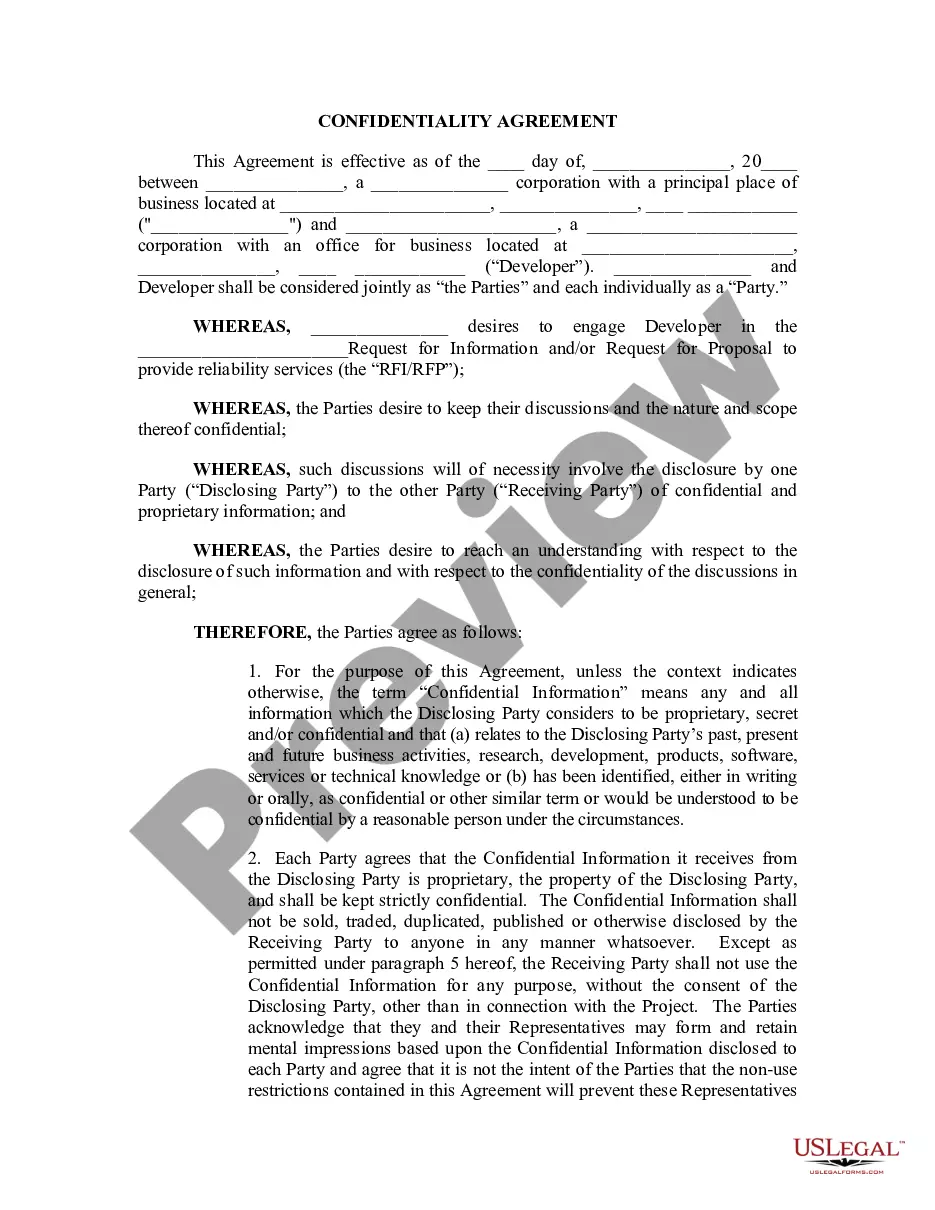

The Wyoming Company Property Agreement is a legally binding document that outlines the terms and conditions surrounding the ownership, control, and use of company property in the state of Wyoming. This agreement ensures clarity and protection for both the company and the employees or stakeholders involved. Keywords: Wyoming, Company Property Agreement, ownership, control, use, terms and conditions, clarity, protection, employees, stakeholders. There are several types of Wyoming Company Property Agreements, each serving a specific purpose. These include: 1. Intellectual Property Agreement: This type of agreement specifically focuses on the ownership and usage rights of intellectual property assets such as copyrights, trademarks, patents, and trade secrets. It outlines the responsibility of the company in protecting and enforcing these rights while ensuring that employees or third parties do not infringe upon them. 2. Equipment and Asset Use Agreement: This agreement pertains to the usage, maintenance, and responsibility of company-owned equipment and assets. It outlines the terms for employees or stakeholders to use these items, ensuring they are used appropriately, properly maintained, and returned in good condition. 3. Confidentiality and Non-Disclosure Agreement: This agreement ensures the protection of confidential information, trade secrets, and proprietary data owned by the company. It binds employees or stakeholders to maintain strict confidentiality and refrain from sharing or using such information for personal gain or the benefit of competitors. 4. Real Estate Property Agreement: This type of agreement is relevant when the company owns or leases real estate property in Wyoming. It outlines the rights and responsibilities of the company, including maintenance, repairs, payment of rent or mortgage, and compliance with local laws and regulations. 5. Vehicle Use Agreement: If the company provides vehicles for employee use, this agreement governs the terms and conditions surrounding their usage. It establishes guidelines for authorized usage, maintenance, insurance coverage, and liability of the employees while operating company vehicles. 6. Stock Option Agreement: This agreement pertains to company stock options granted to employees or stakeholders. It outlines the terms, conditions, and restrictions associated with the acquisition, exercise, and sale of such stock options, ensuring compliance with state and federal regulations. In conclusion, the Wyoming Company Property Agreement is a comprehensive legal document that regulates the ownership, control, and usage of various types of company property. By having different types of agreements, companies can tailor their contracts to specific assets, intellectual property, or property-related matters, providing clear guidelines and protection for both parties involved.

Wyoming Company Property Agreement

Description

How to fill out Wyoming Company Property Agreement?

Choosing the right authorized record web template can be a have difficulties. Obviously, there are tons of web templates available on the net, but how can you get the authorized form you require? Utilize the US Legal Forms website. The assistance offers 1000s of web templates, for example the Wyoming Company Property Agreement, which you can use for organization and personal requires. All the varieties are inspected by specialists and meet up with federal and state demands.

When you are already authorized, log in for your accounts and click the Download switch to have the Wyoming Company Property Agreement. Make use of accounts to appear with the authorized varieties you might have ordered previously. Proceed to the My Forms tab of your own accounts and obtain an additional backup from the record you require.

When you are a new consumer of US Legal Forms, here are simple instructions so that you can adhere to:

- Initial, be sure you have selected the proper form for your town/state. It is possible to look through the form while using Review switch and study the form description to ensure it is the best for you.

- In the event the form fails to meet up with your preferences, take advantage of the Seach discipline to find the appropriate form.

- When you are positive that the form would work, select the Get now switch to have the form.

- Opt for the prices prepare you want and enter the required information and facts. Make your accounts and buy an order with your PayPal accounts or bank card.

- Opt for the submit structure and obtain the authorized record web template for your device.

- Total, change and produce and signal the acquired Wyoming Company Property Agreement.

US Legal Forms will be the largest library of authorized varieties in which you can find different record web templates. Utilize the service to obtain appropriately-produced documents that adhere to state demands.

Form popularity

FAQ

How to Start an LLC in WyomingChoose a Name for Your LLC.Appoint a Registered Agent.File Articles of Organization.Prepare an Operating Agreement.Comply With Tax and Regulatory Requirements.Annual Report.

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

Fortunately, there is no general Wyoming business license per se. For most businesses in the state of Wyoming, a business license isn't necessary, so there are no extra fees to pay or forms to file. You must only pay for an annual report and maintain a registered agent in Wyoming.

Conclusion. To sum it up, a holding company is a business entity that does not produce any goods or services or conduct business operations. Instead, it owns and controls other companies.

To make amendments to your limited liability company in Wyoming, you provide the completed Limited Liability Company Amendment to Articles of Organization form in duplicate to the Secretary of State by mail or in person, along with the filing fee.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

An operating company does all the trading selling products, entering into contracts, hiring employees. A holding company holds the business' assets such as real estate and intellectual property.

A holding company does not need any special type of operating agreement. However, it should include and address terms and issues that are specific to the industry in which the holding company is being used.

Is an LLC Operating Agreement required in Wyoming? No. An Operating Agreement is not required in Wyoming. Although it is not required, the SBA recommends that all LLCs in every state have a clear and detailed Operating Agreement.

One thing that the new Act did not do was add a requirement that LLC operating agreements must be in writing to be enforceable. Under the new Act, as with the old law, an LLC operating agreement may be written or oral.