Title: Wyoming Worksheet for Analyzing a Self-Employed Independent Contractor: A Comprehensive Overview Description: Are you a business owner or self-employed individual in Wyoming hiring independent contractors? Look no further! This detailed guide will walk you through everything you need to know about the Wyoming Worksheet for Analyzing a Self-Employed Independent Contractor. Keywords: Wyoming, worksheet, self-employed, independent contractor, analyze, comprehensive, guide 1. Understanding the Wyoming Worksheet for Analyzing a Self-Employed Independent Contractor: Learn about the purpose and significance of the Wyoming Worksheet, which serves as a comprehensive tool for assessing the classification status of independent contractors. Explore how this evaluation form aids in determining the working relationship, control factors, and associated risks. 2. Key Elements Covered in the Wyoming Worksheet: Delve into the various sections and components included in the Wyoming Worksheet. Keywords to focus on include "Employee vs. Independent Contractor," "Nature of Work," "Financial Control," "Behavioral Control," and "Type of Relationship." Gain insight into each section's significance in assessing worker classification accurately. 3. Different Types of Wyoming Worksheets for Analyzing a Self-Employed Independent Contractor: While the core components remain the same, Wyoming offers different versions of the worksheet designed to cater to the specific needs of various industries. Explore these versions and understand their unique characteristics — mechanical and construction industry workers, consultants and freelancers, truck drivers, healthcare professionals, and more. 4. Step-by-step Guide to Completing the Wyoming Worksheet: Follow our comprehensive guide on how to effectively fill out the Wyoming Worksheet. Explore the intent behind each question and understand how to provide appropriate responses that align with the independent contractor status. Navigate through each section with ease for accurate classification outcomes. 5. Top Considerations for Accurate Classification: Discover the critical factors that businesses and self-employed individuals must consider when analyzing the status of an independent contractor in Wyoming. Keywords for this section include "IRS guidelines," "right of control," "contractual arrangements," "compensation structure," "exclusivity of services," and "written agreements." 6. Consequences of Misclassification: Highlight the potential risks and repercussions for misclassifying workers in Wyoming. Understand the legal, financial, and operational consequences that businesses may face due to incorrect classification. Explore the importance of staying compliant with regulations and avoiding costly penalties. 7. Seeking Legal and Professional Assistance: If the analysis of an independent contractor's status seems complex or uncertain, it is advisable to seek legal counsel or professional guidance. Explore the benefits of consulting with an attorney or accountant experienced in Wyoming employment law to ensure compliance and avoid potential issues. By utilizing the Wyoming Worksheet for Analyzing a Self-Employed Independent Contractor, businesses and self-employed individuals can confidently classify workers, mitigate risks, and maintain compliance with regulations. Start your journey today to effectively navigate Wyoming's independent contractor classification process.

Wyoming Worksheet Analyzing a Self-Employed Independent Contractor

Description

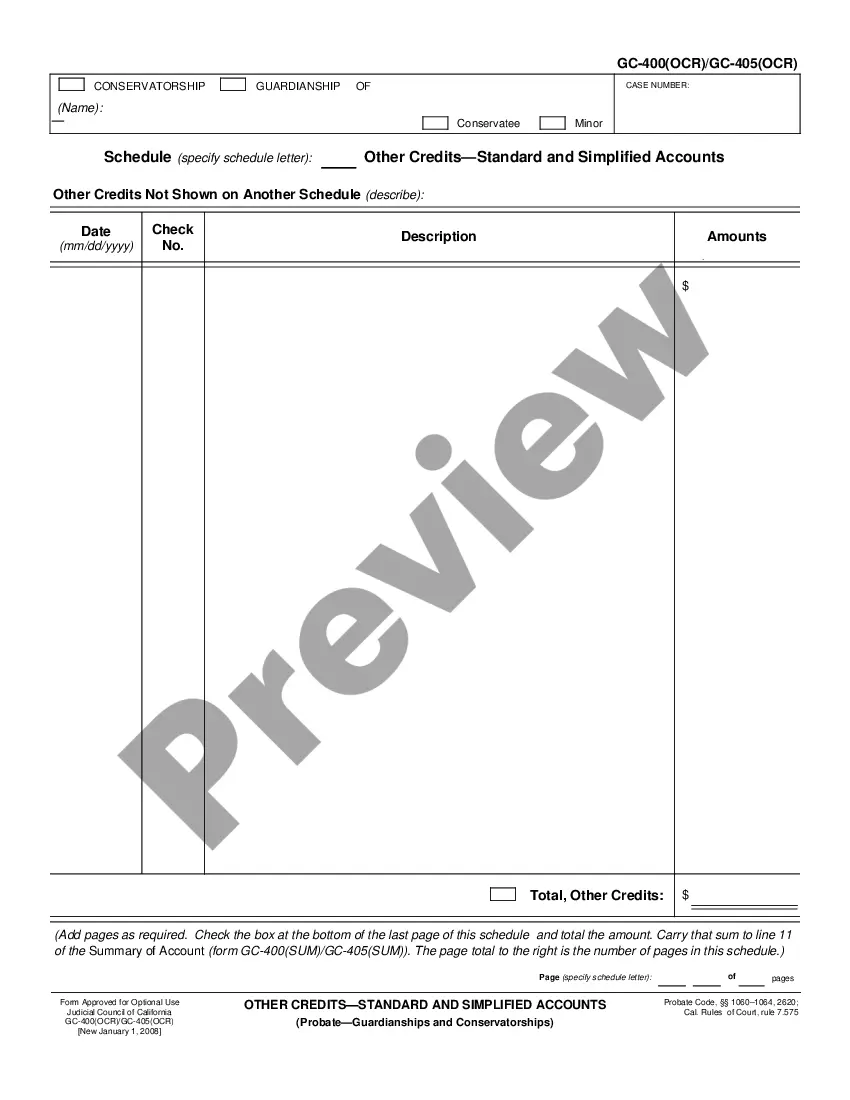

How to fill out Wyoming Worksheet Analyzing A Self-Employed Independent Contractor?

US Legal Forms - among the largest libraries of authorized types in the States - delivers a variety of authorized file templates it is possible to down load or produce. Using the site, you may get a large number of types for organization and person functions, sorted by groups, states, or keywords and phrases.You will discover the most recent types of types like the Wyoming Worksheet Analyzing a Self-Employed Independent Contractor within minutes.

If you already possess a subscription, log in and down load Wyoming Worksheet Analyzing a Self-Employed Independent Contractor through the US Legal Forms local library. The Down load switch will appear on each and every form you view. You have accessibility to all in the past delivered electronically types within the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, allow me to share basic recommendations to get you began:

- Ensure you have chosen the best form for your metropolis/region. Go through the Preview switch to examine the form`s content. Read the form information to actually have selected the proper form.

- In case the form does not match your demands, use the Research industry near the top of the monitor to discover the the one that does.

- When you are content with the form, affirm your selection by visiting the Get now switch. Then, select the prices program you favor and provide your qualifications to sign up for an profile.

- Procedure the purchase. Use your Visa or Mastercard or PayPal profile to finish the purchase.

- Pick the formatting and down load the form in your system.

- Make modifications. Fill out, change and produce and indicator the delivered electronically Wyoming Worksheet Analyzing a Self-Employed Independent Contractor.

Each and every web template you added to your money does not have an expiry particular date and it is your own forever. So, if you wish to down load or produce another duplicate, just proceed to the My Forms portion and click on on the form you want.

Gain access to the Wyoming Worksheet Analyzing a Self-Employed Independent Contractor with US Legal Forms, probably the most extensive local library of authorized file templates. Use a large number of specialist and express-distinct templates that meet your business or person needs and demands.

Form popularity

FAQ

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.