Wyoming Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Are you presently in a situation that you need to have documents for either organization or person functions virtually every day? There are a variety of authorized record web templates available on the net, but finding ones you can rely on isn`t straightforward. US Legal Forms delivers a huge number of develop web templates, like the Wyoming Personal Property - Schedule B - Form 6B - Post 2005, which can be published to fulfill federal and state needs.

If you are already acquainted with US Legal Forms website and have a merchant account, just log in. After that, it is possible to download the Wyoming Personal Property - Schedule B - Form 6B - Post 2005 web template.

Should you not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the right area/region.

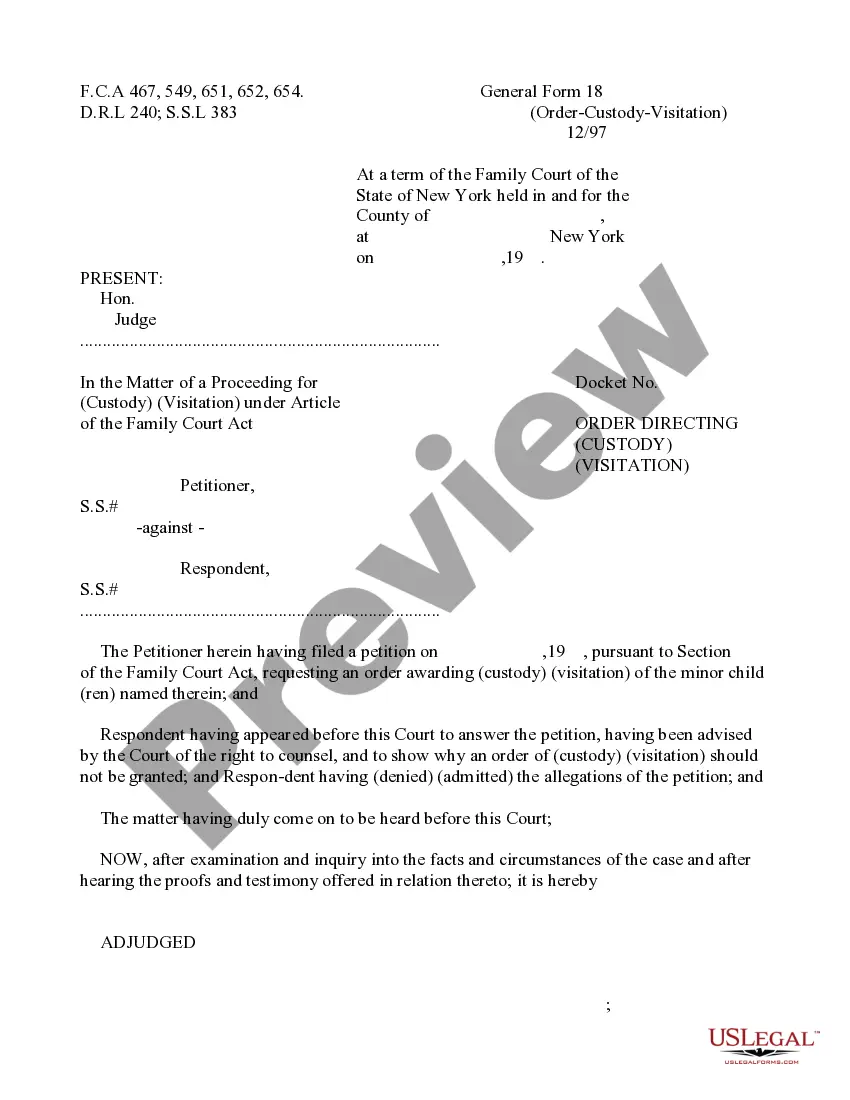

- Utilize the Review option to analyze the form.

- Browse the outline to actually have chosen the proper develop.

- In the event the develop isn`t what you are looking for, make use of the Look for discipline to get the develop that meets your needs and needs.

- Whenever you obtain the right develop, click on Purchase now.

- Choose the prices prepare you would like, fill in the specified info to produce your account, and pay money for the transaction with your PayPal or bank card.

- Pick a hassle-free document formatting and download your backup.

Locate each of the record web templates you possess bought in the My Forms food selection. You may get a extra backup of Wyoming Personal Property - Schedule B - Form 6B - Post 2005 any time, if needed. Just select the required develop to download or produce the record web template.

Use US Legal Forms, by far the most substantial variety of authorized forms, in order to save time as well as steer clear of errors. The services delivers expertly made authorized record web templates that can be used for an array of functions. Make a merchant account on US Legal Forms and commence creating your life a little easier.