Wyoming Restructuring Agreement is a legal document designed to facilitate the restructuring or reorganization of a business entity, typically in the state of Wyoming. It outlines the terms and conditions under which the restructuring will take place, ensuring that all parties involved understand their rights and obligations. This agreement is commonly utilized when a company is facing financial difficulties, seeking to streamline operations, or undergoing a change in ownership. Keywords: Wyoming Restructuring Agreement, legal document, restructuring, reorganization, business entity, terms and conditions, financial difficulties, streamline operations, change in ownership. There are several types of Wyoming Restructuring Agreements, each serving a specific purpose based on the needs and goals of the involved parties. Some common types include: 1. Debt Restructuring Agreement: This agreement is used when a company aims to renegotiate the terms of its existing debts, such as loans or credit facilities. It typically involves extending repayment periods, reducing interest rates, or adjusting payment schedules to alleviate financial pressure. 2. Merger or Acquisition Agreement: This type of restructuring agreement is utilized during mergers or acquisitions, where two or more entities combine to form a new entity or when one entity acquires another. It outlines the terms of the transaction, including the transfer of assets, liabilities, and ownership rights. 3. Bankruptcy Restructuring Agreement: In situations where a business faces bankruptcy, this agreement is employed to reorganize its operations, debts, and assets. It typically involves developing a plan to repay creditors, protect assets, and potentially continue business operations. 4. Equity Restructuring Agreement: When a company undergoes changes in ownership or seeks to reallocate its equity among stakeholders, this agreement is essential. It outlines the transfer of stocks, ownership percentages, and any associated rights or obligations. 5. Operational Restructuring Agreement: This type of agreement is used to enhance the efficiency and effectiveness of a business by reorganizing its operational structure. It often involves consolidating departments, outsourcing functions, or implementing new strategies to optimize performance. Keywords: Debt Restructuring Agreement, Merger or Acquisition Agreement, Bankruptcy Restructuring Agreement, Equity Restructuring Agreement, Operational Restructuring Agreement.

Wyoming Restructuring Agreement

Description

How to fill out Wyoming Restructuring Agreement?

Are you currently within a situation that you require papers for both enterprise or individual reasons virtually every working day? There are a lot of legitimate papers layouts available on the net, but discovering kinds you can trust isn`t straightforward. US Legal Forms offers a large number of type layouts, much like the Wyoming Restructuring Agreement, which are published in order to meet state and federal demands.

When you are currently informed about US Legal Forms web site and also have a merchant account, just log in. Following that, you may down load the Wyoming Restructuring Agreement template.

Should you not come with an profile and need to start using US Legal Forms, abide by these steps:

- Get the type you will need and ensure it is for that proper metropolis/county.

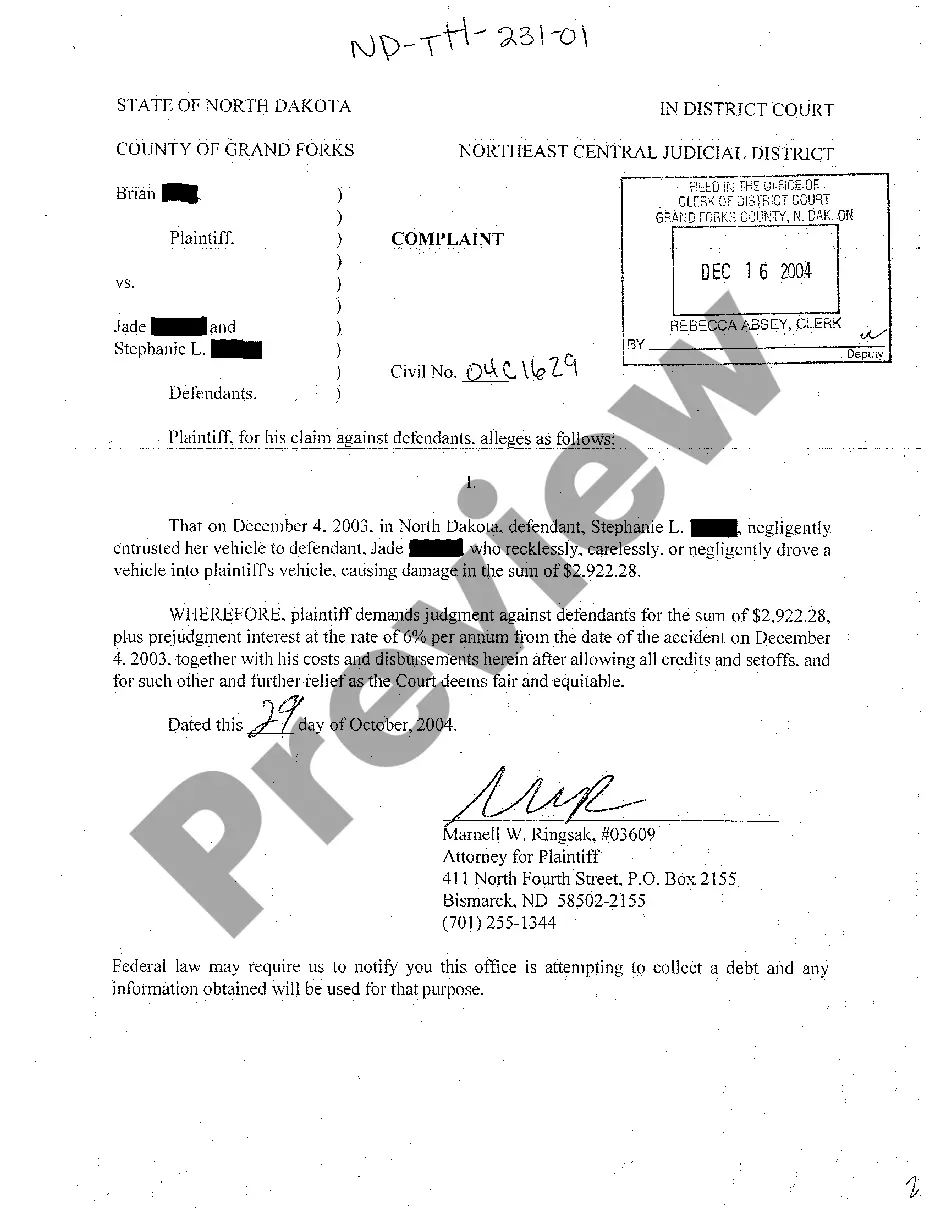

- Use the Review option to examine the form.

- Read the information to ensure that you have selected the proper type.

- If the type isn`t what you`re looking for, use the Look for area to discover the type that suits you and demands.

- Once you find the proper type, just click Get now.

- Pick the rates prepare you would like, fill out the specified information to create your bank account, and pay for your order using your PayPal or Visa or Mastercard.

- Decide on a practical paper format and down load your copy.

Get every one of the papers layouts you might have purchased in the My Forms menu. You may get a extra copy of Wyoming Restructuring Agreement at any time, if possible. Just click the required type to down load or print out the papers template.

Use US Legal Forms, one of the most extensive selection of legitimate varieties, to save lots of time as well as avoid errors. The assistance offers skillfully produced legitimate papers layouts that you can use for a range of reasons. Produce a merchant account on US Legal Forms and initiate generating your way of life a little easier.