The Wyoming Approval of Incentive Stock Option Plan is a significant step in establishing an effective and beneficial incentive program for businesses operating in Wyoming. This plan aims to enhance employee engagement, attract and retain talented individuals, and stimulate the growth and success of businesses. The approval of an Incentive Stock Option Plan in Wyoming provides qualifying companies with the opportunity to grant stock options to their employees. These options give employees the right to purchase company stocks at a predetermined price, often referred to as the exercise price, within a specified period. There are various types of Wyoming Approval of Incentive Stock Option Plans available, including statutory and non-statutory plans. Statutory plans are designed to comply with the requirements of the Internal Revenue Code (IRC) Section 422, while non-statutory plans do not have to adhere to these specific regulations. Both types offer different benefits and implications for both employers and employees. Under the Wyoming Approval of Incentive Stock Option Plan, companies can allocate a predefined number of shares to be granted as stock options. This allocation is typically done by the company's board of directors or a designated committee and is subject to approval by the state of Wyoming. Once the stock options are granted, employees may exercise their options by purchasing the specified number of shares at the predetermined exercise price. When employees exercise their options, they become shareholders of the company, allowing them to participate in potential future gains and profits. One significant advantage of the Wyoming Approval of Incentive Stock Option Plan is the potential tax benefits it offers to both companies and employees. Depending on the specific plan, employees may qualify for favorable tax treatment, such as capital gains tax rates, upon the sale of their shares. To qualify for the Wyoming Approval of Incentive Stock Option Plan, companies must meet certain criteria outlined by the state. These criteria may include, but are not limited to, being a Wyoming-based company, having a minimum number of employees, and adhering to specific guidelines regarding stock option grant pricing and vesting periods. Overall, the Wyoming Approval of Incentive Stock Option Plan serves as a valuable tool for companies to incentivize their employees, foster a sense of ownership and loyalty, and promote company growth. By implementing this plan, businesses in Wyoming can attract top talent, stimulate economic development, and ultimately contribute to the state's overall success.

Wyoming Approval of Incentive Stock Option Plan

Description

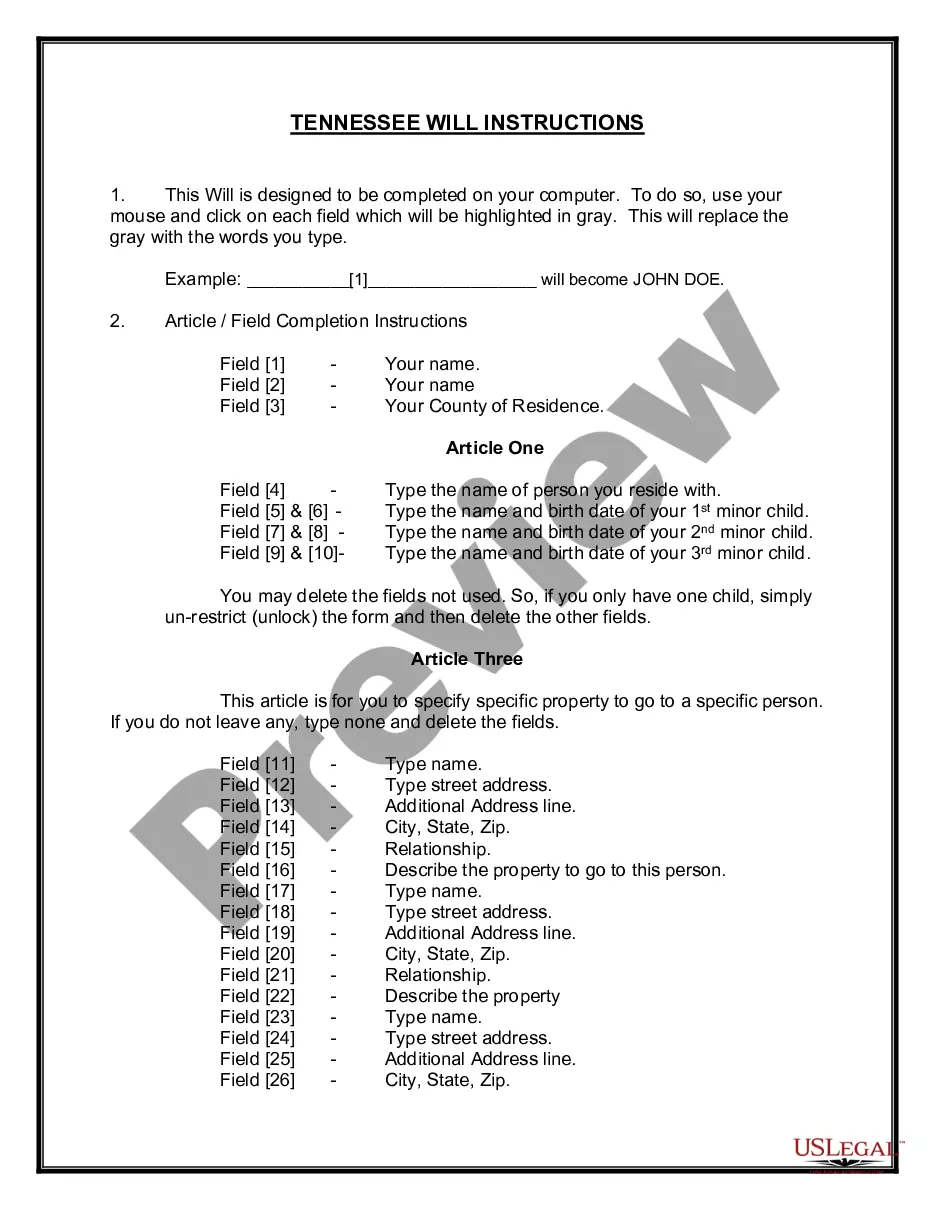

How to fill out Wyoming Approval Of Incentive Stock Option Plan?

Finding the right authorized record design could be a have a problem. Needless to say, there are tons of templates available online, but how do you get the authorized form you want? Use the US Legal Forms internet site. The support gives a huge number of templates, like the Wyoming Approval of Incentive Stock Option Plan, that you can use for enterprise and private needs. Each of the forms are examined by professionals and meet up with state and federal requirements.

Should you be previously registered, log in to your account and click on the Download option to obtain the Wyoming Approval of Incentive Stock Option Plan. Use your account to appear with the authorized forms you might have ordered earlier. Check out the My Forms tab of your own account and obtain another backup in the record you want.

Should you be a new end user of US Legal Forms, listed below are simple recommendations that you can follow:

- Initial, ensure you have chosen the correct form for the area/state. It is possible to examine the shape while using Preview option and look at the shape explanation to guarantee it will be the best for you.

- In the event the form is not going to meet up with your expectations, utilize the Seach field to get the proper form.

- Once you are sure that the shape is proper, select the Purchase now option to obtain the form.

- Choose the rates program you want and enter the required information. Create your account and pay for the transaction making use of your PayPal account or Visa or Mastercard.

- Opt for the submit file format and obtain the authorized record design to your gadget.

- Complete, revise and print and signal the received Wyoming Approval of Incentive Stock Option Plan.

US Legal Forms will be the greatest library of authorized forms that you can see different record templates. Use the service to obtain professionally-produced paperwork that follow state requirements.