Wyoming Nonemployee Directors Stock Plan of TJ International, Inc.

Description

How to fill out Nonemployee Directors Stock Plan Of TJ International, Inc.?

It is possible to spend several hours on the web attempting to find the legitimate document template which fits the federal and state specifications you need. US Legal Forms offers 1000s of legitimate kinds that are reviewed by professionals. You can easily download or printing the Wyoming Nonemployee Directors Stock Plan of TJ International, Inc. from our assistance.

If you have a US Legal Forms account, you can log in and then click the Down load button. Afterward, you can full, revise, printing, or sign the Wyoming Nonemployee Directors Stock Plan of TJ International, Inc.. Every legitimate document template you purchase is yours forever. To obtain an additional copy associated with a obtained form, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site initially, keep to the easy guidelines below:

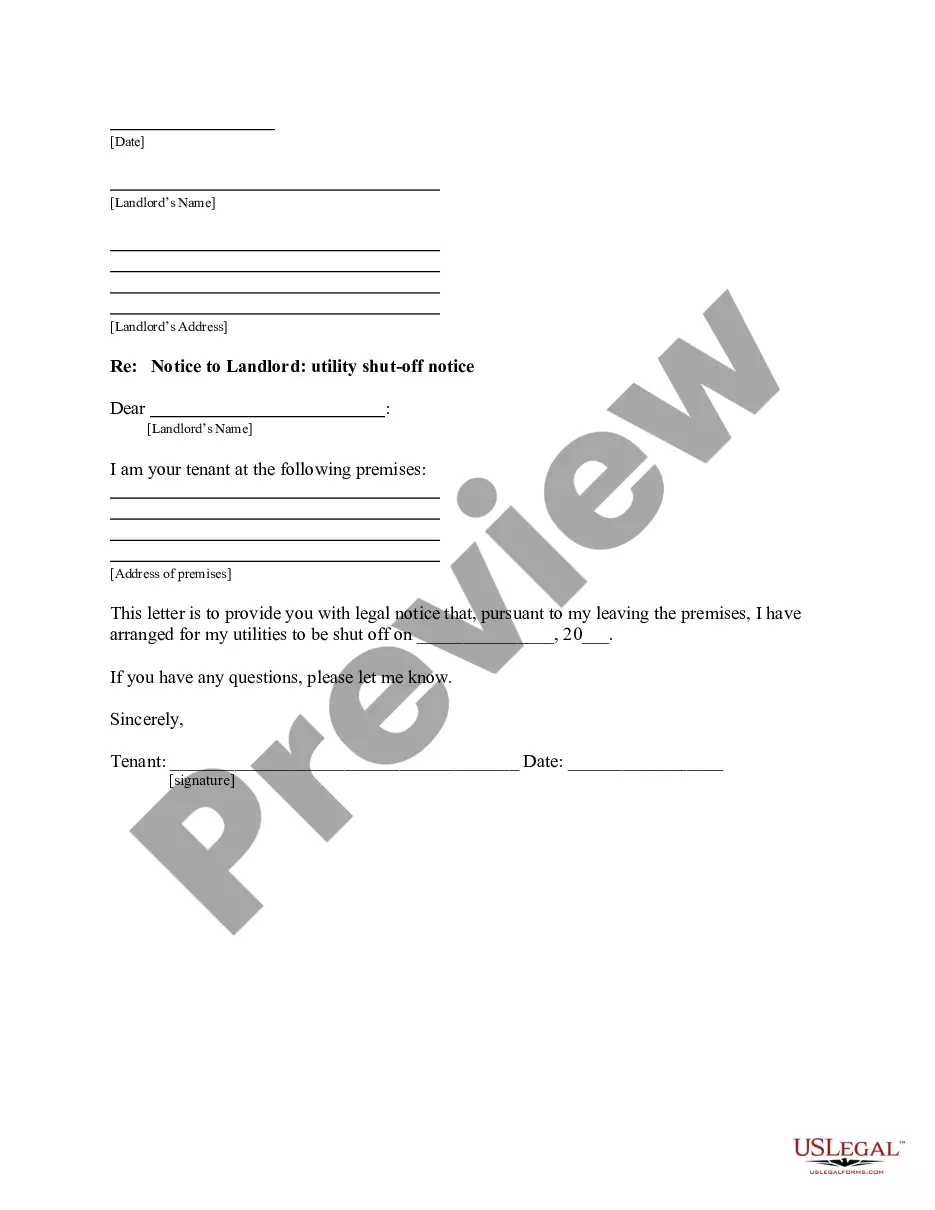

- Very first, make sure that you have selected the correct document template for that county/town of your liking. Browse the form information to ensure you have picked the correct form. If offered, utilize the Preview button to search with the document template also.

- If you want to find an additional edition in the form, utilize the Research industry to discover the template that meets your needs and specifications.

- When you have identified the template you would like, just click Acquire now to carry on.

- Pick the rates program you would like, type in your references, and register for your account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal account to pay for the legitimate form.

- Pick the formatting in the document and download it in your device.

- Make modifications in your document if necessary. It is possible to full, revise and sign and printing Wyoming Nonemployee Directors Stock Plan of TJ International, Inc..

Down load and printing 1000s of document templates while using US Legal Forms web site, which provides the largest selection of legitimate kinds. Use expert and state-specific templates to take on your organization or individual demands.