Wyoming Employee Stock Purchase Plan (WE SPP) is a program designed to give employees of Wyoming-based companies the opportunity to purchase company stock at a discounted price. This plan is governed by the laws and regulations of Wyoming and is a popular benefit offered by many employers in the state. The Wyoming Employee Stock Purchase Plan allows employees to set aside a portion of their paycheck to buy company stock, usually at a discounted price. The discounted rate is typically below the current market price, making it an attractive opportunity for employees to invest in their own company's success. One type of Wyoming Employee Stock Purchase Plan is the tax-qualified plan. In this plan, employees can contribute up to a certain percentage of their salary towards purchasing company stock. The contributions are deducted from the employee's paycheck over a specific period, usually six months to two years, and then used to purchase the stock at the end of the offering period. Another type of Wyoming Employee Stock Purchase Plan is the non-tax-qualified plan. While similar to the tax-qualified plan, this type of plan does not offer favorable tax treatment. Employees can still contribute a portion of their salary towards purchasing company stock, but the contributions are made with after-tax dollars. Participating in a Wyoming Employee Stock Purchase Plan can provide several benefits to employees. Firstly, it allows employees to become shareholders in the company they work for, aligning their interests with the company's success. Additionally, the ability to purchase stock at a discounted price creates the potential for financial gains if the stock price increases over time. When considering participating in a Wyoming Employee Stock Purchase Plan, employees should take into account factors such as the discount percentage offered, any holding period requirements, and the risks associated with investing in company stock. It is advisable to carefully review the plan's terms and consult with a financial advisor before making any decisions. In conclusion, the Wyoming Employee Stock Purchase Plan is a valuable benefit for employees of Wyoming-based companies. It provides an opportunity to invest in company stock at a discounted price, aligning employee and company interests while potentially generating financial gains. By understanding the types and features of these plans, employees can make informed decisions regarding their participation.

Wyoming Employee Stock Purchase Plan

Description

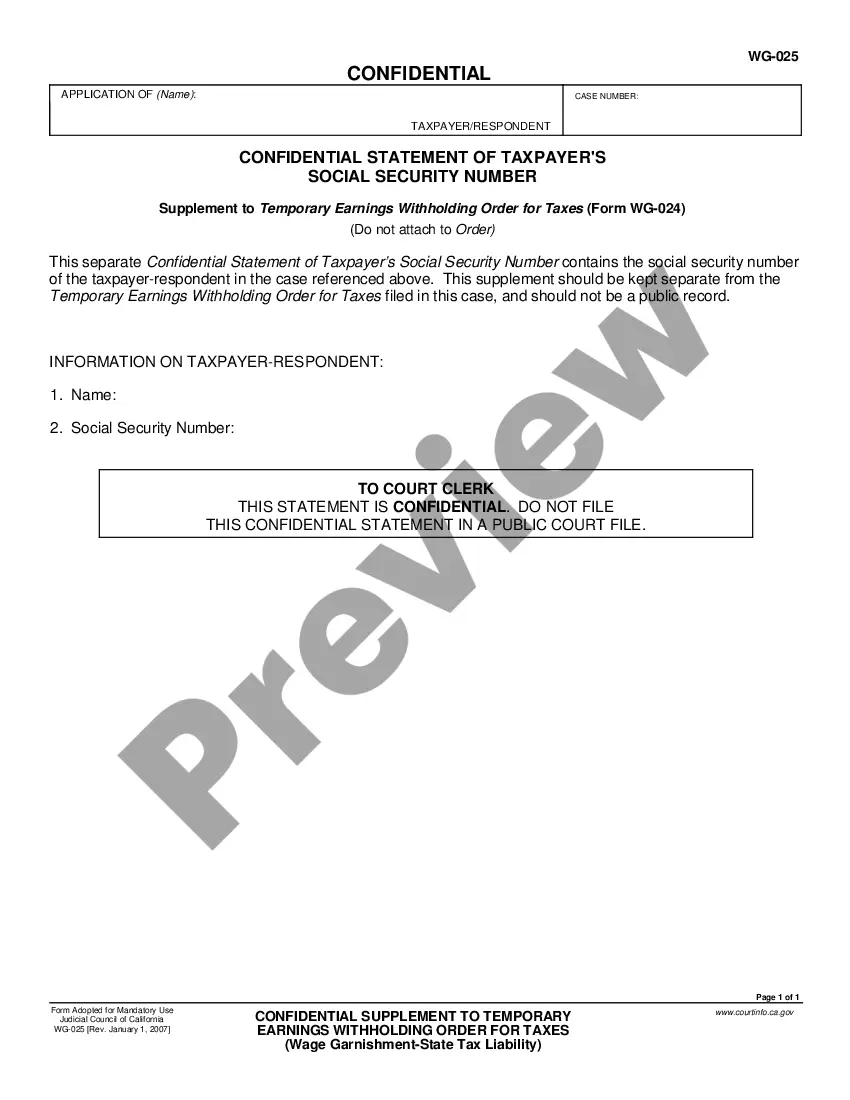

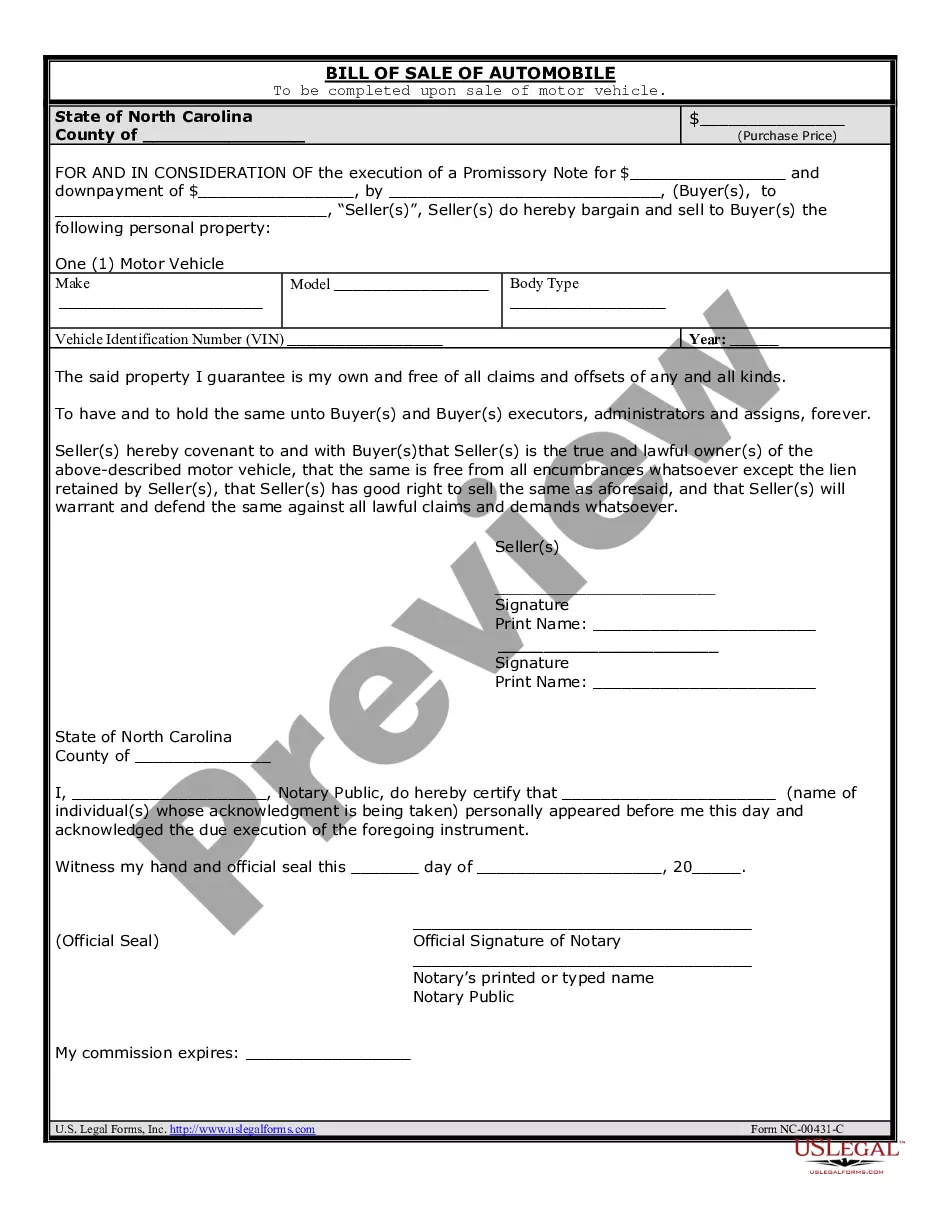

How to fill out Wyoming Employee Stock Purchase Plan?

If you need to comprehensive, obtain, or print authorized papers themes, use US Legal Forms, the largest selection of authorized varieties, which can be found online. Use the site`s simple and hassle-free search to find the files you need. Numerous themes for company and personal functions are categorized by categories and states, or search phrases. Use US Legal Forms to find the Wyoming Employee Stock Purchase Plan with a few clicks.

Should you be already a US Legal Forms client, log in to your accounts and click the Down load option to obtain the Wyoming Employee Stock Purchase Plan. You can even accessibility varieties you formerly acquired inside the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for your right town/land.

- Step 2. Utilize the Preview solution to look through the form`s content. Do not overlook to read the description.

- Step 3. Should you be unhappy together with the develop, use the Look for field at the top of the screen to discover other models of the authorized develop design.

- Step 4. After you have identified the shape you need, select the Get now option. Opt for the rates strategy you prefer and add your qualifications to register to have an accounts.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the file format of the authorized develop and obtain it on your gadget.

- Step 7. Total, edit and print or sign the Wyoming Employee Stock Purchase Plan.

Each authorized papers design you acquire is your own permanently. You may have acces to every single develop you acquired inside your acccount. Click the My Forms section and choose a develop to print or obtain yet again.

Contend and obtain, and print the Wyoming Employee Stock Purchase Plan with US Legal Forms. There are many expert and express-particular varieties you may use for your personal company or personal needs.

Form popularity

FAQ

The security options benefit is taxable to you as employment income in the year you exercise the options. It's reported to you on your T4 tax slip, along with your salary, bonus and other sources of employment income. The security options benefit is normally added to the adjusted cost base (ACB) of your shares.

Form W-2 Your W-2 includes the taxable income from your ESPP. This form is provided by your employer. Form 3922 Form 3922 has details about your ESPP purchase that will help you report the income from your sales of ESPP stock. This form is provided by your employer.

Any discount offered to the original stock price is taxed as ordinary income, while the remaining gain is taxed as a long-term capital gain. The entire gain will be taxed as ordinary income if you have not held it for: One year after the stock was transferred to you; or. Two years after the option was granted4.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.