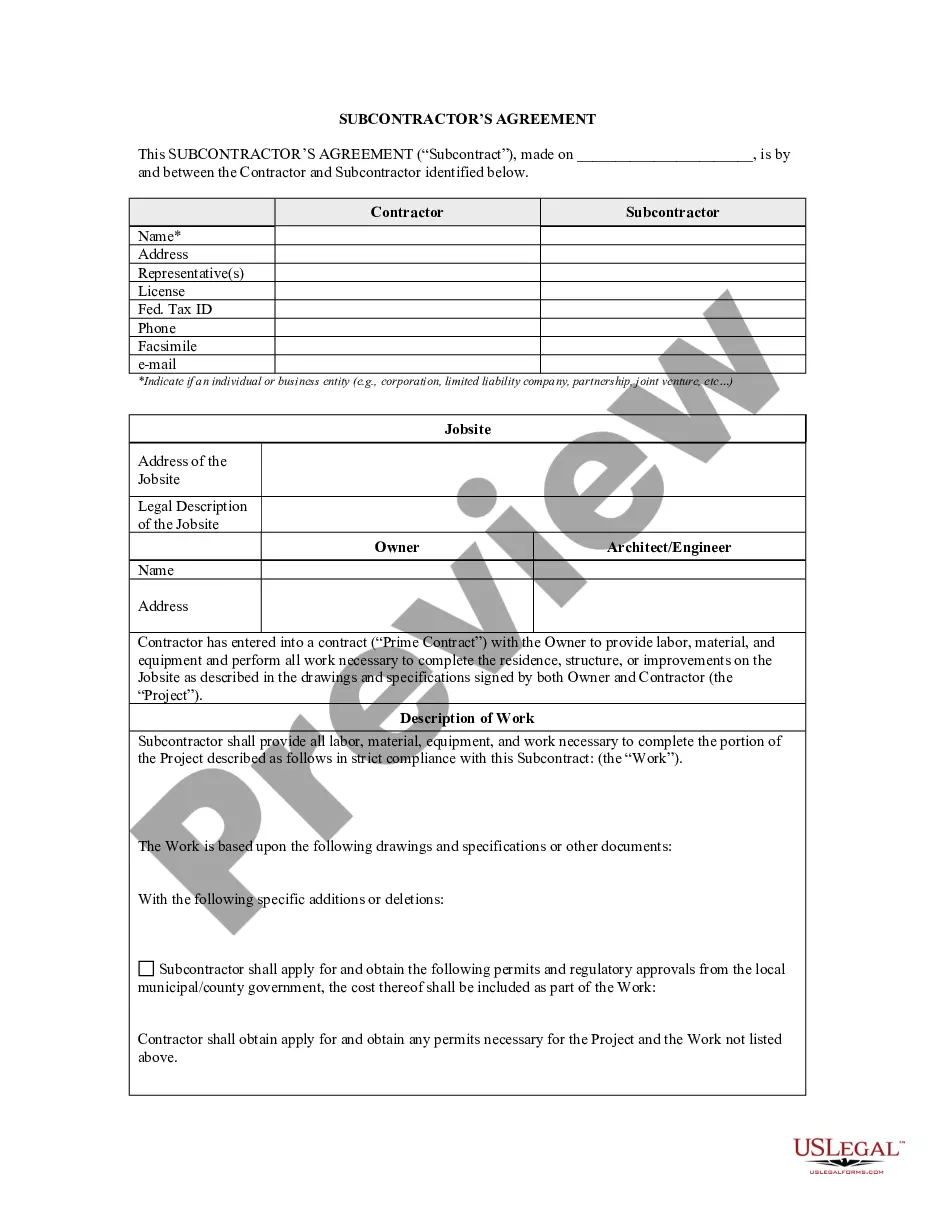

Wyoming Adoption of incentive compensation plan

Description

How to fill out Adoption Of Incentive Compensation Plan?

Discovering the right legitimate papers format can be quite a battle. Obviously, there are tons of layouts accessible on the Internet, but how do you find the legitimate form you require? Use the US Legal Forms website. The support offers 1000s of layouts, for example the Wyoming Adoption of incentive compensation plan, that you can use for company and private demands. All of the types are examined by professionals and satisfy state and federal specifications.

In case you are presently signed up, log in for your profile and then click the Obtain button to obtain the Wyoming Adoption of incentive compensation plan. Utilize your profile to look throughout the legitimate types you possess bought earlier. Check out the My Forms tab of your profile and get yet another copy from the papers you require.

In case you are a whole new customer of US Legal Forms, listed below are simple directions that you can stick to:

- First, be sure you have selected the correct form for your personal metropolis/region. You may look through the shape utilizing the Review button and browse the shape explanation to ensure it will be the right one for you.

- In the event the form fails to satisfy your requirements, utilize the Seach area to find the proper form.

- Once you are positive that the shape is proper, click the Get now button to obtain the form.

- Pick the rates plan you want and type in the required info. Build your profile and pay money for the order with your PayPal profile or charge card.

- Select the file formatting and download the legitimate papers format for your device.

- Total, change and produce and signal the acquired Wyoming Adoption of incentive compensation plan.

US Legal Forms may be the largest local library of legitimate types for which you can see numerous papers layouts. Use the company to download skillfully-manufactured paperwork that stick to state specifications.

Form popularity

FAQ

Total compensation is the totality of all payments and benefits given to an employee by an employer. Total compensation consists of base salary, bonus pay, employee benefits, perks, commissions, lifestyle spending accounts, and tips.

Effective on or after July 1, 2009, a data center business that has a physical location in Iowa and that meets specific criteria may obtain an exemption from sales and use tax on specific purchases that are used in the operation and maintenance of the data center business.

The Ohio Data Center Tax Abatement Program incentive requires an investment of $100 million or more in a three-year period and a total annual payroll greater than $1.5 million to be eligible for a total or partial exemption of up to 100% on all sales taxes on construction materials, computer equipment, mechanical and ...

Up to 15% on dollars spent in Wyoming during a film shoot.

Wyoming offers data centers that invest at least $5 million a sales tax exemption on computer equipment. Data centers that invest at least $50 million also can get a sales tax break on power supplies and cooling equipment.

High Technology Valuation Act (Data Centers) In addition, sales tax is eliminated from all purchases of prewritten computer software, computers, computer hardware, servers, building materials and tangible personal property for direct use in a high-technology business or internet advertising business.