Wyoming Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

Are you within a placement that you require paperwork for either company or individual purposes just about every time? There are tons of authorized record web templates available online, but finding versions you can depend on isn`t simple. US Legal Forms offers thousands of kind web templates, just like the Wyoming Profit Sharing Plan, which are composed in order to meet federal and state specifications.

If you are previously acquainted with US Legal Forms internet site and possess a free account, basically log in. Following that, it is possible to download the Wyoming Profit Sharing Plan web template.

If you do not come with an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for your appropriate area/county.

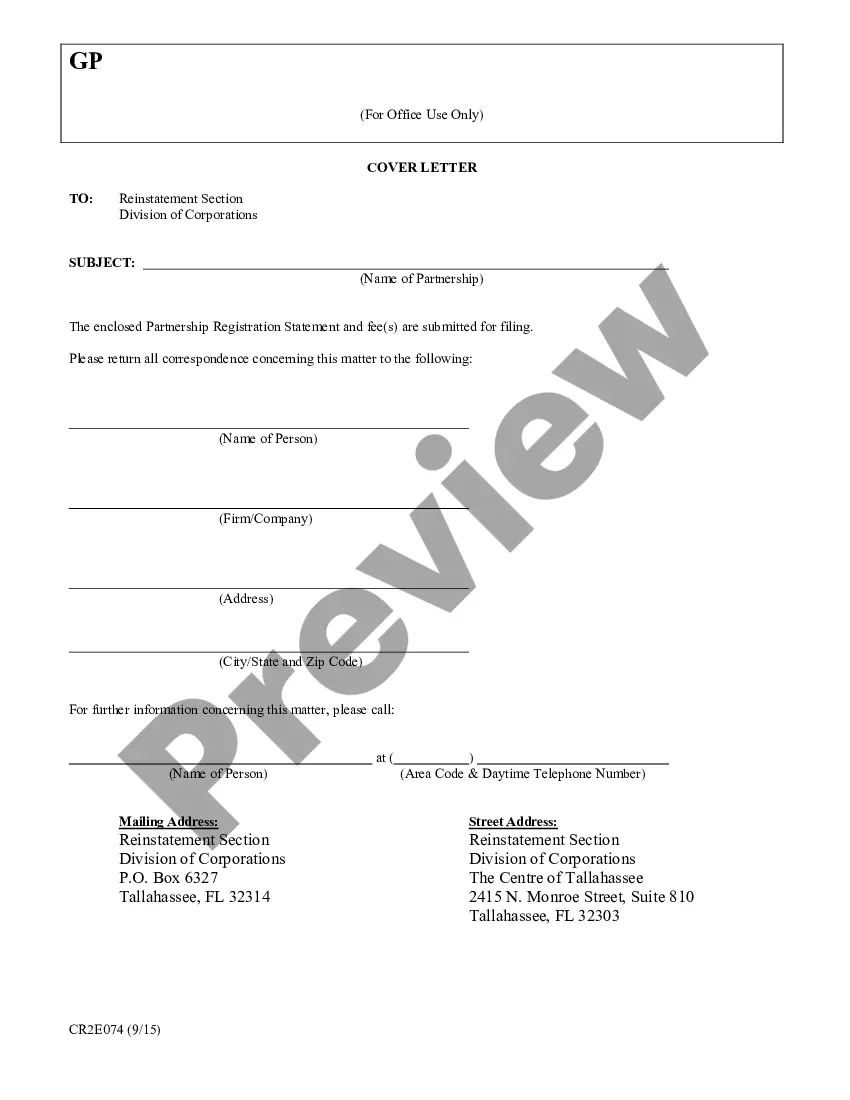

- Utilize the Preview switch to review the shape.

- Browse the outline to ensure that you have chosen the right kind.

- When the kind isn`t what you are looking for, utilize the Lookup area to get the kind that fits your needs and specifications.

- Once you find the appropriate kind, just click Acquire now.

- Opt for the costs prepare you need, complete the required information and facts to produce your money, and buy the order with your PayPal or bank card.

- Select a hassle-free paper format and download your version.

Locate all the record web templates you possess purchased in the My Forms menus. You can aquire a more version of Wyoming Profit Sharing Plan any time, if required. Just click on the needed kind to download or print out the record web template.

Use US Legal Forms, one of the most extensive selection of authorized varieties, to save time as well as steer clear of errors. The support offers appropriately created authorized record web templates which can be used for an array of purposes. Make a free account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

If you have a total of 48 or more months of contributions in the Wyoming Retirement System (WRS), you must obtain an official benefit estimate from WRS before you may take a refund on your account. Please contact WRS to obtain the forms required.

Under the Rule of 85, you are eligible for retirement benefits without a reduction if your age plus your years of service in WRS equal 85 or more. The Rule of 85 is valuable because it enables you to receive an unreduced retirement benefit sooner than the eligibility age that otherwise applies.

Wyoming does not impose taxes on social security or other retirement income, making it a favorable destination for retirees. Additionally, the state boasts relatively low property taxes. This favorable tax environment can make a significant difference when it comes to what you can do with your retirement accounts.

Based on the findings, Wyoming ranked 2nd overall. ing to the study, the region surrounding Wyoming is a good place to retire to in general. The study ranked South Dakota 3rd, Colorado 5th, Idaho 6th, and Montana 8th.

Low cost of living: Wyoming's cost of living is generally lower than the national average, which can be a major benefit for retirees on a fixed income. Housing and healthcare costs are also relatively affordable compared to other states.

States with no income tax Alaska. Florida. Nevada. South Dakota. Tennessee. Texas. Washington. Wyoming.

There's no transfer of your retirement contributions or service credit between retirement systems. You'll be a member of both systems and are subject to the membership, benefits, and rights of each system.

Virginia tops the list of the best states for retirement with excellent scores in affordability, quality of life, and healthcare. Florida is second on the list of best states to retire in, which is unsurprising due to its low costs, generous tax laws, and high quality of life.