The Wyoming Tax Sharing Agreement is a contractual agreement established between different governmental entities within the state of Wyoming to distribute tax revenues in an equitable and efficient manner. It aims to promote collaboration, fairness, and economic development among the entities involved. The primary purpose of the Wyoming Tax Sharing Agreement is to allocate tax collections fairly across counties, municipalities, and special purpose districts based on specific criteria such as population, property values, or revenue generation. This ensures that all jurisdictions receive their appropriate share of tax revenues, thereby facilitating the provision of essential public services and infrastructure development. Wyoming Tax Sharing Agreements can be categorized into various types based on the entities involved: 1. County Tax Sharing Agreement: This agreement focuses on balancing tax revenues among different counties within Wyoming. It ensures that counties with lower population or economic activity receive a fair share of tax revenue generated within the state. This promotes balanced development and helps smaller counties to sustain local services effectively. 2. Municipal Tax Sharing Agreement: Municipalities within Wyoming may enter into tax sharing agreements to distribute tax revenues among themselves. This type of agreement is usually beneficial for towns or cities that are in proximity and have overlapping economic or infrastructure dependencies. Municipal tax sharing agreements promote cooperation and resource pooling among neighboring municipalities for the betterment of the region. 3. Special Purpose District Tax Sharing Agreement: Special purpose districts, such as school districts or water districts, may also establish tax sharing agreements to regulate the distribution of tax revenues among themselves. This ensures that funds are allocated efficiently to meet specific service requirements within the district. For instance, a school district tax sharing agreement would ensure that funding is fairly distributed among schools based on student enrollment or specific educational needs. By implementing Wyoming Tax Sharing Agreements, the state aims to minimize any potential disparities in tax revenue distribution and promote collaboration among different jurisdictions. This collaborative approach helps to enhance public service delivery, support infrastructure development, and foster overall economic growth across the various counties, municipalities, and special purpose districts within Wyoming.

Wyoming Tax Sharing Agreement

Description

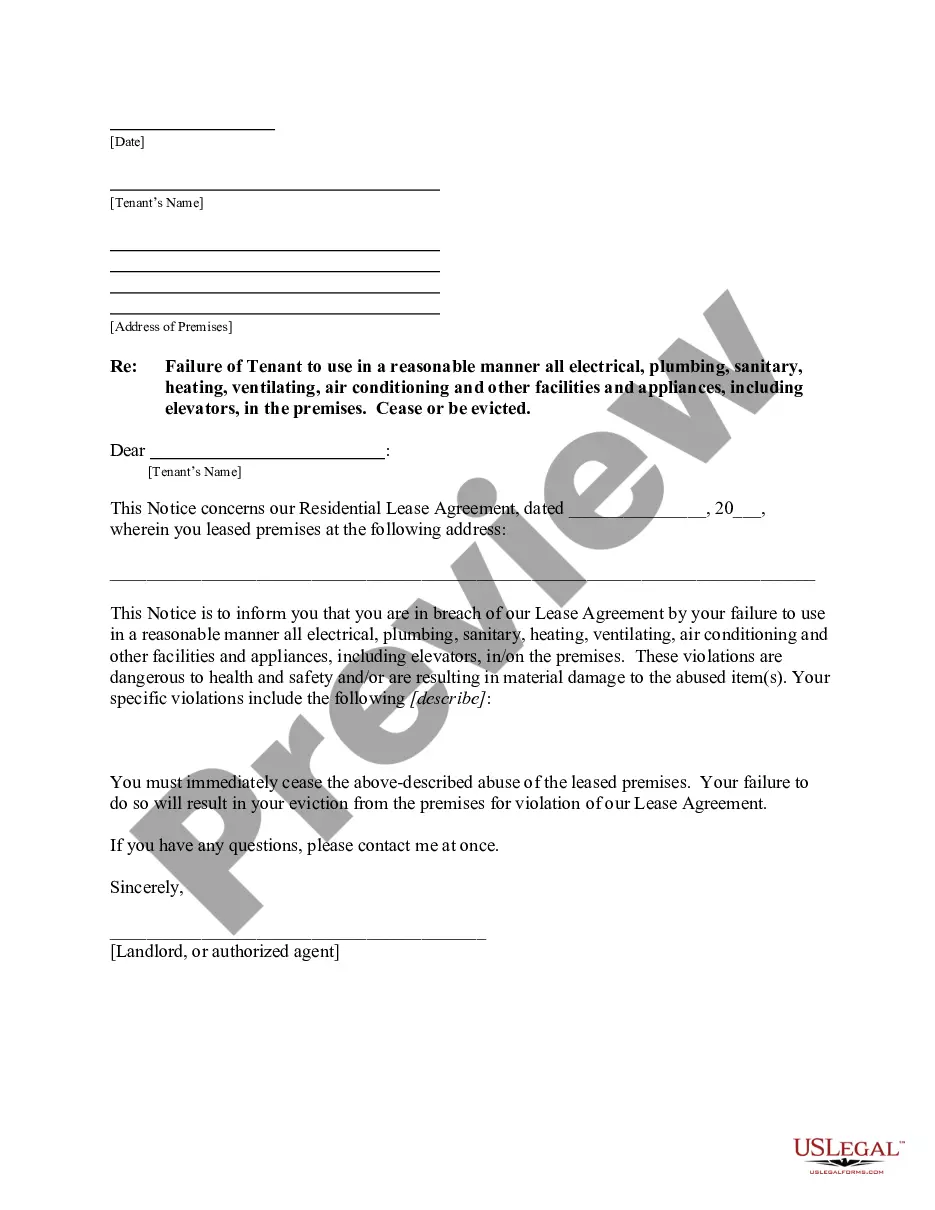

How to fill out Wyoming Tax Sharing Agreement?

Choosing the right lawful document web template might be a battle. Obviously, there are plenty of themes available on the net, but how can you find the lawful kind you require? Use the US Legal Forms internet site. The support provides a huge number of themes, for example the Wyoming Tax Sharing Agreement, which you can use for organization and personal needs. Each of the varieties are checked out by specialists and fulfill state and federal specifications.

Should you be already authorized, log in to the account and then click the Acquire key to find the Wyoming Tax Sharing Agreement. Use your account to search through the lawful varieties you possess purchased previously. Go to the My Forms tab of your respective account and obtain an additional version in the document you require.

Should you be a new end user of US Legal Forms, allow me to share easy instructions that you can stick to:

- First, ensure you have chosen the right kind for your personal city/region. You may look through the shape while using Preview key and look at the shape description to make certain it is the best for you.

- In case the kind will not fulfill your expectations, use the Seach field to get the correct kind.

- Once you are positive that the shape is proper, click the Purchase now key to find the kind.

- Opt for the rates prepare you want and type in the necessary info. Make your account and pay money for the transaction using your PayPal account or bank card.

- Opt for the data file format and obtain the lawful document web template to the system.

- Comprehensive, revise and print out and indication the attained Wyoming Tax Sharing Agreement.

US Legal Forms will be the most significant library of lawful varieties that you will find numerous document themes. Use the company to obtain skillfully-created paperwork that stick to status specifications.