Wyoming Short-Term Incentive Plan

Description

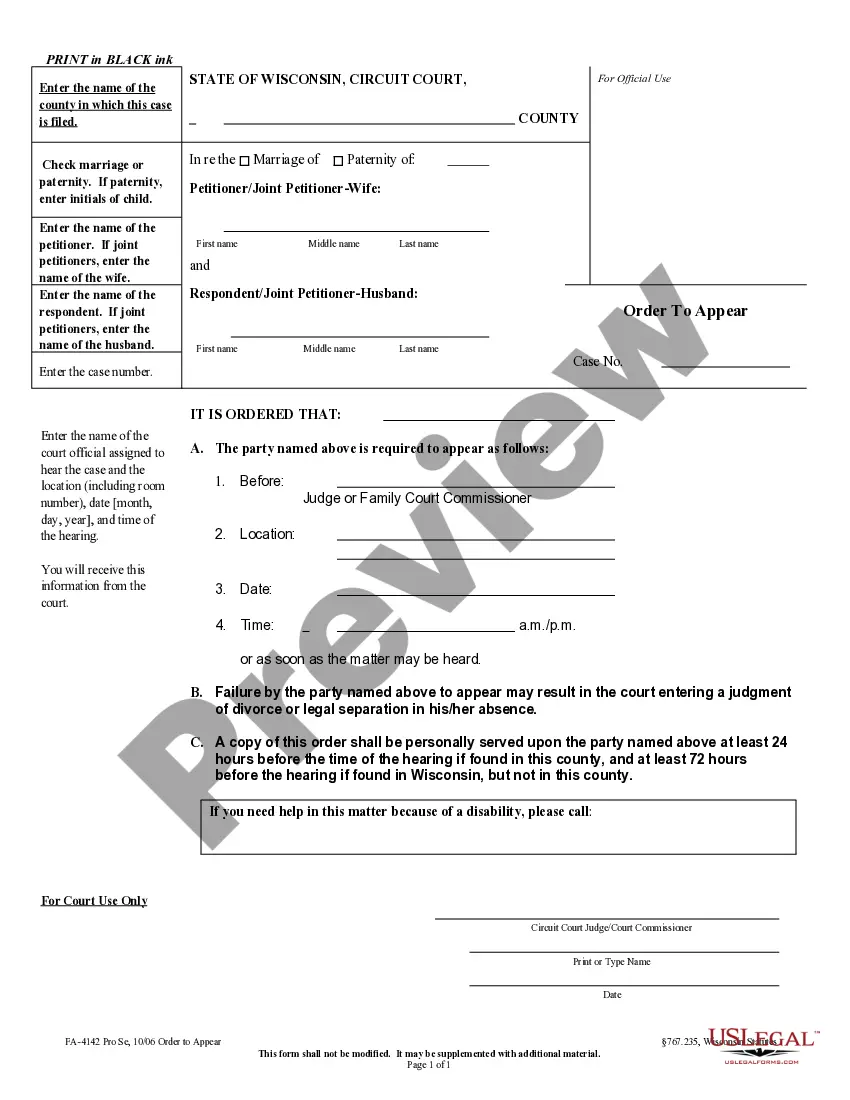

How to fill out Short-Term Incentive Plan?

US Legal Forms - one of several biggest libraries of lawful forms in America - gives a variety of lawful record web templates it is possible to down load or print out. While using web site, you may get 1000s of forms for enterprise and person purposes, categorized by categories, claims, or keywords.You will find the newest types of forms like the Wyoming Short-Term Incentive Plan within minutes.

If you already possess a monthly subscription, log in and down load Wyoming Short-Term Incentive Plan through the US Legal Forms catalogue. The Download switch can look on every single develop you look at. You get access to all earlier acquired forms inside the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, allow me to share straightforward guidelines to get you started out:

- Be sure you have chosen the best develop for your personal city/county. Click the Preview switch to review the form`s information. Look at the develop description to ensure that you have chosen the correct develop.

- In case the develop doesn`t satisfy your specifications, use the Search area on top of the display to obtain the one who does.

- If you are satisfied with the shape, validate your selection by simply clicking the Get now switch. Then, select the rates program you favor and supply your qualifications to sign up for the accounts.

- Procedure the purchase. Make use of credit card or PayPal accounts to complete the purchase.

- Find the formatting and down load the shape on your gadget.

- Make changes. Complete, change and print out and signal the acquired Wyoming Short-Term Incentive Plan.

Each template you put into your money lacks an expiration date and is also yours for a long time. So, if you wish to down load or print out another duplicate, just proceed to the My Forms segment and click on about the develop you require.

Get access to the Wyoming Short-Term Incentive Plan with US Legal Forms, the most considerable catalogue of lawful record web templates. Use 1000s of professional and state-distinct web templates that fulfill your business or person needs and specifications.

Form popularity

FAQ

Workers' compensation death benefits in Wyoming The surviving spouse, minor children, and other dependents may qualify for monthly benefits lasting for as long as 100 months. The minimum benefit that can be paid is 80% of the state's average monthly wage. The maximum is twice the state's average monthly wage.

Temporary Total Disability benefits are the equivalent of 2/3 of your gross monthly wage at the time of injury, but cannot exceed the Statewide Average Wage for the quarter you were injured. Temporary Total Disability benefits are not taxable.

Workers Compensation insurance provides benefits to employees injured during the course of their employment. In most circumstances, employers that are required to obtain this coverage must do so from the State of Wyoming Workers Compensation Program pursuant to the Workers Compensation Act WS. §§ 27-14-101, et seq.

You must Report your Injury to your employer within 72 hours of the accident causing your injury and within 10 days to the Workers' Compensation Division. Injury reports must be signed by the injured worker.

Unemployment insurance recipients in Wyoming must meet the following criteria in order to qualify for benefits: Recipients must have lost employment through no fault of their own. Recipients must have earned sufficient wages during the base period?the first 12 months of the 15 months prior to filing a claim.

Key Takeaways. The monopolistic states are Wyoming, Washington, Ohio, and North Dakota. All four monopolistic states bar the sale of workers compensation insurance by private insurers. In these states, employers must buy insurance from a state-run insurance fund.

Short Time Compensation (STC) allows businesses to reduce the hours they provide to workers. Those workers then are able to use Unemployment Insurance (UI) benefits to offset the loss of income.

Temporary Total Disability benefits are the equivalent of 2/3 of your gross monthly wage at the time of injury, but cannot exceed the Statewide Average Wage for the quarter you were injured. Temporary Total Disability benefits are not taxable.