Wyoming Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Wyoming Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Finding the right lawful document design might be a battle. Needless to say, there are a variety of web templates available on the Internet, but how do you discover the lawful type you want? Take advantage of the US Legal Forms internet site. The services gives thousands of web templates, like the Wyoming Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, which you can use for enterprise and private requires. Each of the varieties are checked by experts and meet up with federal and state specifications.

Should you be currently signed up, log in to your account and click on the Acquire switch to find the Wyoming Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. Utilize your account to appear through the lawful varieties you might have ordered earlier. Proceed to the My Forms tab of your respective account and acquire yet another duplicate in the document you want.

Should you be a brand new customer of US Legal Forms, allow me to share easy instructions that you should adhere to:

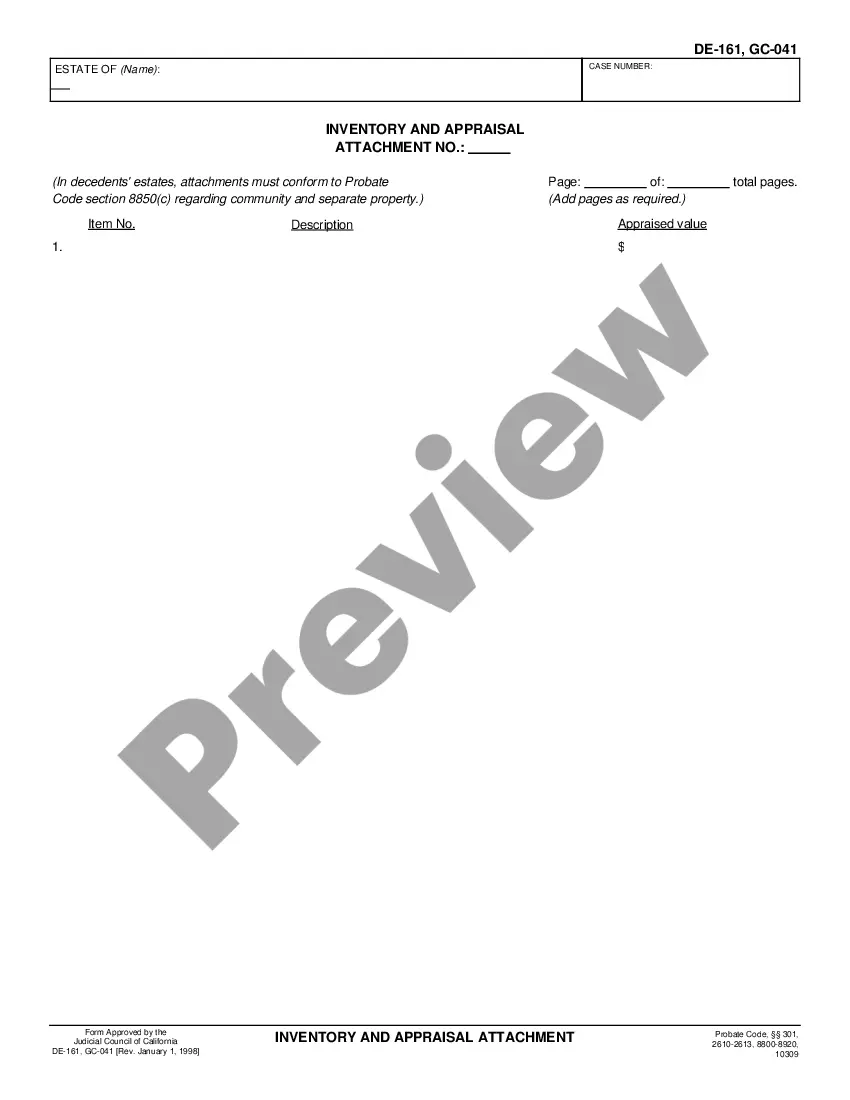

- Initially, make certain you have chosen the appropriate type to your city/county. It is possible to look through the shape making use of the Review switch and look at the shape description to make sure this is the best for you.

- When the type fails to meet up with your needs, take advantage of the Seach area to obtain the appropriate type.

- When you are certain that the shape is proper, select the Purchase now switch to find the type.

- Select the rates program you desire and type in the required information. Design your account and purchase your order utilizing your PayPal account or bank card.

- Select the document formatting and download the lawful document design to your product.

- Complete, edit and produce and sign the attained Wyoming Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

US Legal Forms may be the largest collection of lawful varieties that you will find numerous document web templates. Take advantage of the service to download expertly-created papers that adhere to express specifications.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof. (2) The false representation of -- (A) the character, amount, or legal status of any debt; or.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).