Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. (Wyoming PSA) is a legal document that governs the pooling and servicing of mortgage loans by Ameriquest Mortgage Securities, Inc. This agreement outlines the rights and responsibilities of the parties involved in the securitization process and ensures compliance with applicable laws and regulations. Key elements of the Wyoming PSA include loan eligibility criteria, loan servicing requirements, payment distribution procedures, the allocation of risks and responsibilities, and the creation of mortgage-backed securities (MBS) for investors. It serves as a framework for the management and administration of mortgage loans throughout their lifecycle. By pooling mortgage loans, Ameriquest Mortgage Securities, Inc. combines various loans into a single investment vehicle, allowing investors to gain exposure to a diversified pool of mortgages. This diversification helps to spread risk and increase the attractiveness of the investment. The Wyoming PSA specifies the characteristics and criteria for the mortgage loans to be included in the pool, such as credit scores, loan amounts, and property types. The agreement also details the servicing requirements for the mortgage loans. Ameriquest Mortgage Securities, Inc. may act as the service or engage a third-party service to handle tasks such as collecting borrower payments, managing escrow accounts, and conducting foreclosure proceedings if necessary. The Wyoming PSA outlines the service's obligations, including reporting to investors, maintaining accurate records, and ensuring compliance with applicable laws and regulations. Payment distribution procedures are an essential component of the Wyoming PSA. As borrowers make their mortgage payments, the funds are distributed to the investors based on predefined rules. Typically, the principal and interest payments are split among the investors in proportion to their investments in the MBS. The agreement also establishes mechanisms for handling delinquent loans, early repayments, and defaults, aiming to protect the investors' interests. While the Wyoming PSA generally refers to the specific agreement created by Ameriquest Mortgage Securities, Inc., it is important to note that there might be variations or different types of pooling and servicing agreements within this context. These variations could include specific terms tailored to different types of mortgage loans, asset classes, or investor preferences. For instance, there may be Wyoming SAS for residential mortgage-backed securities (RMBS) or commercial mortgage-backed securities (CMOS), each with their own unique terms and conditions. In summary, the Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. serves as a comprehensive legal document that governs the pooling and servicing of mortgage loans for securitization purposes. It outlines the rights and obligations of the parties involved and ensures compliance with relevant regulations. This agreement plays a critical role in the creation of mortgage-backed securities and helps to provide a framework for investors and borrowers alike.

Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

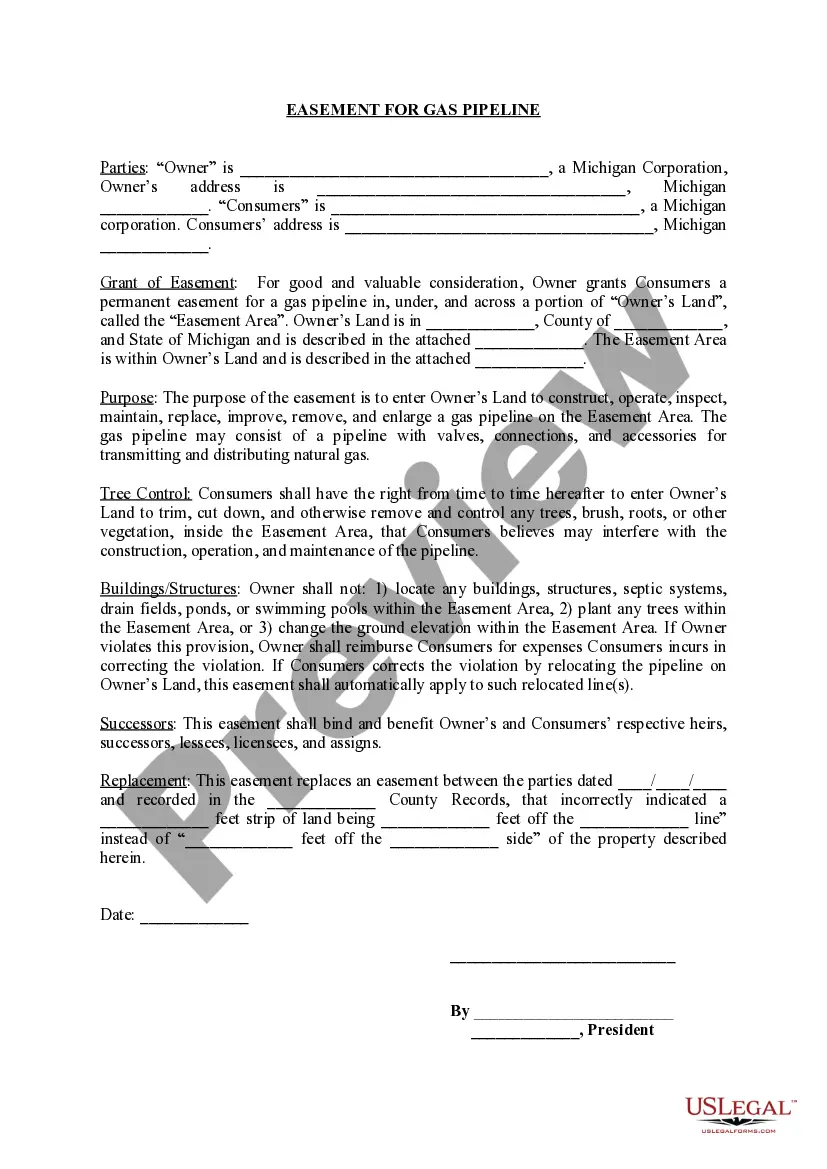

How to fill out Wyoming Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

Have you been in a place the place you will need files for possibly organization or specific uses nearly every day time? There are a variety of lawful record web templates available on the Internet, but getting versions you can trust is not simple. US Legal Forms offers a huge number of type web templates, such as the Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., that are composed in order to meet state and federal demands.

Should you be presently acquainted with US Legal Forms internet site and have your account, merely log in. After that, you are able to acquire the Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. template.

Unless you provide an profile and want to begin using US Legal Forms, follow these steps:

- Get the type you want and ensure it is for your correct metropolis/county.

- Take advantage of the Preview switch to examine the form.

- Read the description to ensure that you have selected the correct type.

- When the type is not what you`re looking for, use the Lookup area to find the type that meets your requirements and demands.

- Whenever you get the correct type, just click Purchase now.

- Opt for the rates plan you would like, fill in the specified information to generate your money, and purchase your order making use of your PayPal or credit card.

- Decide on a convenient file structure and acquire your version.

Get each of the record web templates you may have purchased in the My Forms menu. You can aquire a further version of Wyoming Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. anytime, if necessary. Just click on the essential type to acquire or produce the record template.

Use US Legal Forms, by far the most extensive assortment of lawful forms, in order to save time as well as avoid errors. The assistance offers expertly produced lawful record web templates that can be used for an array of uses. Produce your account on US Legal Forms and begin generating your daily life a little easier.