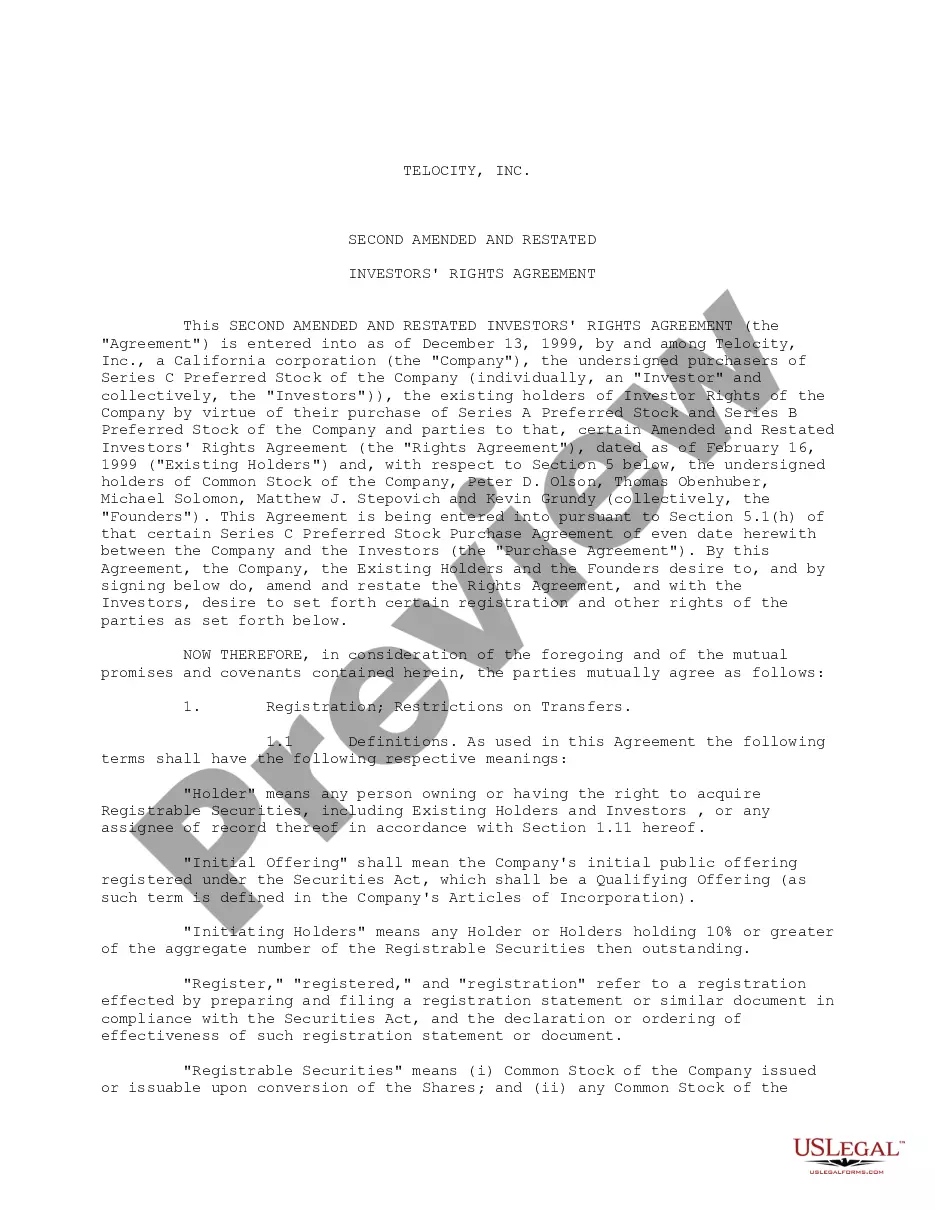

Wyoming Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders

Description

How to fill out Investors' Rights Agreement Between Telocity, Inc., Existing Holders, And Founders?

If you wish to comprehensive, acquire, or printing authorized file web templates, use US Legal Forms, the most important variety of authorized varieties, that can be found online. Utilize the site`s simple and easy practical search to find the documents you need. Different web templates for organization and specific functions are sorted by types and suggests, or key phrases. Use US Legal Forms to find the Wyoming Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders with a handful of clicks.

If you are previously a US Legal Forms customer, log in for your account and click on the Acquire key to get the Wyoming Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders. You may also access varieties you formerly downloaded within the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that proper town/country.

- Step 2. Utilize the Preview option to look through the form`s articles. Never forget to see the explanation.

- Step 3. If you are unsatisfied together with the develop, make use of the Lookup discipline on top of the display to find other types from the authorized develop format.

- Step 4. When you have discovered the form you need, select the Acquire now key. Pick the prices prepare you favor and include your references to sign up for an account.

- Step 5. Procedure the transaction. You may use your bank card or PayPal account to complete the transaction.

- Step 6. Pick the format from the authorized develop and acquire it in your product.

- Step 7. Full, modify and printing or indicator the Wyoming Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders.

Each and every authorized file format you acquire is the one you have permanently. You might have acces to each and every develop you downloaded with your acccount. Click the My Forms portion and choose a develop to printing or acquire once again.

Remain competitive and acquire, and printing the Wyoming Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders with US Legal Forms. There are many specialist and state-certain varieties you can use for your personal organization or specific demands.

Form popularity

FAQ

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

Registration rights are a form of control provision that enables investors to force companies to file a registration document, to serve purposes of both transparency and audit. The document must be filed with the Securities and Exchange Commission (SEC), complying with the Securities Act of 1933.

3 registration gives investors the right to demand that a company registers their shares using Form 3. Form 3 is a shorter registration form than Form 1, which is used in an initial stock launch or IPO. Form 3 can be used by a company one year after an IPO.

If the seller complies with Rule 144, the sale will not violate the registration requirements of the Securities Act. Rule 144 imposes certain holding period, informational, volume, manner of sale and notice obligations in certain situations and for certain stockholders.

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company. Registration Right: What it is, How it Works - Investopedia investopedia.com ? terms ? registrationright investopedia.com ? terms ? registrationright

DPA Triggering Rights means (i) ?control? (as defined in the DPA); (ii) access to any ?material non-public technical information? (as defined in the DPA) in the possession of the Company; (iii) membership or observer rights on the Board of Directors or equivalent governing body of the Company or the right to nominate ... DPA Triggering Rights Definition | Law Insider lawinsider.com ? dictionary ? dpa-triggering... lawinsider.com ? dictionary ? dpa-triggering...

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in. Know Your Shareholder Rights - Investopedia investopedia.com ? investing ? know-your-s... investopedia.com ? investing ? know-your-s...