The Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds is a strategic collaboration aimed at restructuring and optimizing the operations and assets of both entities. This partnership allows for a more efficient management of resources and offers various benefits for investors. The Wyoming Plan of Reorganization involves a comprehensive assessment of the current financial and operational standing of Ingenuity Capital Trust and Firsthand Funds. By analyzing their respective assets, liabilities, and market positions, a clear roadmap for restructuring and realigning their business strategies is created. One type of Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds focuses on portfolio diversification. This involves identifying the strengths and weaknesses of each entity's investment portfolios and developing a combined portfolio structure that maximizes returns while minimizing risk. Investments may be reallocated, and new asset classes could be introduced to achieve a well-balanced and robust investment portfolio. Another type of Wyoming Plan of Reorganization is centered around resource optimization. This involves identifying redundancies, cost-saving opportunities, and potential synergies between the operational structures of Ingenuity Capital Trust and Firsthand Funds. By streamlining operations, both entities can achieve improved efficiencies and economies of scale, ultimately enhancing investor returns. The Wyoming Plan of Reorganization also encompasses a comprehensive evaluation of the management teams of both entities. The goal is to identify and retain talented individuals who can drive the joint entity's growth and success. Ensuring a seamless integration of teams and leveraging expertise is crucial for capitalizing on the potential benefits resulting from the reorganization. By implementing the Wyoming Plan of Reorganization, Ingenuity Capital Trust and Firsthand Funds aim to enhance their respective competencies and market positions. Combining their resources, knowledge, and experience allows for greater market penetration, expanded product offerings, and increased opportunities for innovative investment strategies. Through this collaboration, Ingenuity Capital Trust and Firsthand Funds also seek to provide superior services to investors. By leveraging their combined resources, they can deliver top-notch investor relations, account management, and customer support, ensuring a positive and rewarding experience for all stakeholders. Overall, the Wyoming Plan of Reorganization represents a strategic initiative that enables Ingenuity Capital Trust and Firsthand Funds to optimize their operations, streamline processes, and unlock new opportunities for growth. By coming together under a structured plan, they can create a stronger, more robust entity that is well-positioned to thrive in the ever-evolving financial marketplace.

Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

How to fill out Wyoming Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

US Legal Forms - one of many most significant libraries of authorized kinds in the USA - delivers a variety of authorized record layouts you are able to download or print. Utilizing the website, you will get thousands of kinds for business and person uses, categorized by groups, says, or keywords.You will find the newest variations of kinds just like the Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds in seconds.

If you already have a membership, log in and download Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds in the US Legal Forms local library. The Acquire button can look on every single type you look at. You have accessibility to all earlier delivered electronically kinds in the My Forms tab of the profile.

If you want to use US Legal Forms initially, allow me to share basic recommendations to help you started off:

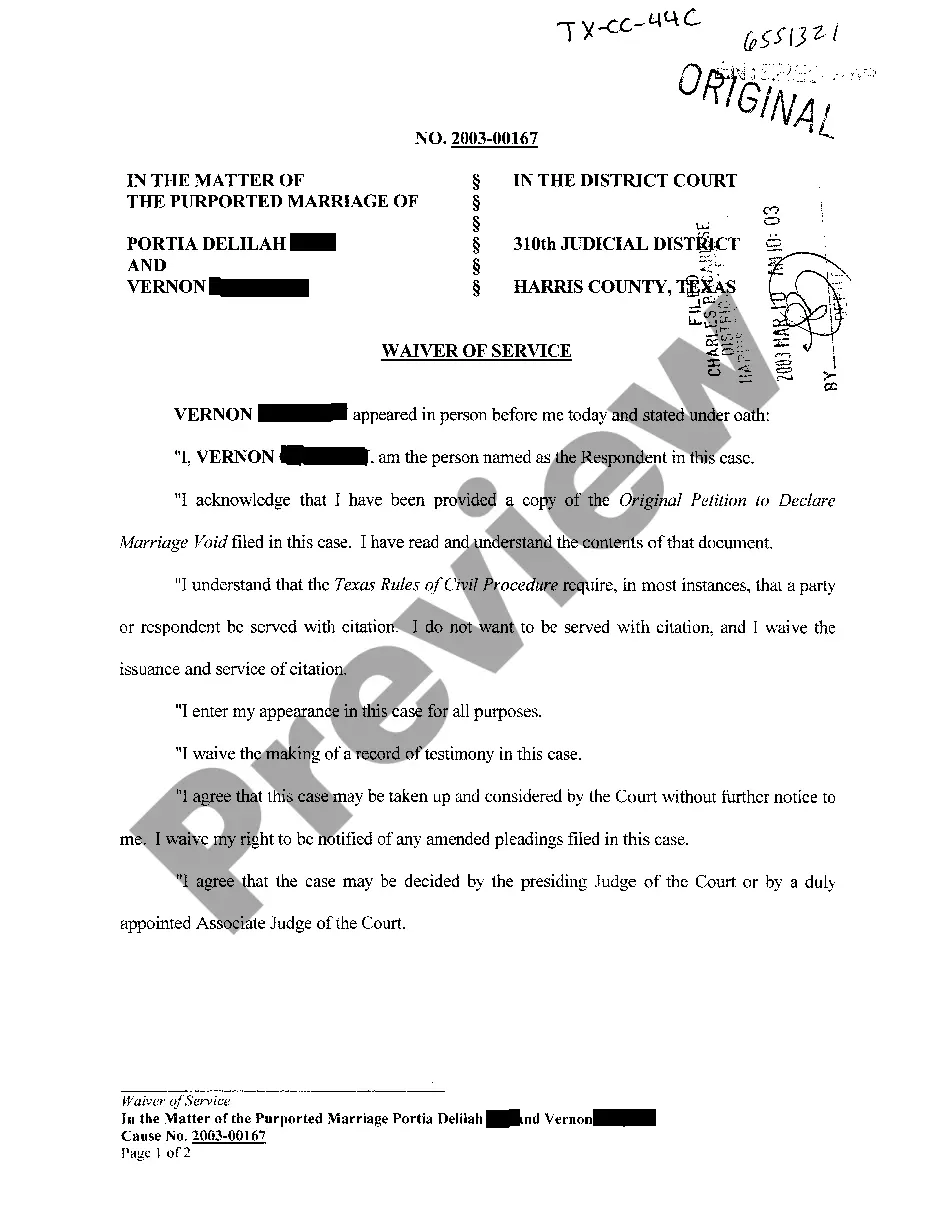

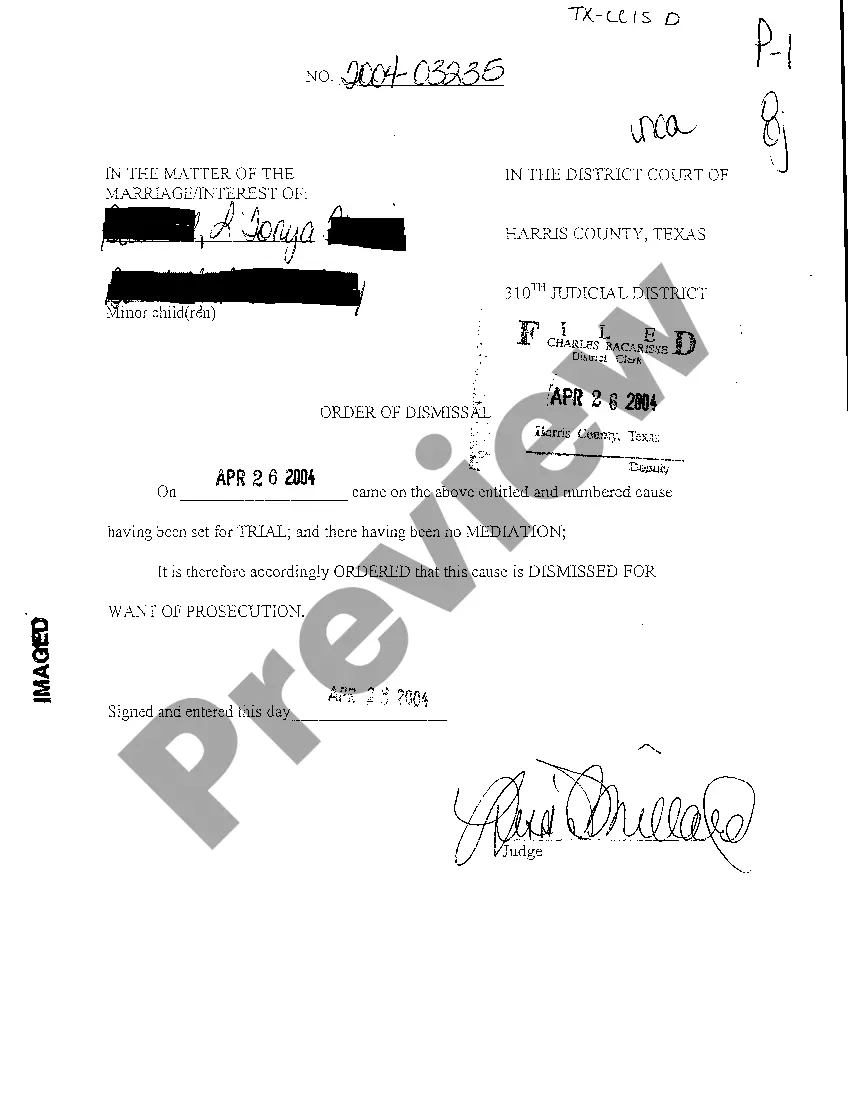

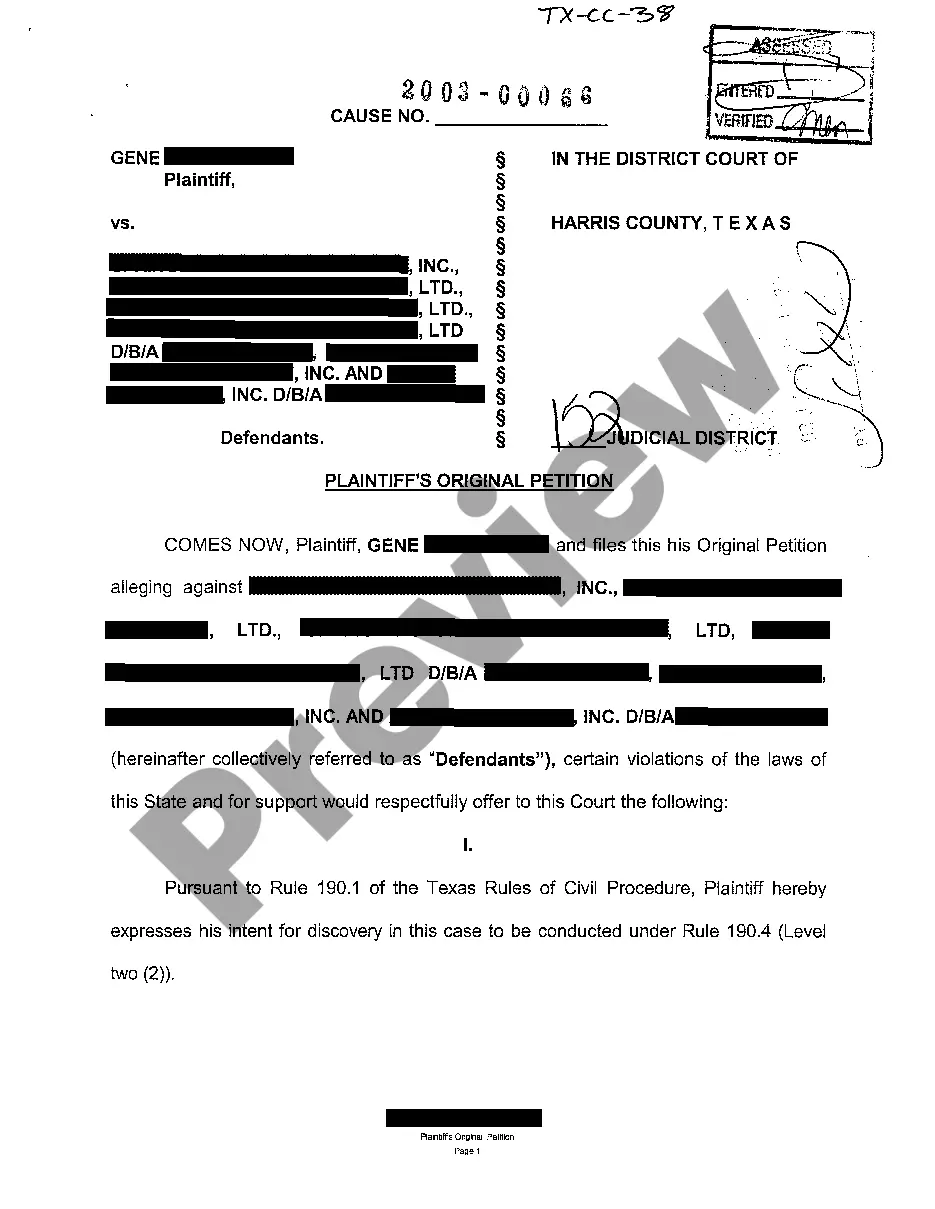

- Ensure you have selected the right type for the metropolis/county. Click on the Review button to examine the form`s information. Read the type information to ensure that you have selected the appropriate type.

- In the event the type doesn`t suit your demands, make use of the Research field near the top of the display screen to find the the one that does.

- In case you are content with the form, verify your selection by visiting the Purchase now button. Then, pick the rates prepare you want and supply your references to register for an profile.

- Method the deal. Utilize your credit card or PayPal profile to perform the deal.

- Choose the structure and download the form on your own system.

- Make modifications. Fill up, modify and print and indication the delivered electronically Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Each format you included with your bank account lacks an expiration day which is your own property eternally. So, in order to download or print another copy, just visit the My Forms segment and click around the type you require.

Obtain access to the Wyoming Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms, one of the most substantial local library of authorized record layouts. Use thousands of expert and state-specific layouts that meet up with your small business or person needs and demands.