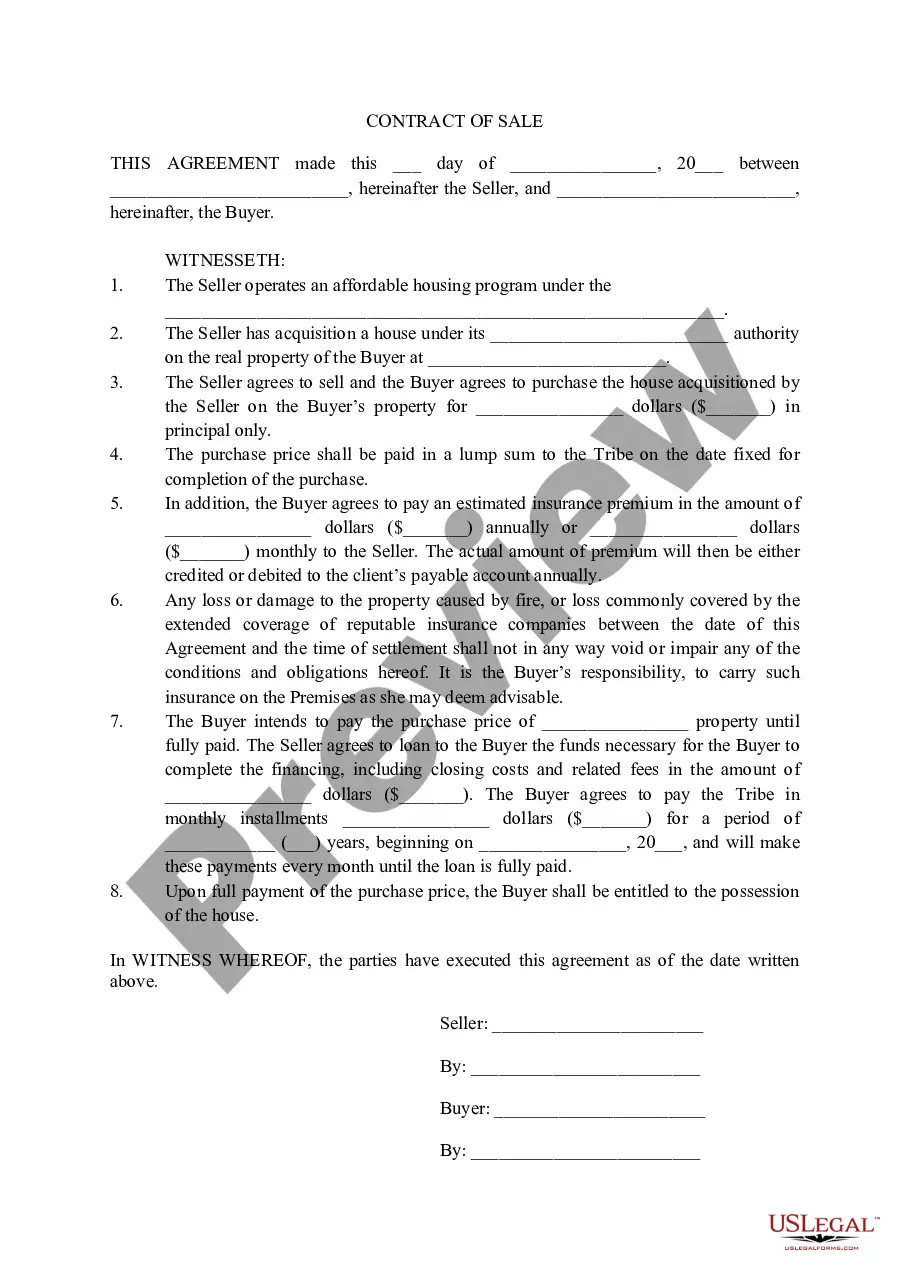

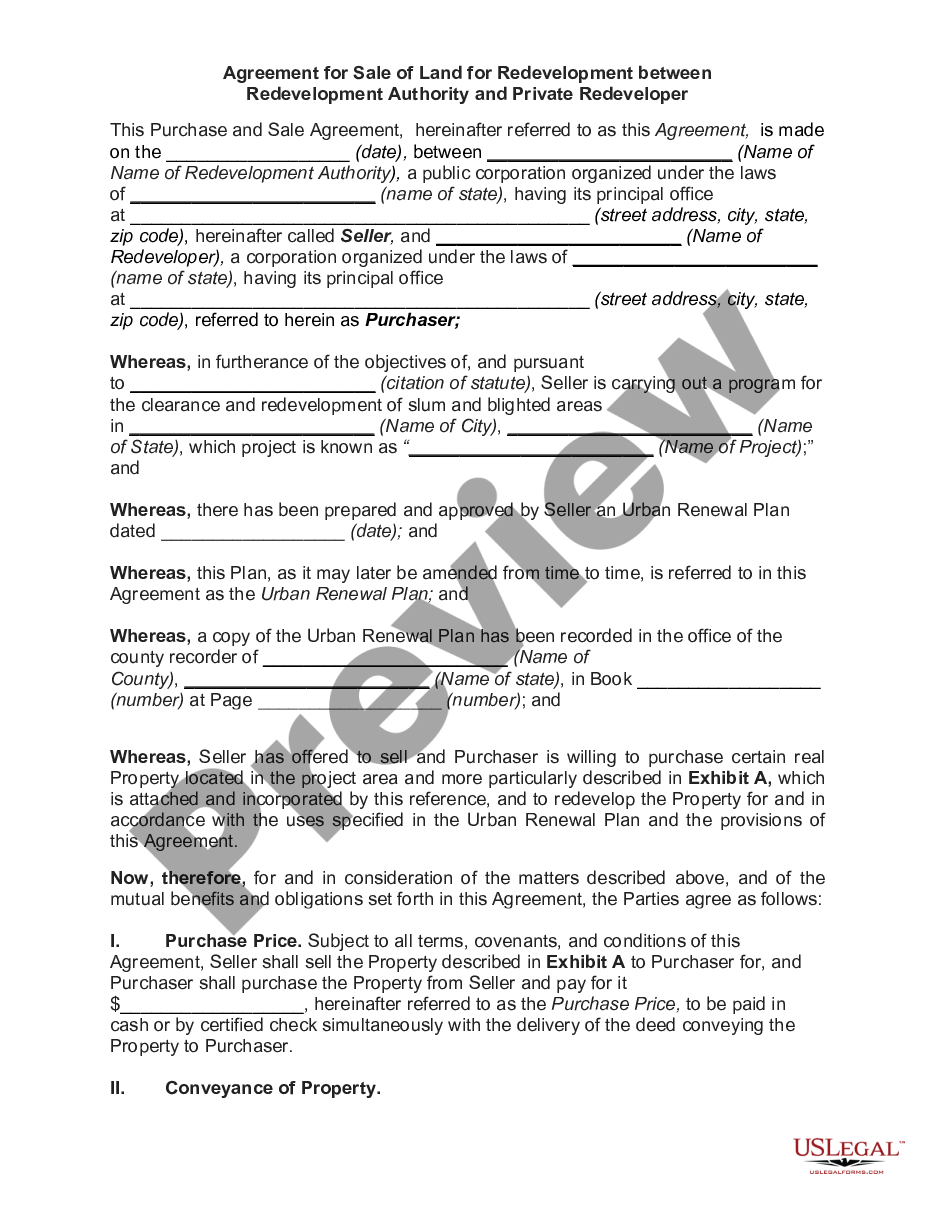

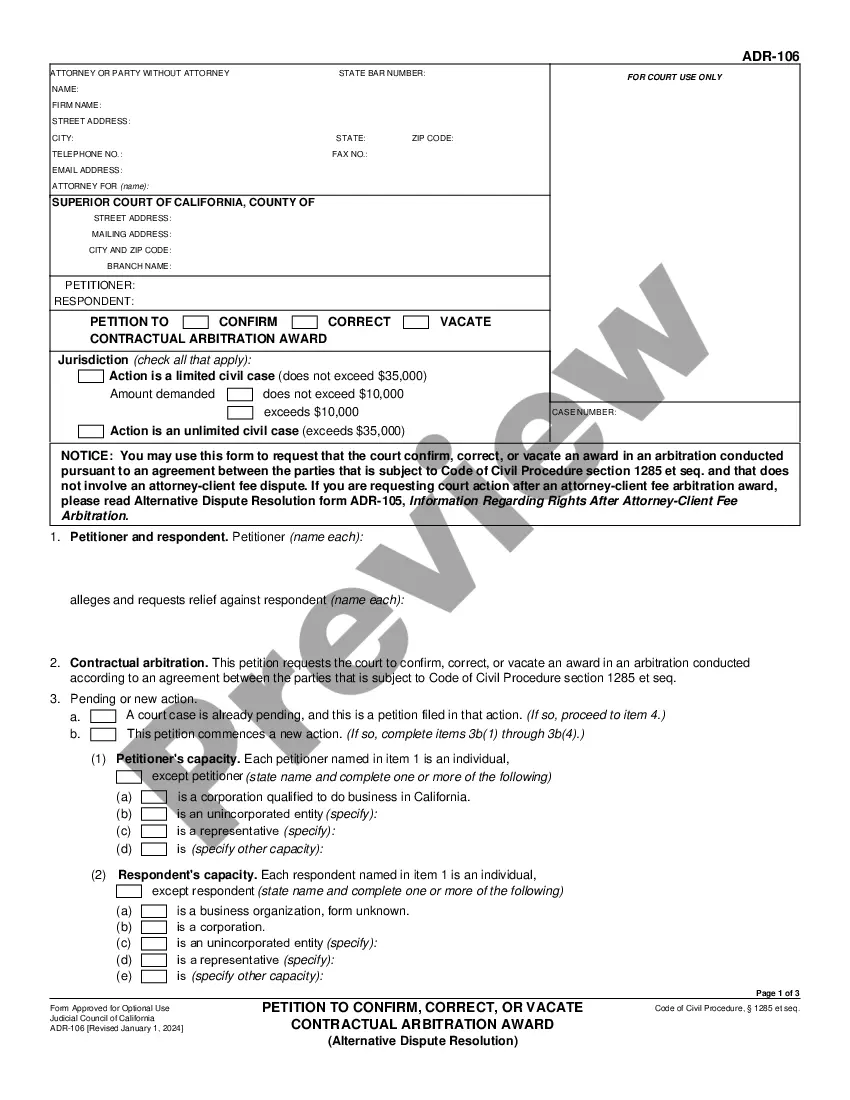

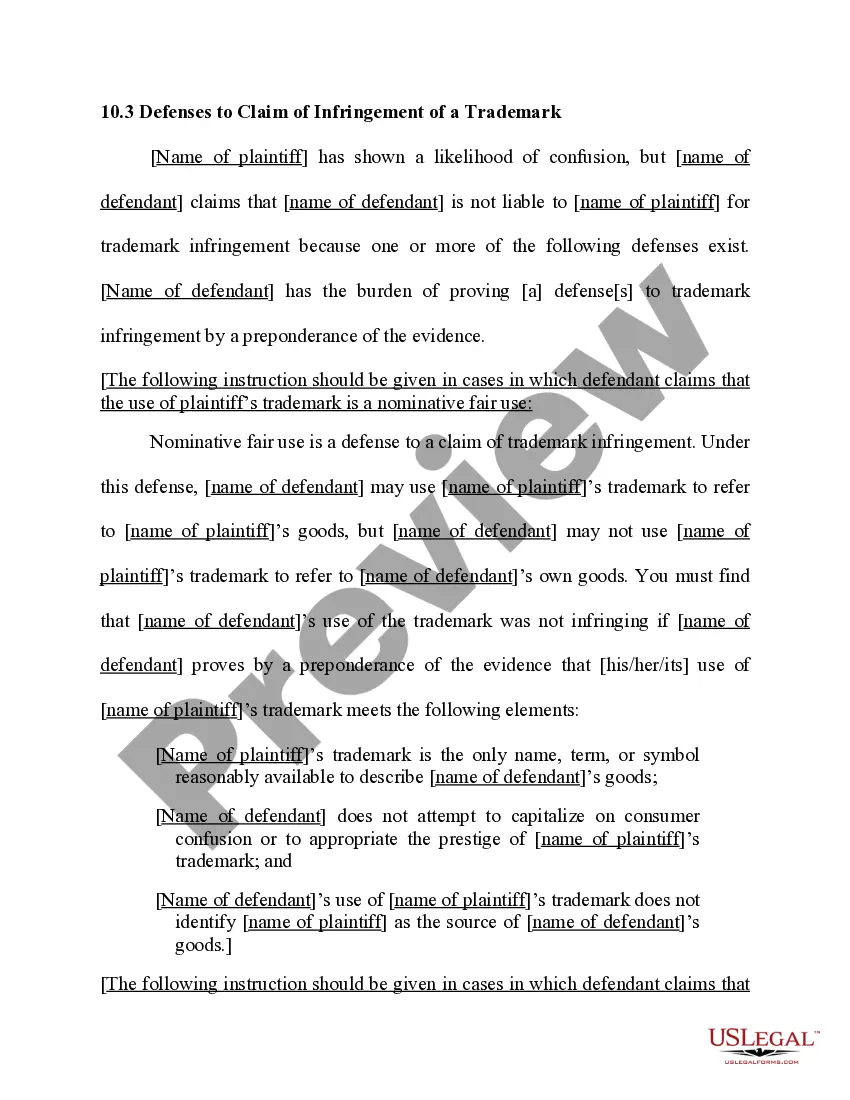

Wyoming Distribution Agreement is a legally binding contract between Ingenuity Capital Management, LLC (ICM) and Daugherty Capital Markets, serving as a comprehensive framework for distributing financial products and services in the state of Wyoming. This agreement outlines the terms and conditions governing the relationship between the two entities, ensuring efficient and lawful distribution activities. Keywords: Wyoming Distribution Agreement, Ingenuity Capital Management, LLC, Daugherty Capital Markets, financial products, services, terms and conditions, distribution activities. This agreement ensures that both parties adhere to the regulations and laws governing distribution practices in Wyoming, promoting transparency, compliance, and the protection of investor interests. The document typically addresses key aspects, such as: 1. Scope and Termination: The agreement defines the specific products and services covered by the distribution arrangement. It also outlines the conditions under which either party can terminate the agreement. 2. Rights and Obligations: Both ICM and Daugherty Capital Markets have defined rights and obligations pertaining to the distribution of financial products. This includes the responsibility for compliance with state and federal regulations, disclosure requirements, and duty to act in the best interest of clients. 3. Compensation and Expenses: The agreement defines the compensation structure for the distribution services, including commissions, fees, or other remuneration. It may also outline any expenses that will be borne by each party. 4. Reporting and Record-Keeping: It is essential to maintain accurate records of distribution activities. The agreement may lay out the reporting requirements, specifying the frequency and format of reports to be submitted by ICM to Daugherty Capital Markets. 5. Intellectual Property and Confidentiality: Intellectual property rights and trade secrets are often protected in the distribution agreement. Both parties agree to maintain confidentiality of proprietary information and may outline non-disclosure provisions. Different types of Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Daugherty Capital Markets may include variations based on the nature of financial products being distributed, such as mutual funds, exchange-traded funds (ETFs), or insurance products. Each type of distribution agreement may have specific provisions relevant to the respective product or service. Overall, the Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Daugherty Capital Markets establishes a solid framework for the distribution of financial products and services in Wyoming, ensuring compliance with regulations, protecting the rights of both parties, and fostering a professional relationship.

Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Rafferty Capital Markets

Description

How to fill out Wyoming Distribution Agreement Between Ingenuity Capital Management, LLC And Rafferty Capital Markets?

If you wish to total, down load, or printing legitimate papers templates, use US Legal Forms, the largest assortment of legitimate varieties, that can be found on the Internet. Make use of the site`s easy and handy search to obtain the paperwork you need. A variety of templates for enterprise and individual uses are sorted by classes and says, or keywords and phrases. Use US Legal Forms to obtain the Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Rafferty Capital Markets in just a number of clicks.

When you are already a US Legal Forms consumer, log in for your bank account and click the Download key to have the Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Rafferty Capital Markets. You can also accessibility varieties you in the past downloaded from the My Forms tab of the bank account.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for the correct town/region.

- Step 2. Make use of the Review method to look over the form`s content. Don`t overlook to read through the information.

- Step 3. When you are not happy together with the kind, make use of the Lookup area on top of the display screen to get other types in the legitimate kind web template.

- Step 4. When you have identified the form you need, click on the Purchase now key. Select the costs program you like and add your accreditations to register to have an bank account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format in the legitimate kind and down load it on your own device.

- Step 7. Comprehensive, modify and printing or indicator the Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Rafferty Capital Markets.

Each and every legitimate papers web template you buy is your own property eternally. You may have acces to every single kind you downloaded within your acccount. Go through the My Forms portion and choose a kind to printing or down load again.

Compete and down load, and printing the Wyoming Distribution Agreement between Ingenuity Capital Management, LLC and Rafferty Capital Markets with US Legal Forms. There are many specialist and express-specific varieties you can use to your enterprise or individual demands.