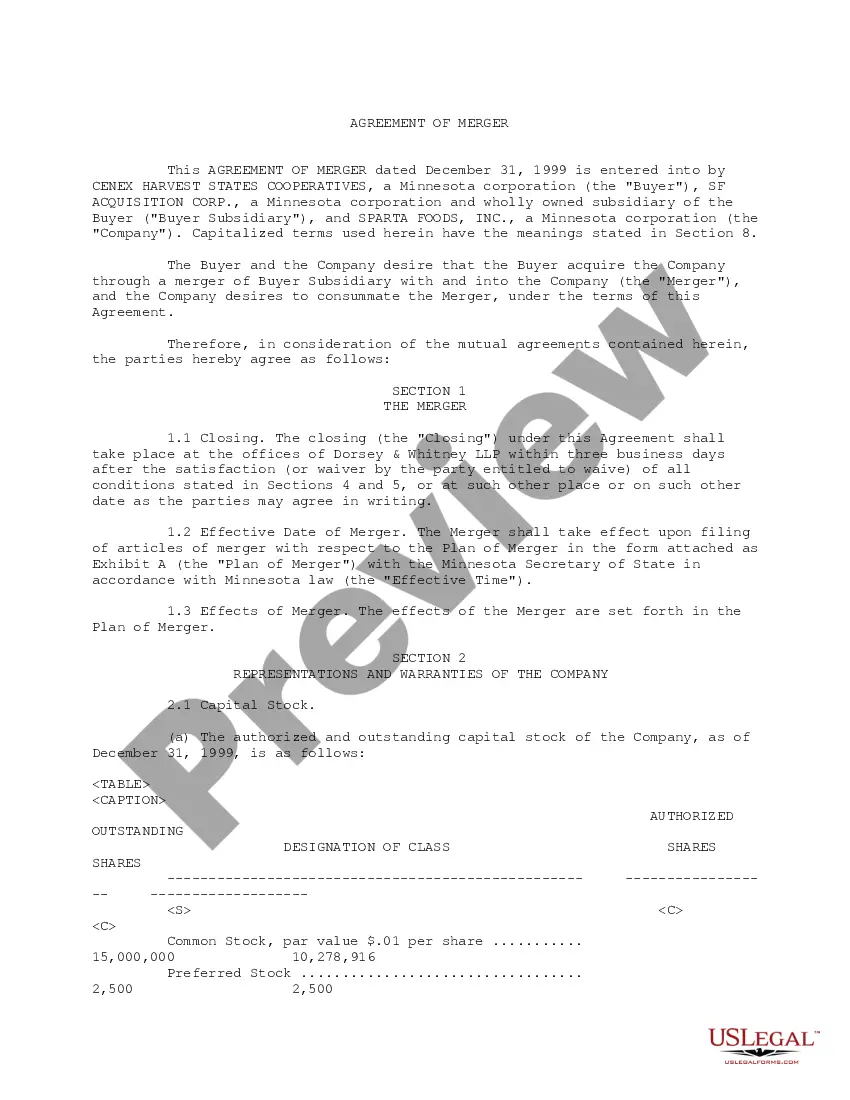

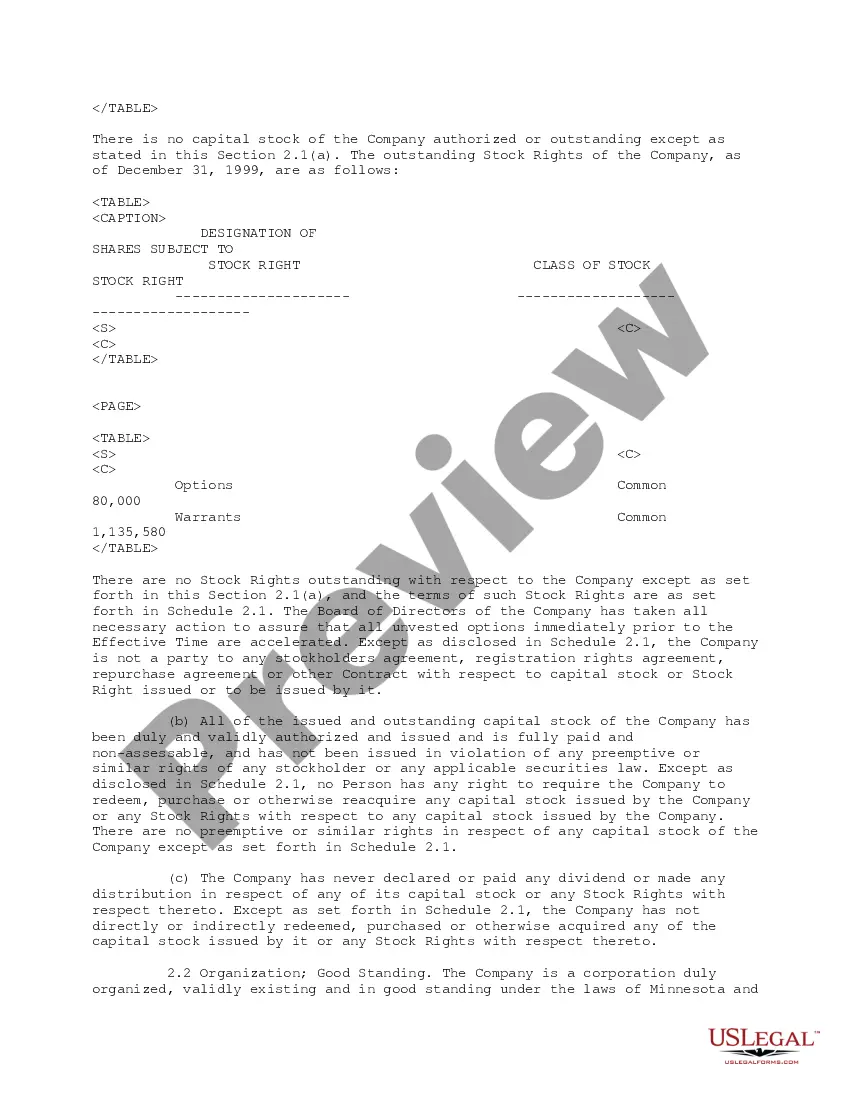

Wyoming Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

US Legal Forms - one of several most significant libraries of authorized forms in the USA - delivers an array of authorized file web templates you may acquire or printing. Using the site, you can get a huge number of forms for organization and individual functions, sorted by groups, claims, or search phrases.You can get the newest versions of forms such as the Wyoming Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. within minutes.

If you already have a registration, log in and acquire Wyoming Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. from your US Legal Forms catalogue. The Down load option will appear on every develop you look at. You have access to all formerly delivered electronically forms from the My Forms tab of your bank account.

In order to use US Legal Forms the first time, listed here are basic guidelines to help you began:

- Be sure you have chosen the best develop for your personal metropolis/state. Click the Review option to review the form`s content material. Look at the develop outline to actually have selected the appropriate develop.

- When the develop does not match your requirements, utilize the Search industry towards the top of the screen to find the one which does.

- When you are pleased with the shape, affirm your decision by clicking on the Purchase now option. Then, select the pricing prepare you like and offer your accreditations to sign up for an bank account.

- Procedure the deal. Make use of your charge card or PayPal bank account to complete the deal.

- Find the format and acquire the shape in your device.

- Make alterations. Load, edit and printing and sign the delivered electronically Wyoming Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

Each format you included with your bank account does not have an expiration day and is your own property permanently. So, if you wish to acquire or printing yet another duplicate, just go to the My Forms section and then click on the develop you will need.

Gain access to the Wyoming Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. with US Legal Forms, probably the most substantial catalogue of authorized file web templates. Use a huge number of expert and status-distinct web templates that fulfill your business or individual requirements and requirements.