Wyoming Recapitalization Agreement: A Comprehensive Explanation and Types The Wyoming Recapitalization Agreement is a legal contract executed between the shareholders, partners, or members of a Wyoming-based company to rearrange the ownership structure and capital distribution of the organization. This agreement outlines the terms and conditions under which the company's capital is restructured, providing a clear framework for the parties involved. By implementing a Wyoming Recapitalization Agreement, businesses can effectively modify their financial structure and ownership interests to meet changing market dynamics, financial goals, or legal requirements. It allows stakeholders to reconfigure their equity and debt investments, which can result in various benefits such as improved governance, enhanced financing options, or increased market value. Types of Wyoming Recapitalization Agreement: 1. Equity Recapitalization: Equity recapitalization is a type of Wyoming Recapitalization Agreement that focuses on reorganizing the company's ownership structure. It involves exchanging existing shares or creating new shares to alter the distribution of ownership among shareholders. Equity recapitalization aims to attract new investors, address ownership disputes, or provide liquidity to existing shareholders. 2. Debt Recapitalization: Debt recapitalization refers to restructuring a company's debt obligations through the Wyoming Recapitalization Agreement. Businesses may choose this type of agreement to improve their financial stability by refinancing existing debts, securing more favorable loan terms, or decreasing interest rates. Debt recapitalization allows companies to reduce financial burdens or extend payment periods, providing much-needed flexibility during challenging economic conditions. 3. Asset Recapitalization: Asset recapitalization involves rearranging the company's assets and liabilities, rather than altering ownership or debt structures. This type of Wyoming Recapitalization Agreement allows businesses to optimize their asset portfolios. It might involve selling non-core assets, acquiring strategic assets, or divesting underperforming assets to maximize overall operational efficiency and profitability. 4. Dividend Recapitalization: Dividend recapitalization focuses on modifying the company's dividend policy and distribution among shareholders. This type of Wyoming Recapitalization Agreement allows companies to adjust dividend allocations, either up or down, based on changing financial circumstances or business objectives. Dividend recapitalization enables companies to align their dividend payments with cash flow generation capabilities while considering future growth prospects. In conclusion, the Wyoming Recapitalization Agreement is a powerful tool for companies to restructure their financial and ownership landscape. Whether through equity, debt, asset, or dividend recapitalization, businesses can adapt to evolving needs and capitalize on new opportunities. It is essential for stakeholders to understand the various types of Wyoming Recapitalization Agreements to choose the most suitable path forward for their organization's long-term success.

Wyoming Recapitalization Agreement

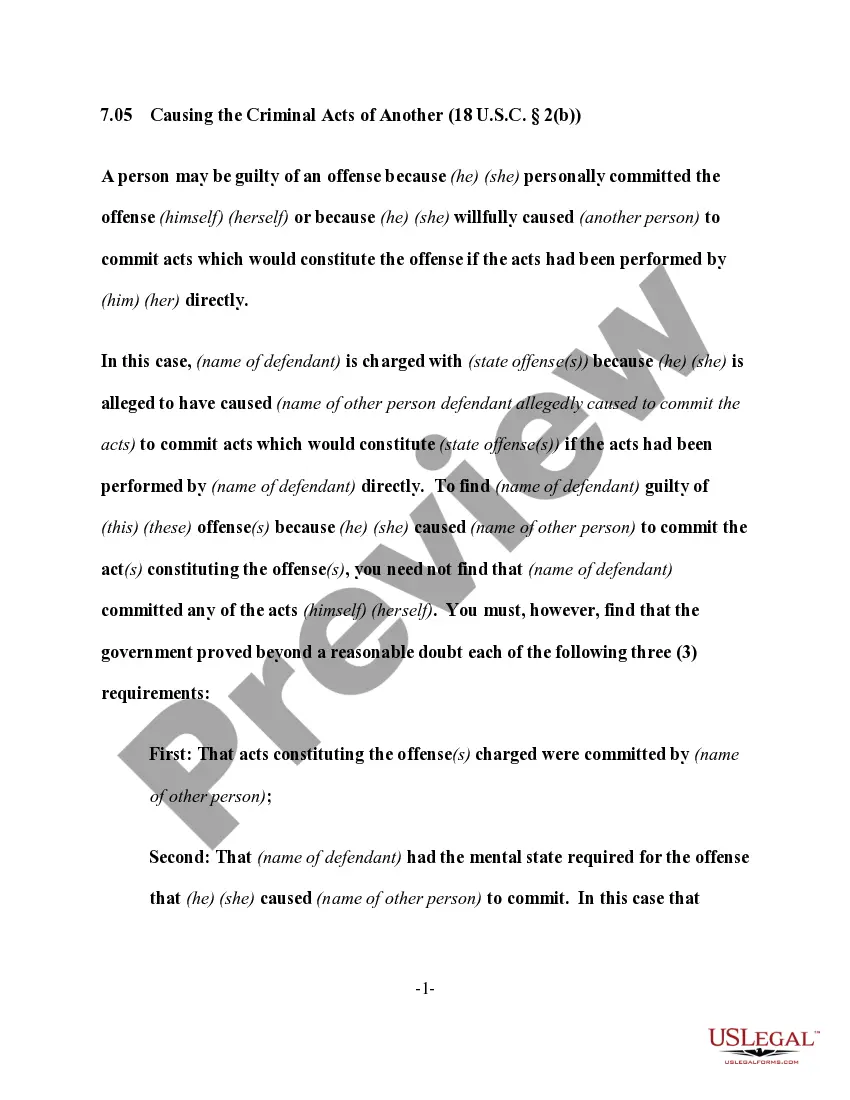

Description

How to fill out Wyoming Recapitalization Agreement?

US Legal Forms - among the largest libraries of legitimate forms in America - provides an array of legitimate papers templates you are able to down load or produce. Making use of the internet site, you will get a large number of forms for enterprise and individual uses, categorized by groups, claims, or search phrases.You can find the most recent versions of forms such as the Wyoming Recapitalization Agreement in seconds.

If you have a membership, log in and down load Wyoming Recapitalization Agreement from the US Legal Forms collection. The Acquire option can look on each develop you look at. You have access to all formerly delivered electronically forms from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed below are simple recommendations to help you get started off:

- Be sure to have selected the best develop for your personal town/region. Click the Preview option to analyze the form`s articles. Read the develop outline to ensure that you have chosen the proper develop.

- In case the develop doesn`t match your demands, make use of the Look for discipline towards the top of the display screen to get the one which does.

- When you are content with the form, affirm your decision by simply clicking the Get now option. Then, select the prices prepare you like and supply your accreditations to register for an bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to finish the purchase.

- Choose the format and down load the form on the gadget.

- Make adjustments. Fill out, change and produce and indication the delivered electronically Wyoming Recapitalization Agreement.

Each and every template you included with your account does not have an expiration day and is also your own eternally. So, if you wish to down load or produce one more version, just go to the My Forms section and then click around the develop you will need.

Obtain access to the Wyoming Recapitalization Agreement with US Legal Forms, probably the most substantial collection of legitimate papers templates. Use a large number of professional and status-specific templates that satisfy your organization or individual requirements and demands.