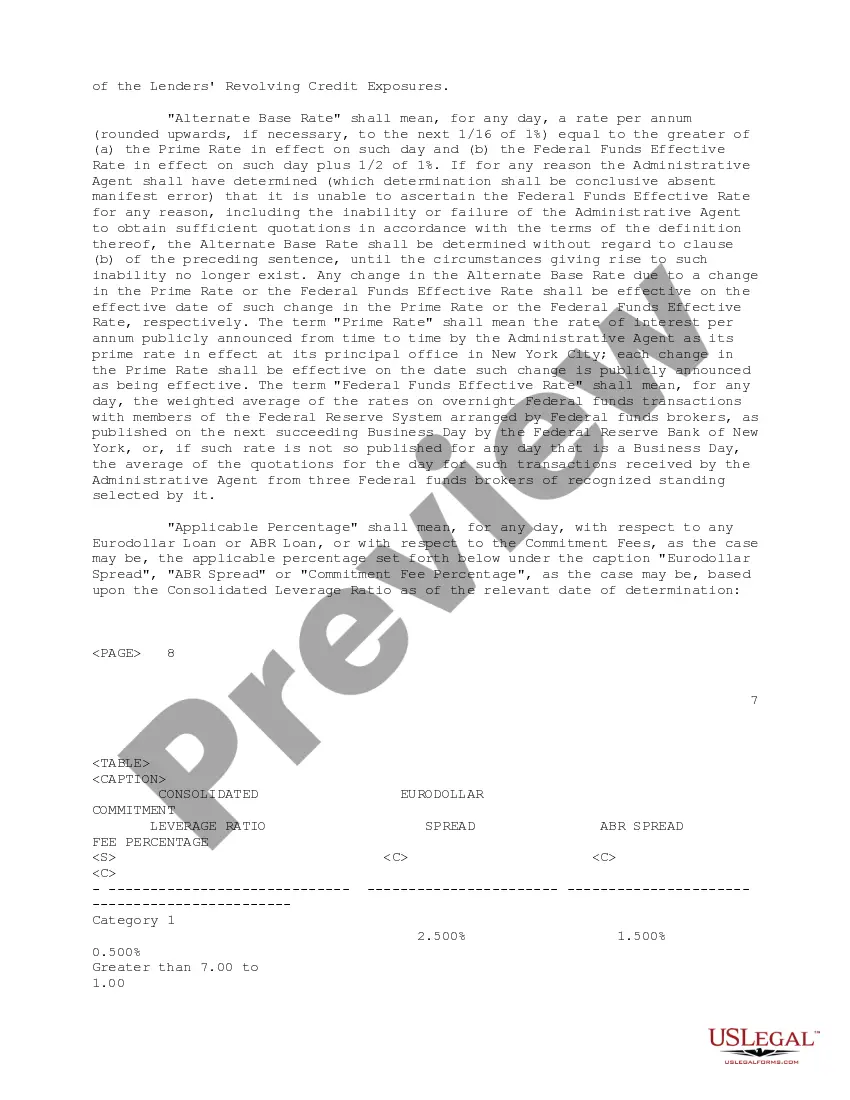

Wyoming Credit Agreements are legal contracts between a lender and a borrower that outline the terms and conditions for extending credit in the state of Wyoming. These agreements are crucial in ensuring a clear understanding and fair treatment for both parties involved in credit transactions. The primary purpose of a Wyoming Credit Agreement is to specify the terms of the credit extension, including the amount of credit provided, interest rates, repayment schedules, fees, and other relevant details. It serves as a legally binding contract that safeguards the rights and responsibilities of both the borrower and the lender. There are different types of Wyoming Credit Agreements, depending on the specific purpose of the credit extension. Some notable types include: 1. Personal Loan Agreement: This type of credit agreement is designed for individuals seeking personal financing. It outlines the terms and conditions surrounding the credit extension, including repayment terms, interest rates, and any applicable fees. 2. Business Credit Agreement: This type of credit agreement is tailored for businesses in Wyoming. It covers credit extensions for business-related purposes, such as working capital, expansion, or equipment financing. The agreement may include provisions specific to the individual needs of the business, such as collateral requirements and loan covenants. 3. Mortgage Agreement: A Wyoming Mortgage Agreement is a credit agreement specifically for real estate transactions. This type of agreement outlines the terms and conditions for providing credit to the borrower to finance the purchase or refinance of a property. It includes details about the loan amount, interest rate, repayment schedule, and any collateral tied to the mortgage. 4. Line of Credit Agreement: This agreement establishes a revolving credit facility with predetermined credit limits. It enables borrowers to access funds up to the approved limit, repay the borrowed amount, and then borrow again. The terms and conditions, including interest rates and repayment schedules, are specified in the agreement. Wyoming Credit Agreements play a crucial role in protecting the rights and interests of both borrowers and lenders. It is essential for all parties involved to carefully review the agreement, seek legal advice if necessary, and ensure that they fully understand the terms and conditions before signing.

Wyoming Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Are you presently in the situation the place you need to have papers for possibly enterprise or personal functions almost every day? There are a lot of legitimate papers themes available on the net, but locating ones you can depend on is not simple. US Legal Forms gives a large number of kind themes, like the Wyoming Credit Agreement regarding extension of credit, that happen to be created to meet state and federal specifications.

When you are currently familiar with US Legal Forms website and get a free account, basically log in. After that, you can acquire the Wyoming Credit Agreement regarding extension of credit format.

Should you not come with an accounts and need to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for that right town/region.

- Take advantage of the Review button to analyze the form.

- Read the outline to ensure that you have selected the proper kind.

- In the event the kind is not what you`re looking for, utilize the Search discipline to get the kind that meets your requirements and specifications.

- Once you discover the right kind, click on Acquire now.

- Pick the costs strategy you want, fill out the necessary details to create your account, and buy the order making use of your PayPal or charge card.

- Decide on a handy file format and acquire your backup.

Locate all of the papers themes you might have purchased in the My Forms food list. You may get a more backup of Wyoming Credit Agreement regarding extension of credit whenever, if required. Just select the needed kind to acquire or printing the papers format.

Use US Legal Forms, probably the most substantial assortment of legitimate varieties, to save lots of some time and prevent blunders. The service gives expertly manufactured legitimate papers themes which you can use for a range of functions. Produce a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A credit facility agreement details the borrower's responsibilities, loan warranties, lending amounts, interest rates, loan duration, default penalties, and repayment terms and conditions.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

Loan or extension of credit means a direct or indirect advance of funds to a customer made on the basis of any obligation of that customer to repay the funds or that is repayable from specific property pledged by or on the customer's behalf.

Also, extend someone credit. Allow a purchase on credit; also, permit someone to owe money. For example, The store is closing your charge account; they won't extend credit to you any more, or The normal procedure is to extend you credit for three months, and after that we charge interest.

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.