Wyoming Subscription Agreement

Description

How to fill out Subscription Agreement?

If you want to complete, acquire, or printing legitimate record layouts, use US Legal Forms, the biggest selection of legitimate forms, that can be found online. Use the site`s basic and handy lookup to discover the files you need. Numerous layouts for business and individual reasons are categorized by groups and claims, or key phrases. Use US Legal Forms to discover the Wyoming Subscription Agreement within a handful of clicks.

Should you be presently a US Legal Forms consumer, log in to your accounts and click on the Down load switch to find the Wyoming Subscription Agreement. You may also accessibility forms you earlier downloaded within the My Forms tab of your accounts.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your right area/nation.

- Step 2. Utilize the Preview choice to look through the form`s content. Never forget to see the description.

- Step 3. Should you be unsatisfied with all the type, utilize the Search industry towards the top of the display screen to get other types of your legitimate type design.

- Step 4. Upon having identified the shape you need, click on the Acquire now switch. Pick the prices prepare you prefer and add your credentials to register on an accounts.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Find the format of your legitimate type and acquire it on the product.

- Step 7. Comprehensive, change and printing or indicator the Wyoming Subscription Agreement.

Every legitimate record design you buy is your own property for a long time. You may have acces to each and every type you downloaded within your acccount. Click on the My Forms area and decide on a type to printing or acquire yet again.

Remain competitive and acquire, and printing the Wyoming Subscription Agreement with US Legal Forms. There are millions of skilled and condition-distinct forms you can utilize for your personal business or individual demands.

Form popularity

FAQ

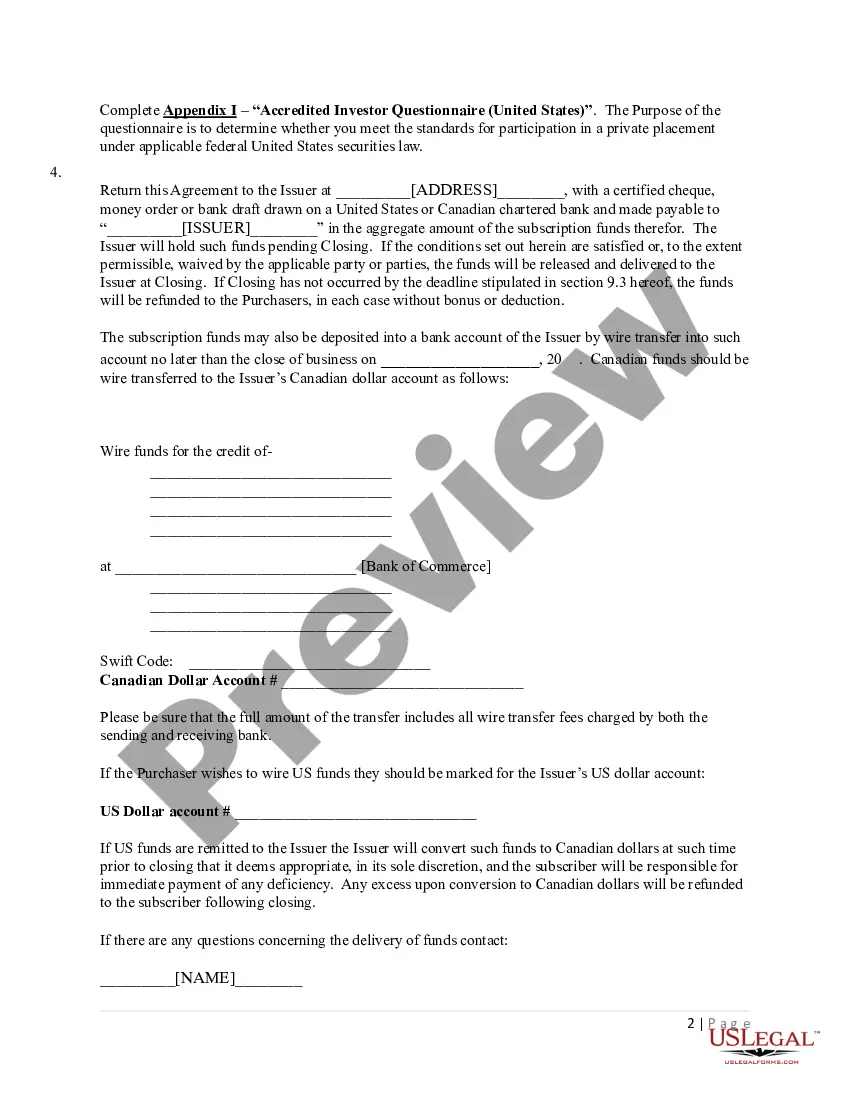

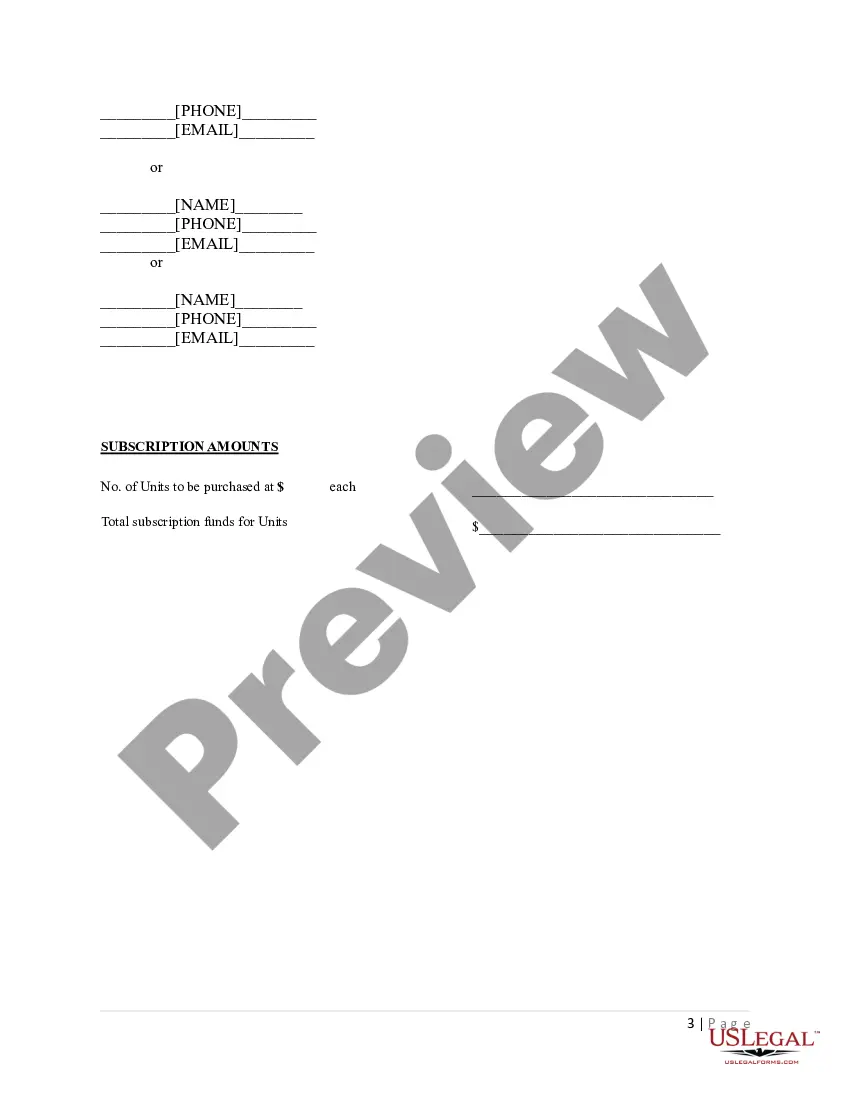

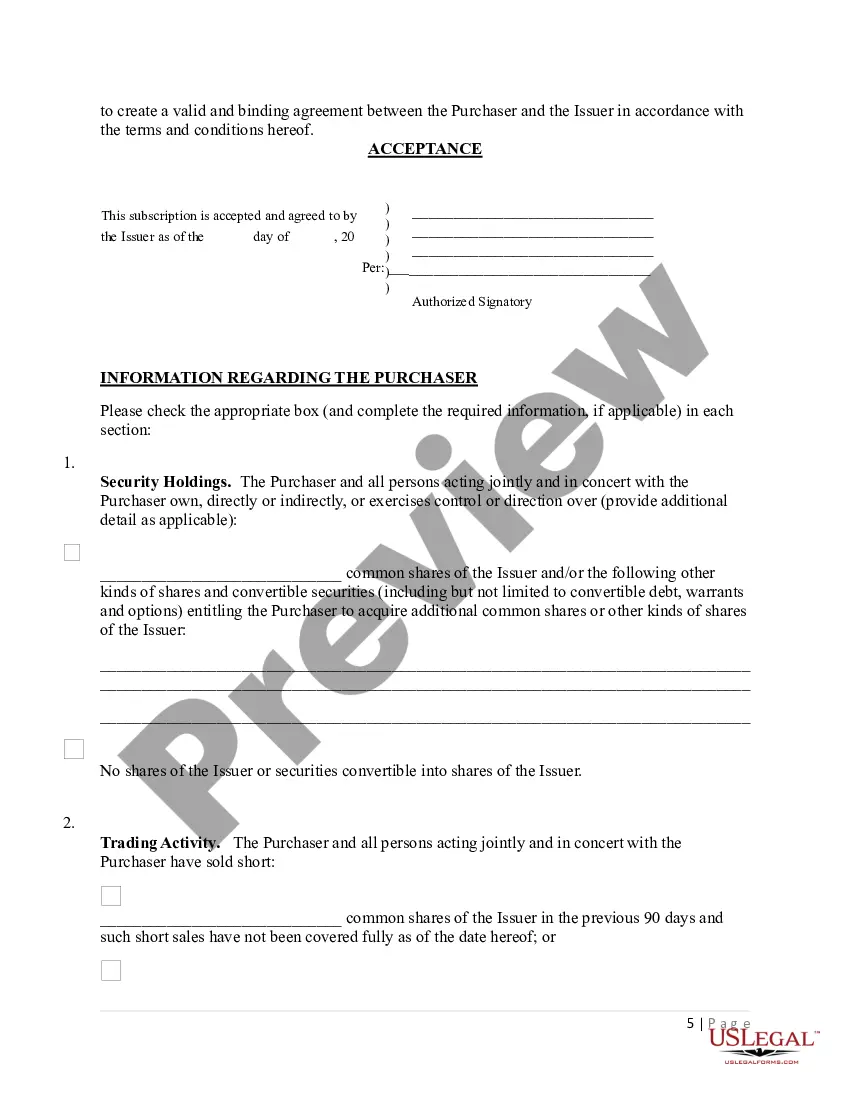

Hear this out loud PauseSummary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Hear this out loud PauseSubject to the terms and conditions hereof, Subscriber hereby agrees to subscribe for and purchase, and the Company hereby agrees to issue and sell to Subscriber, upon the payment of the Purchase Price, the Shares (such subscription and issuance, the "Subscription").

A subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

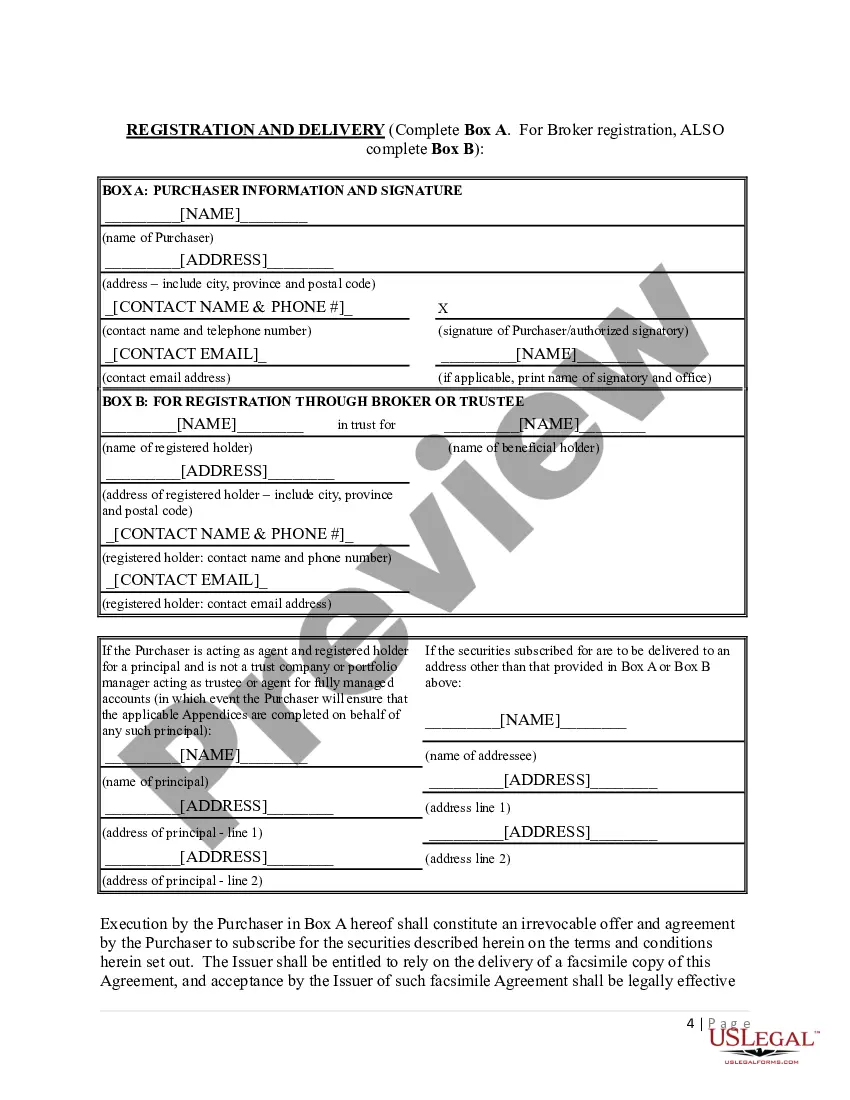

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Hear this out loud Pause1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

By including these five key elements in your Share Subscription Agreement ? subscription price, payment terms, representations and warranties, closing conditions, and indemnification ? you can help safeguard against any potential issues or disputes that may arise down the road.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

Hear this out loud PauseThere are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.