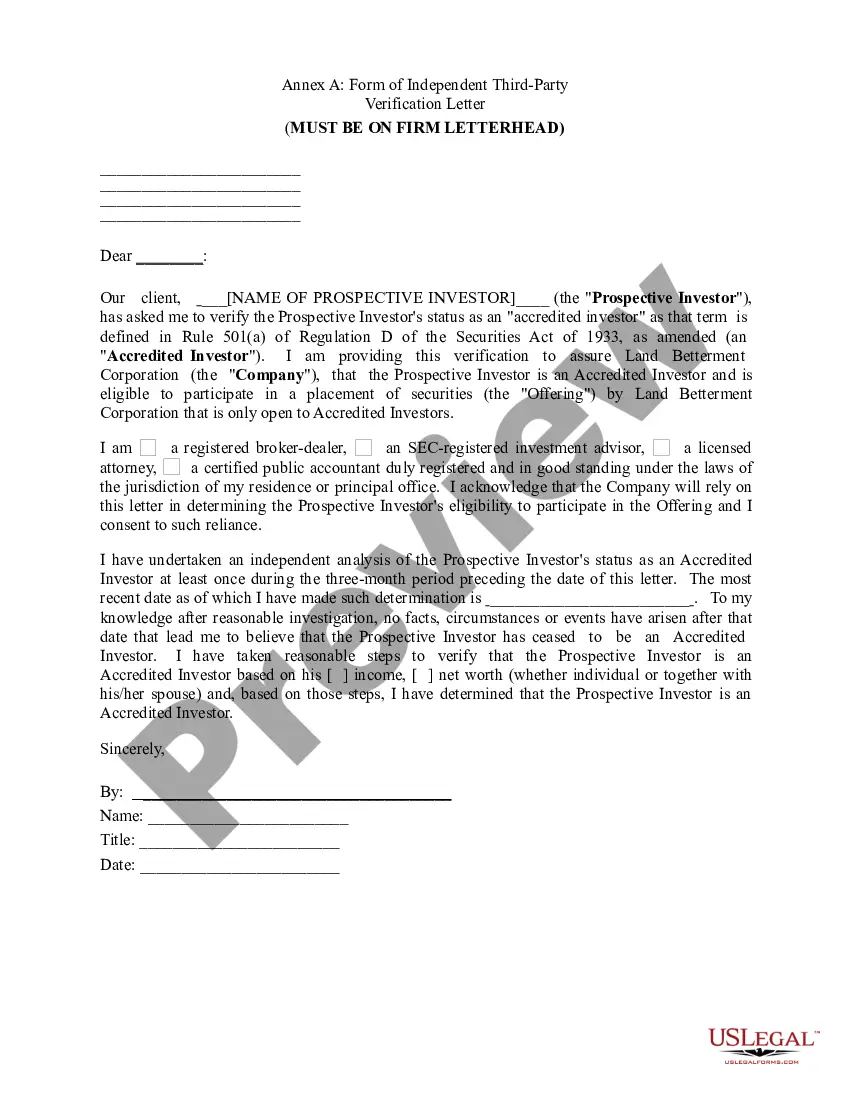

Wyoming Accredited Investor Certification Letter serves as a formal document that confirms an individual's accreditation status in accordance with the regulations set by the Wyoming Securities Act. Accredited investors are individuals or entities who meet certain criteria and possess the financial sophistication and capability to participate in private offerings of securities, which typically involve higher risks. The Wyoming Accredited Investor Certification Letter is an essential tool for issuers, securities brokers, and dealers to ensure compliance with state securities laws and regulations while offering investment opportunities to potential investors. It verifies that the recipient meets the required standards outlined under the Wyoming Securities Act, making them eligible to engage in private offerings. Key elements typically found in a Wyoming Accredited Investor Certification Letter include: 1. Contact Information: The letter includes the issuer's contact details, such as name, address, and contact number, along with the accredited investor's information, including name, address, and contact details. 2. Accreditation Status: The main purpose of the letter is to certify the recipient as an accredited investor under Wyoming state law. It confirms that they have satisfied specific income, net worth, or professional knowledge criteria defined by the act. 3. Criteria Certification: Different types of certification letters may be issued depending on whether the investor qualifies as an individual, entity, or under specific exemptions. For instance, an individual may qualify either through income or net worth requirements, while an entity may qualify based on assets held or under certain exemptions such as financial institutions, trust funds, or governmental entities. 4. Investment Limitations: The letter may mention any limitations and restrictions associated with the accredited investor status. Such restrictions may include the number or value of securities an accredited investor can purchase or the type of securities they can invest in. 5. Solicitation Statement: Sometimes, the letter may contain a statement clarifying that the issuer is not required to file reports with the United States Securities and Exchange Commission (SEC) and any information provided may differ from SEC disclosure requirements. It's important to note that while Wyoming Accredited Investor Certification Letters share similarities with those issued by other states, they specifically adhere to Wyoming's regulations. Additionally, variations may exist depending on the specific circumstances, investment terms, and regulatory updates. In conclusion, the Wyoming Accredited Investor Certification Letter is a crucial document that confirms an individual's accreditation status according to Wyoming state laws. It enables issuers and professionals in the securities' industry to ensure compliance while offering investment opportunities. Each letter is tailored to the investor's specific situation and may come in different types based on individuals, entities, or exemptions that meet the Wyoming Securities Act's requirements.

Wyoming Accredited Investor Certification Letter

Description

How to fill out Wyoming Accredited Investor Certification Letter?

If you have to full, down load, or produce authorized document themes, use US Legal Forms, the most important assortment of authorized forms, which can be found online. Make use of the site`s easy and hassle-free search to get the paperwork you require. Numerous themes for enterprise and personal functions are sorted by types and suggests, or search phrases. Use US Legal Forms to get the Wyoming Accredited Investor Certification Letter in a couple of mouse clicks.

If you are presently a US Legal Forms buyer, log in to the profile and click on the Download button to have the Wyoming Accredited Investor Certification Letter. Also you can gain access to forms you earlier saved within the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for the right area/region.

- Step 2. Make use of the Preview method to look through the form`s content. Don`t forget to read through the information.

- Step 3. If you are not satisfied with all the develop, take advantage of the Lookup field towards the top of the monitor to get other versions of the authorized develop design.

- Step 4. When you have located the form you require, select the Get now button. Select the prices strategy you prefer and add your qualifications to register to have an profile.

- Step 5. Method the purchase. You can utilize your credit card or PayPal profile to accomplish the purchase.

- Step 6. Pick the structure of the authorized develop and down load it on the product.

- Step 7. Total, modify and produce or signal the Wyoming Accredited Investor Certification Letter.

Every authorized document design you acquire is the one you have forever. You possess acces to each develop you saved with your acccount. Click on the My Forms area and select a develop to produce or down load once more.

Compete and down load, and produce the Wyoming Accredited Investor Certification Letter with US Legal Forms. There are thousands of skilled and status-certain forms you can use to your enterprise or personal requires.