Wyoming Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - among the most significant libraries of legal kinds in the United States - delivers a wide array of legal document layouts you may acquire or print. Utilizing the website, you may get a large number of kinds for business and individual reasons, categorized by categories, claims, or keywords and phrases.You will find the newest models of kinds much like the Wyoming Term Sheet - Convertible Debt Financing in seconds.

If you already have a monthly subscription, log in and acquire Wyoming Term Sheet - Convertible Debt Financing from the US Legal Forms catalogue. The Obtain key can look on every single kind you look at. You gain access to all in the past saved kinds within the My Forms tab of your bank account.

If you want to use US Legal Forms initially, here are simple directions to get you started out:

- Be sure you have picked out the best kind for your personal metropolis/region. Select the Review key to analyze the form`s information. Browse the kind description to actually have selected the proper kind.

- When the kind does not suit your demands, utilize the Search area near the top of the monitor to discover the one that does.

- In case you are content with the form, affirm your option by clicking on the Get now key. Then, select the costs prepare you prefer and offer your credentials to register for an bank account.

- Approach the transaction. Make use of your Visa or Mastercard or PayPal bank account to complete the transaction.

- Find the formatting and acquire the form on your device.

- Make alterations. Load, edit and print and sign the saved Wyoming Term Sheet - Convertible Debt Financing.

Each design you included with your bank account does not have an expiry day which is yours permanently. So, if you wish to acquire or print yet another duplicate, just proceed to the My Forms section and click around the kind you require.

Get access to the Wyoming Term Sheet - Convertible Debt Financing with US Legal Forms, by far the most comprehensive catalogue of legal document layouts. Use a large number of expert and express-specific layouts that satisfy your business or individual demands and demands.

Form popularity

FAQ

Convertible debt issued at a substantial premium could result in the instrument being treated entirely as an equity instrument for tax purposes, with no tax consequences during its term or upon redemption.

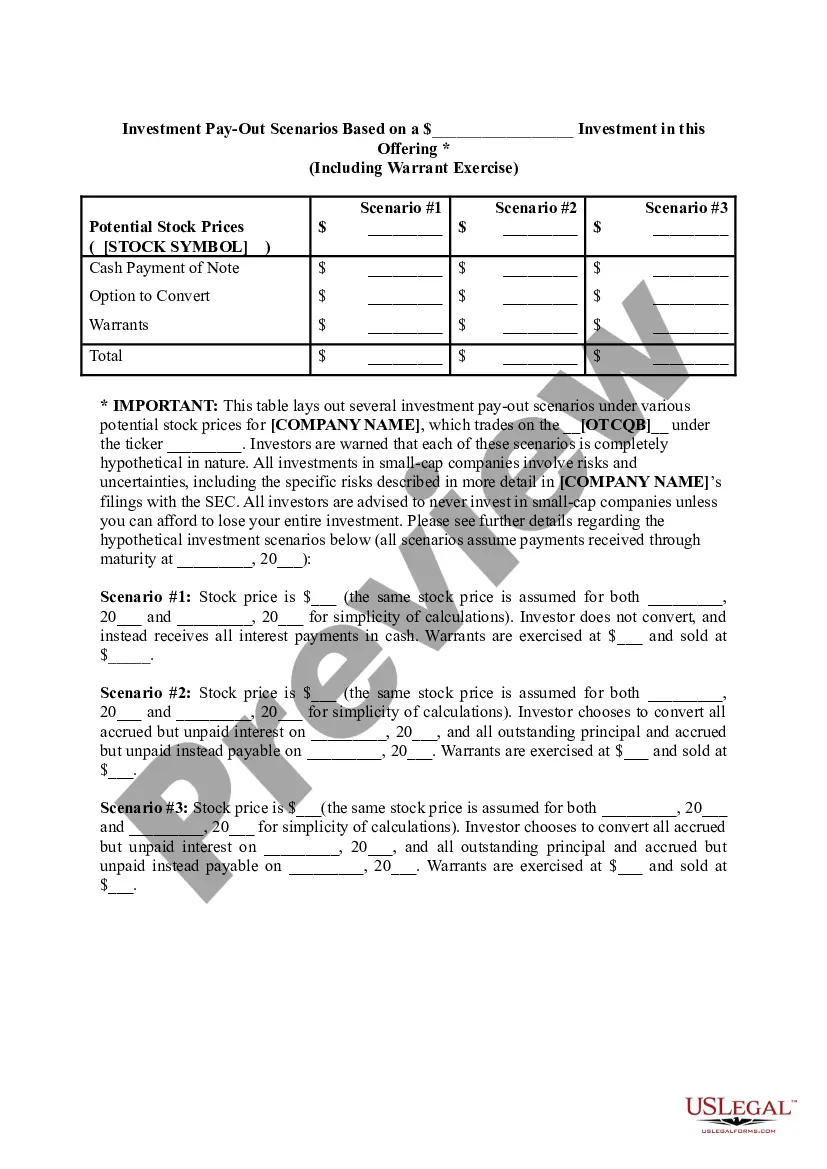

Typically, the result is that the amount will convert to shares. If the convertible notes convert into shares, the company will need to determine how many shares to issue to the noteholder. To do so, the company will usually divide the loan amount, plus any accrued interest, by a certain share price.

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.

The convertible debt that was listed as a non-current liability before the conversion now gets get treated as shareholder's equity.

Conversion to Equity - Accounting for Convertible Debt When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.