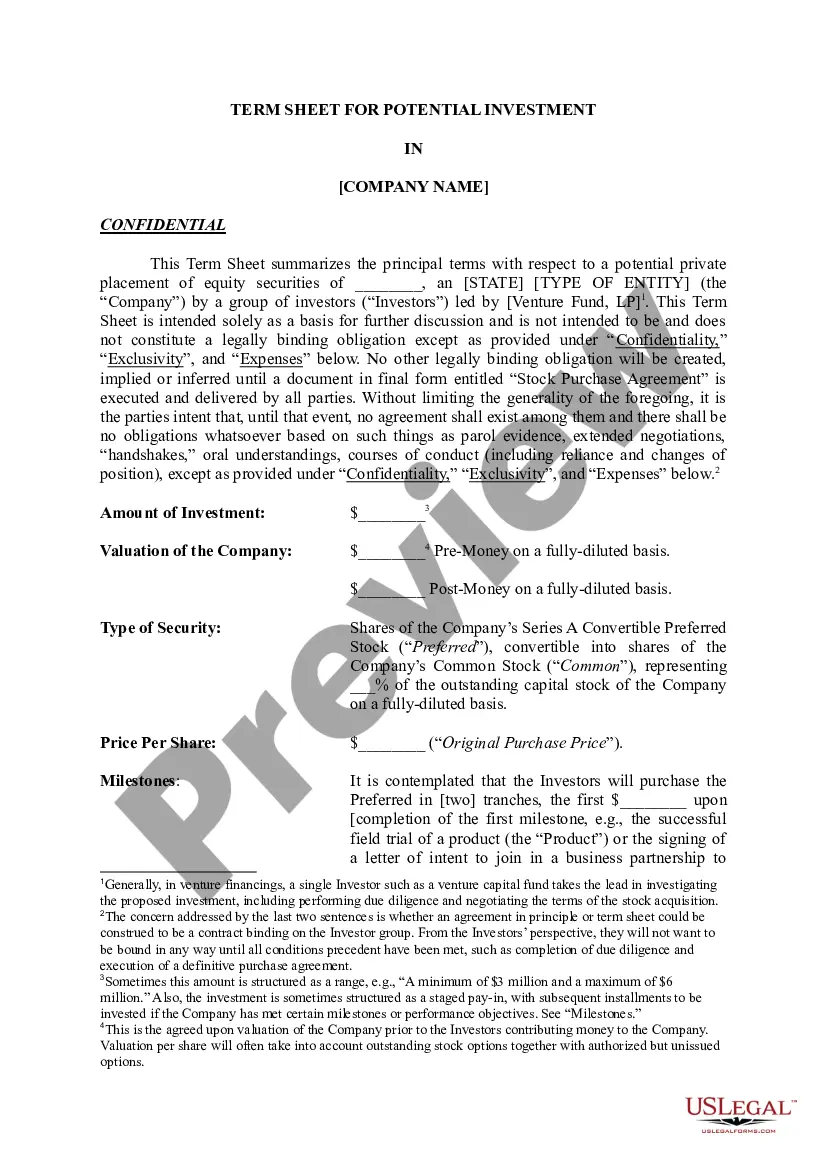

Wyoming Term Sheet for Potential Investment in a Company

Description

How to fill out Term Sheet For Potential Investment In A Company?

You may commit hrs on the web searching for the legal document format that fits the state and federal demands you will need. US Legal Forms supplies thousands of legal types that happen to be examined by experts. You can actually download or print the Wyoming Term Sheet for Potential Investment in a Company from the assistance.

If you have a US Legal Forms account, you are able to log in and click on the Obtain key. Following that, you are able to comprehensive, edit, print, or sign the Wyoming Term Sheet for Potential Investment in a Company. Every legal document format you get is yours forever. To get an additional backup for any obtained form, go to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site for the first time, adhere to the straightforward recommendations below:

- Initial, make certain you have selected the best document format to the state/metropolis that you pick. Browse the form explanation to make sure you have picked out the proper form. If readily available, utilize the Review key to search through the document format too.

- In order to get an additional variation from the form, utilize the Lookup industry to discover the format that meets your needs and demands.

- After you have discovered the format you need, simply click Acquire now to proceed.

- Select the prices program you need, enter your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal account to fund the legal form.

- Select the structure from the document and download it for your product.

- Make adjustments for your document if necessary. You may comprehensive, edit and sign and print Wyoming Term Sheet for Potential Investment in a Company.

Obtain and print thousands of document layouts while using US Legal Forms site, that offers the most important assortment of legal types. Use expert and state-specific layouts to tackle your small business or specific demands.

Form popularity

FAQ

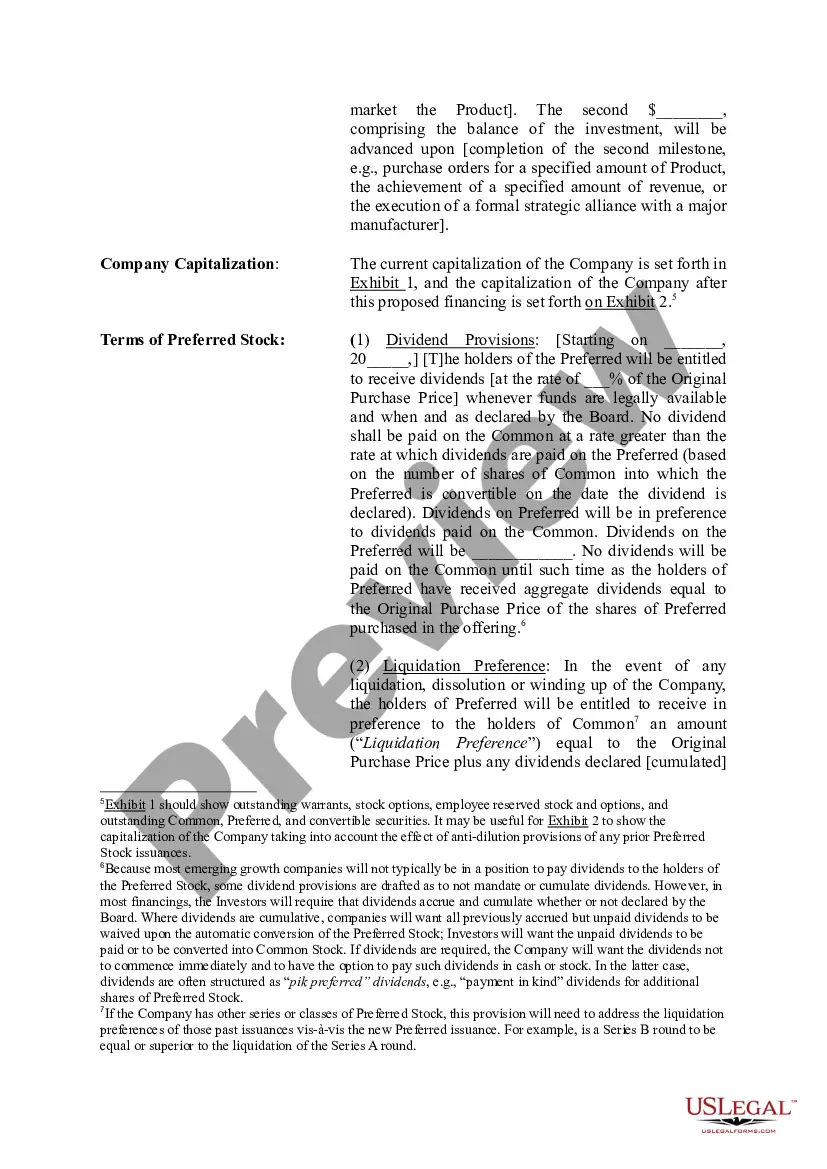

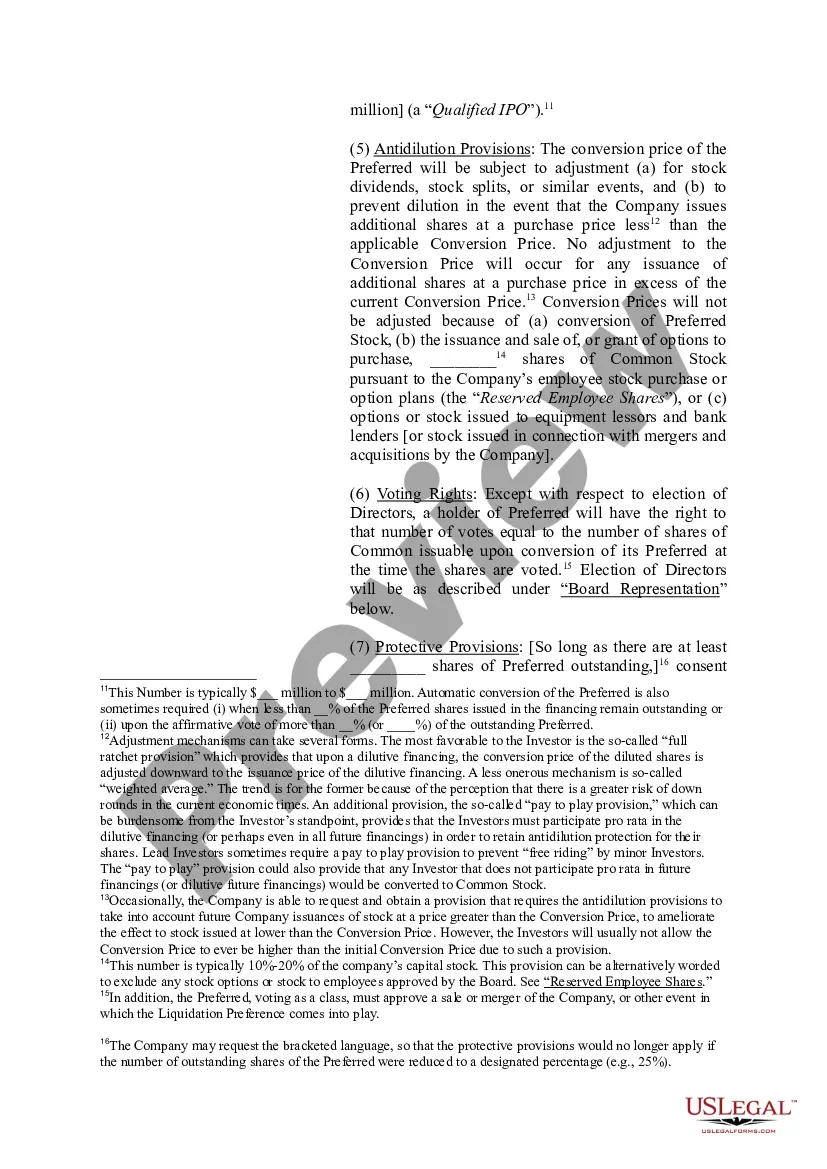

4 Steps to Create a Term Sheet Investment amount. Timing. Company valuation. Form of investment. Stock option plans. Parties' rights and responsibilities. Board representation. Time frame for deal completion.

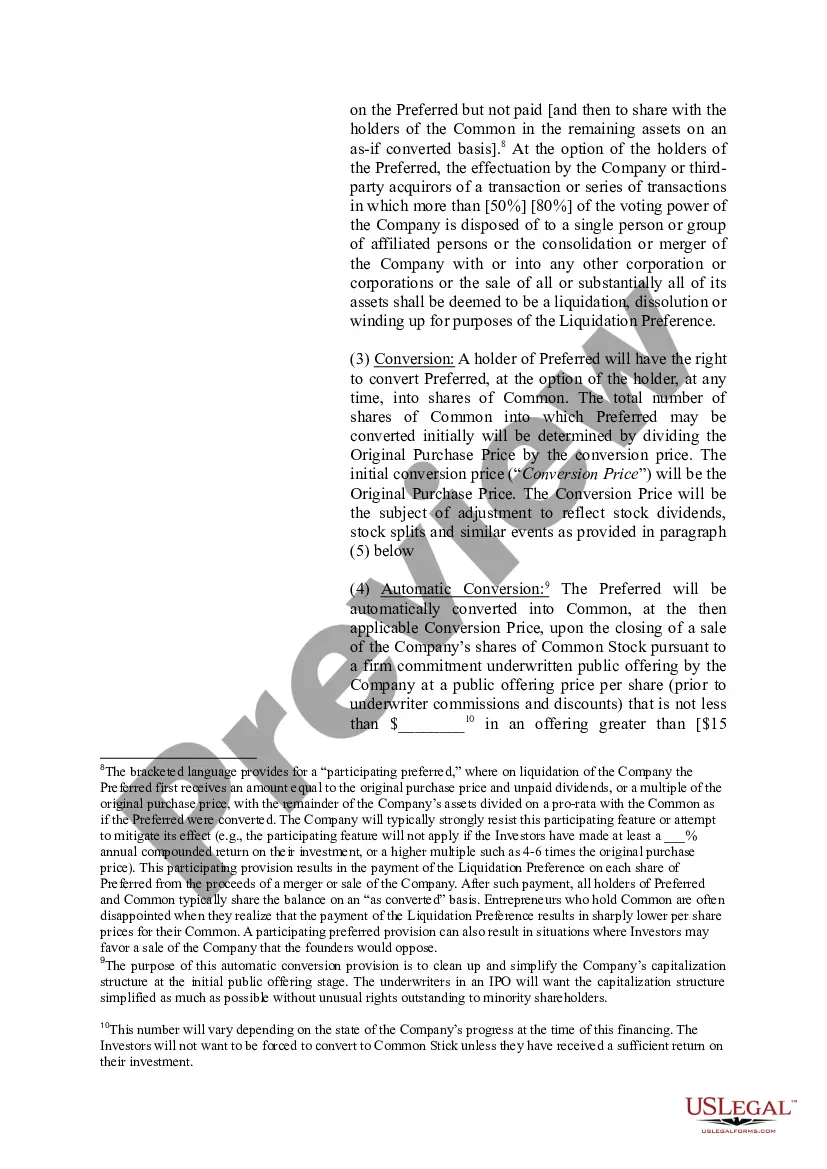

The main point of difference is that, generally, a Term Sheet is not intended to be legally binding while Shareholders Agreements are legally binding. You often use a Term Sheet to quickly agree on the key commercial terms and then use that as a basis to draft up a more formal Shareholders Agreement.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

Once you're certain the investors offering you a term sheet are a good match, go beyond the obvious. Investment dollars and valuation are critical, of course, but don't overlook important details like option pools, liquidation preferences and the composition of your board.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

A term sheet is a list of terms and conditions on which an investor is prepared to fund your business. At a basic level, term sheets describe the amount of the proposed investment and the share of your business the investor would like in return.

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information. Term sheets are most often associated with startups.