Wyoming Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

If you have to complete, obtain, or printing legal papers web templates, use US Legal Forms, the most important assortment of legal varieties, that can be found on the Internet. Utilize the site`s simple and easy handy look for to obtain the paperwork you need. A variety of web templates for business and specific purposes are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Wyoming Summary of Terms of Proposed Private Placement Offering within a few mouse clicks.

When you are currently a US Legal Forms consumer, log in for your accounts and click the Obtain switch to obtain the Wyoming Summary of Terms of Proposed Private Placement Offering. You can even access varieties you in the past downloaded in the My Forms tab of your accounts.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the proper area/country.

- Step 2. Make use of the Preview choice to look over the form`s content material. Do not neglect to learn the explanation.

- Step 3. When you are unhappy together with the develop, utilize the Lookup industry at the top of the monitor to get other models from the legal develop format.

- Step 4. Upon having located the form you need, click on the Purchase now switch. Select the pricing strategy you choose and put your accreditations to sign up for the accounts.

- Step 5. Process the purchase. You should use your bank card or PayPal accounts to complete the purchase.

- Step 6. Find the formatting from the legal develop and obtain it on the gadget.

- Step 7. Full, revise and printing or indication the Wyoming Summary of Terms of Proposed Private Placement Offering.

Every legal papers format you purchase is your own forever. You may have acces to each develop you downloaded with your acccount. Click the My Forms area and decide on a develop to printing or obtain again.

Remain competitive and obtain, and printing the Wyoming Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are millions of specialist and state-particular varieties you can utilize for your personal business or specific demands.

Form popularity

FAQ

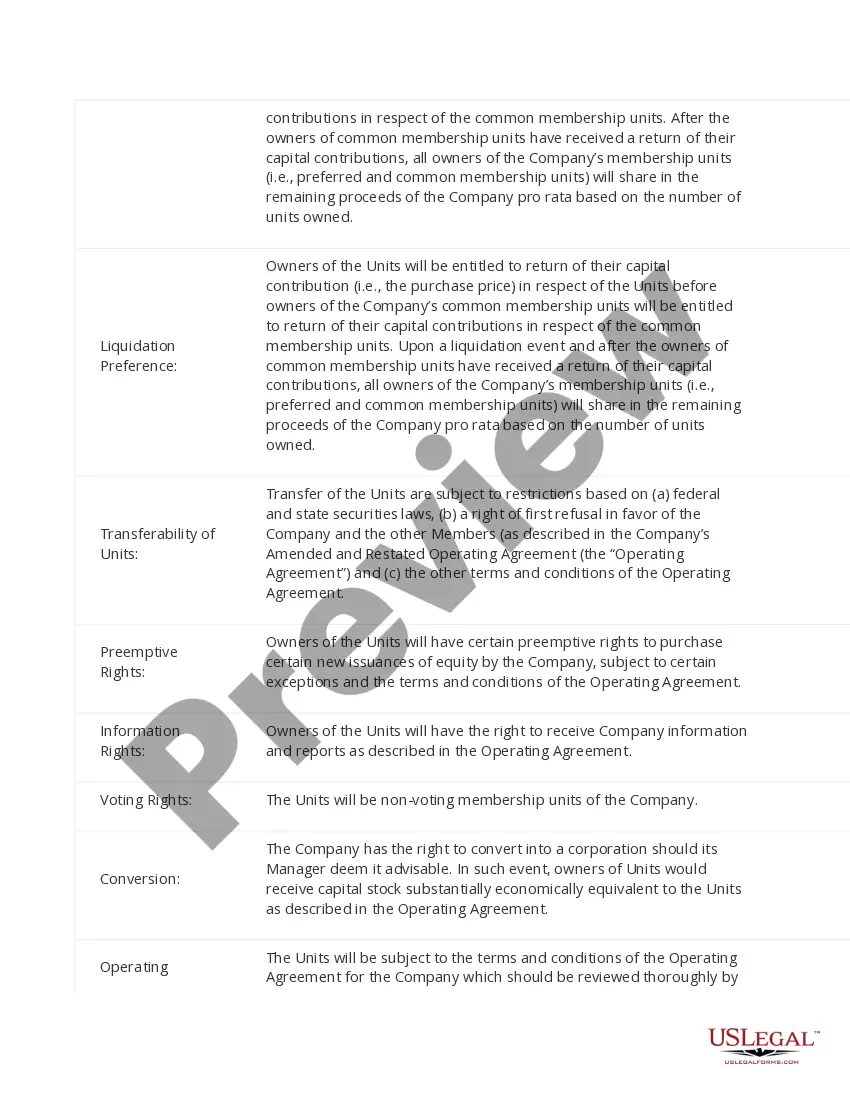

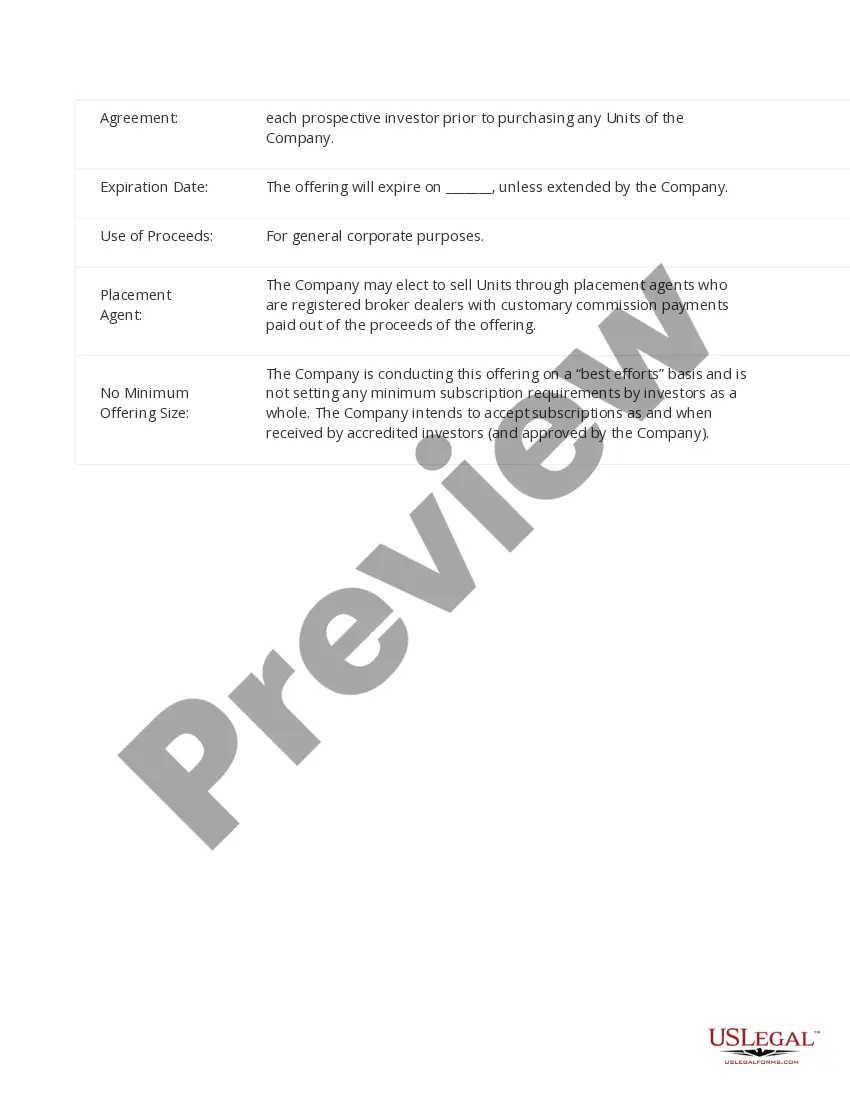

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A true certified copy of Resolution passed by Members of Company. An Explanatory Statement of Resolution by members of Company. An approved offer letter of Private Placement. Form PAS-5 with a detailed list of Allottees.

Private Placement Programs, also called ?High Yield Investment Programs?, are private (non-public) investment programs which are based on the purchase or sale of bank financial instruments. In most cases MTNs are mainly used.

As the name suggests, a ?private placement? is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Private placements involve the non-public sale of securities to a relatively small number of investors.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.