Wyoming Form - Employee Certificate of Authorship

Description

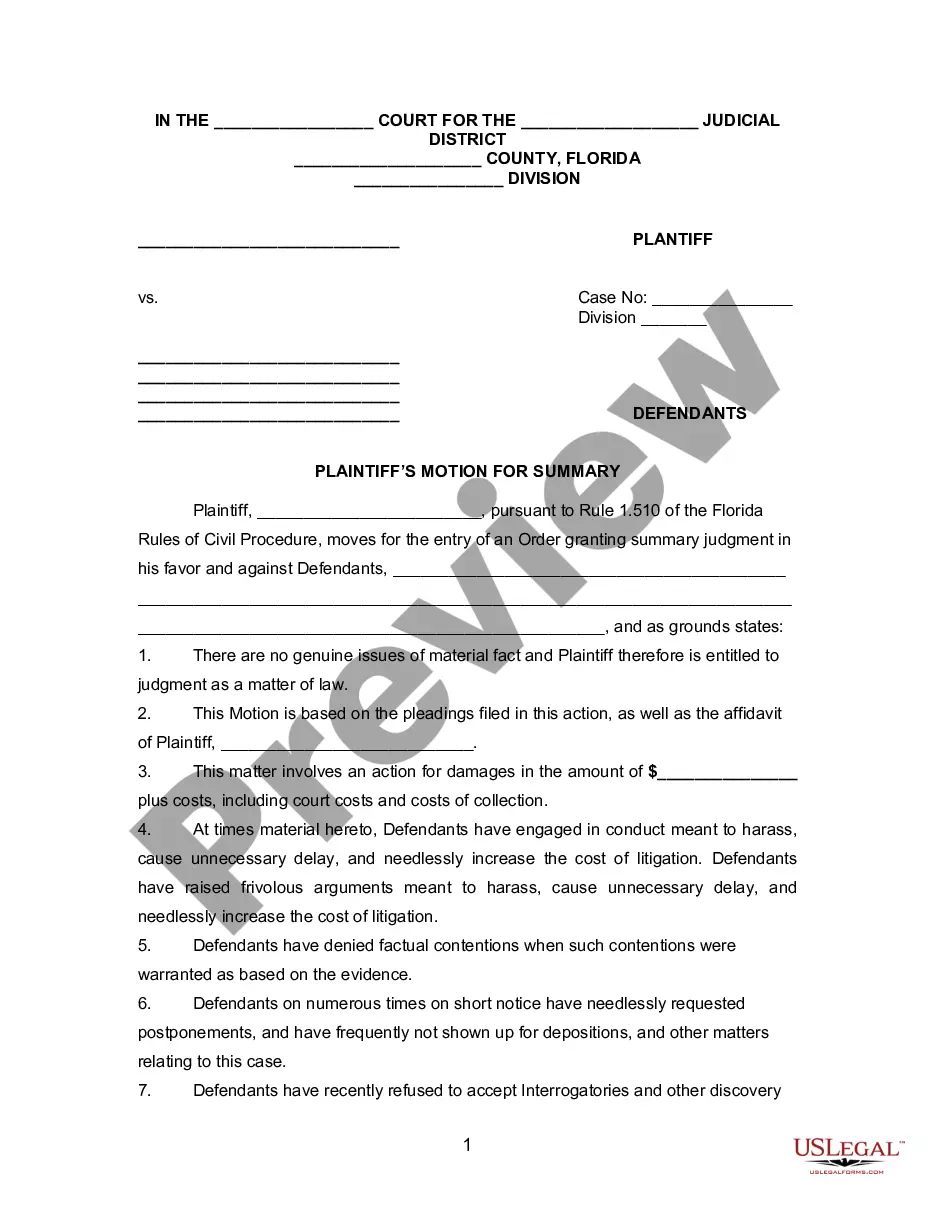

How to fill out Form - Employee Certificate Of Authorship?

If you need to total, acquire, or printing legal record layouts, use US Legal Forms, the greatest variety of legal forms, that can be found online. Use the site`s basic and hassle-free lookup to obtain the files you require. Different layouts for enterprise and personal uses are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the Wyoming Form - Employee Certificate of Authorship within a few click throughs.

Should you be previously a US Legal Forms client, log in to your account and click on the Download option to have the Wyoming Form - Employee Certificate of Authorship. You may also gain access to forms you in the past acquired inside the My Forms tab of your account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your proper town/nation.

- Step 2. Take advantage of the Review solution to check out the form`s content material. Never forget about to see the outline.

- Step 3. Should you be unhappy using the develop, make use of the Research area near the top of the display screen to locate other models of your legal develop web template.

- Step 4. When you have discovered the form you require, click on the Buy now option. Choose the pricing strategy you like and add your references to register to have an account.

- Step 5. Procedure the purchase. You should use your bank card or PayPal account to perform the purchase.

- Step 6. Choose the structure of your legal develop and acquire it on your own device.

- Step 7. Full, revise and printing or signal the Wyoming Form - Employee Certificate of Authorship.

Every single legal record web template you purchase is your own property forever. You may have acces to each develop you acquired within your acccount. Click the My Forms area and select a develop to printing or acquire once again.

Be competitive and acquire, and printing the Wyoming Form - Employee Certificate of Authorship with US Legal Forms. There are thousands of expert and state-distinct forms you can use for your personal enterprise or personal requires.

Form popularity

FAQ

To register a foreign corporation in Wyoming, you must file a Wyoming Application for Certificate of Authority with the Wyoming Secretary of State. You can submit this document by mail or in person. The Certificate of Authority for a foreign Wyoming corporation costs $150 to file.

Companies are required to register with the Wyoming Secretary of State before doing business in Wyoming. Businesses that are incorporated in another state will typically apply for a Wyoming certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity.

Work comp rates for all job classification codes are always expressed as a percentage of $100 in wages. An annual policy is always subject to an audit because it was based on estimated wages and not actual wages. In order to calculate the cost of the policy you only need to multiply each rate with its divided payroll.

Simply doing business in Wyoming is not sufficient to enjoy the tax benefits, you must also live there. This means Wyoming and New Mexico LLCs are the same when it comes to taxes. You will be subject to the taxes of where you live, not where you organize your limited liability company.

An LLC generally requires less business formalities than a corporation. An LLC may be managed directly by members and there is no need to have a separate board of directors, annual shareholder meetings or periodic directors meetings with minutes.

Wyoming has many advantages over other states for building an LLC. It has no state income tax, filing and reporting costs are low, members' privacy is assured, and it has charging order protection laws.

Partnership taxes are typically paid on the partners' tax returns, but Wyoming has no individual state income tax, so it generates tax revenue in other ways. Partnerships may be required to file annual reports.

Unemployment insurance recipients in Wyoming must meet the following criteria in order to qualify for benefits: Recipients must have lost employment through no fault of their own. Recipients must have earned sufficient wages during the base period?the first 12 months of the 15 months prior to filing a claim.