Wyoming Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Wyoming Carpentry Services Contract - Self-Employed Independent Contractor?

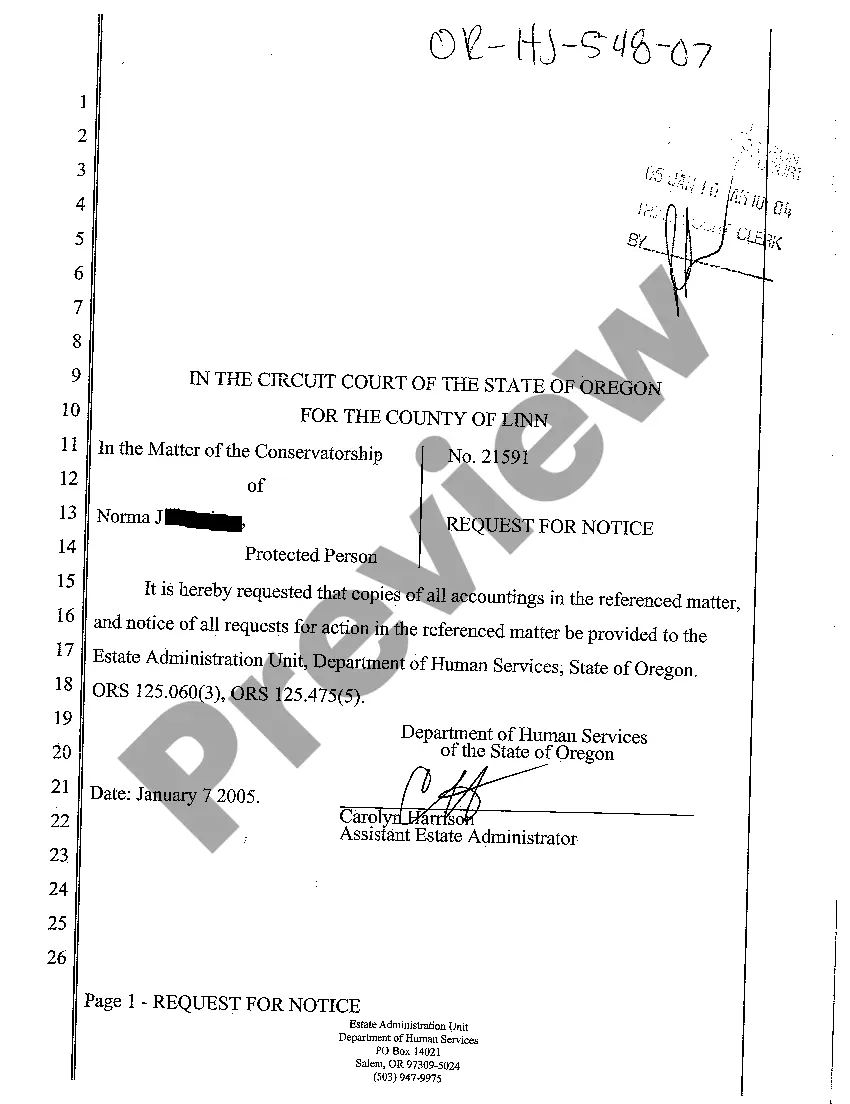

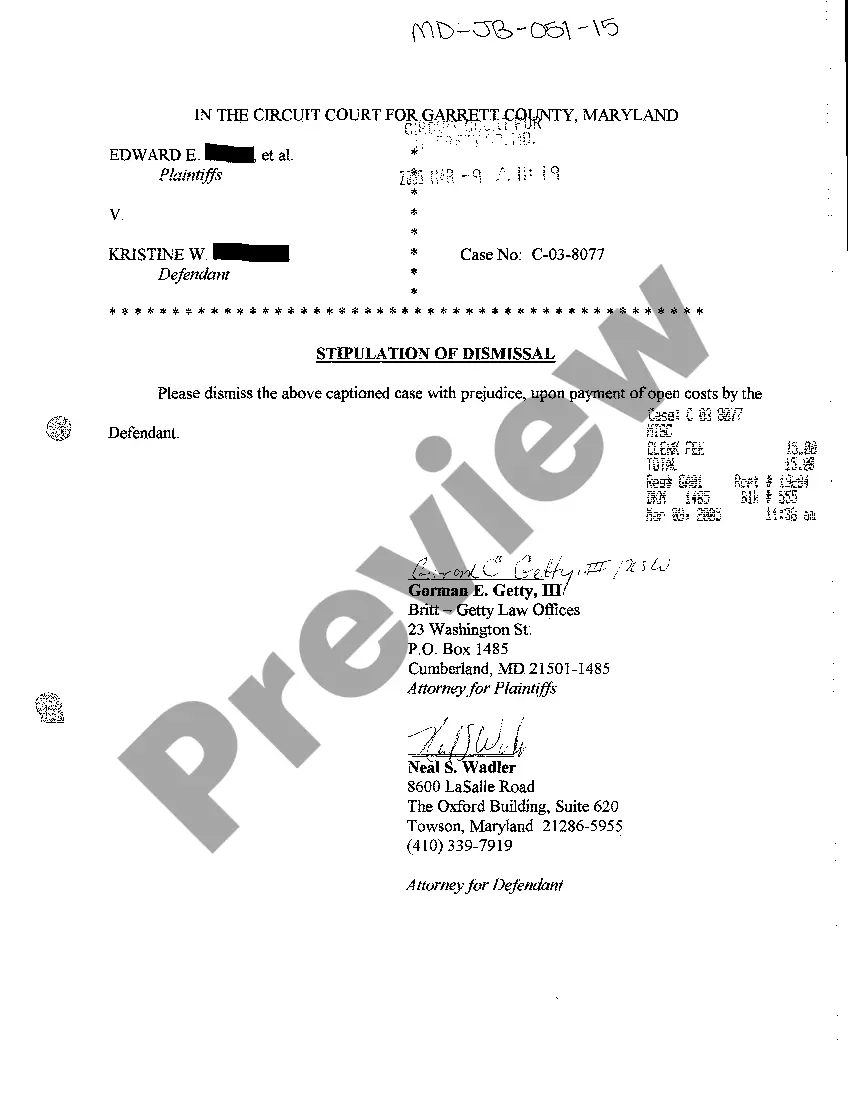

US Legal Forms - one of the most significant libraries of lawful types in the United States - offers an array of lawful document templates you are able to obtain or print. Making use of the website, you may get thousands of types for company and person reasons, categorized by types, states, or search phrases.You will find the most recent variations of types like the Wyoming Carpentry Services Contract - Self-Employed Independent Contractor within minutes.

If you have a membership, log in and obtain Wyoming Carpentry Services Contract - Self-Employed Independent Contractor through the US Legal Forms collection. The Down load key will show up on every develop you view. You get access to all in the past acquired types inside the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, allow me to share basic guidelines to obtain started:

- Be sure you have chosen the right develop for your area/region. Select the Review key to analyze the form`s articles. Browse the develop explanation to ensure that you have selected the appropriate develop.

- If the develop doesn`t satisfy your needs, make use of the Lookup industry near the top of the monitor to discover the one that does.

- In case you are happy with the form, affirm your selection by clicking the Get now key. Then, opt for the rates program you prefer and provide your qualifications to register for the profile.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal profile to finish the purchase.

- Choose the formatting and obtain the form on your own device.

- Make adjustments. Fill up, edit and print and indication the acquired Wyoming Carpentry Services Contract - Self-Employed Independent Contractor.

Every single design you included with your account does not have an expiration particular date and it is your own property eternally. So, if you would like obtain or print an additional version, just proceed to the My Forms portion and then click in the develop you require.

Get access to the Wyoming Carpentry Services Contract - Self-Employed Independent Contractor with US Legal Forms, the most considerable collection of lawful document templates. Use thousands of expert and condition-specific templates that meet up with your small business or person needs and needs.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.