Wyoming Self-Employed Independent Contractor Chemist Agreement

Description

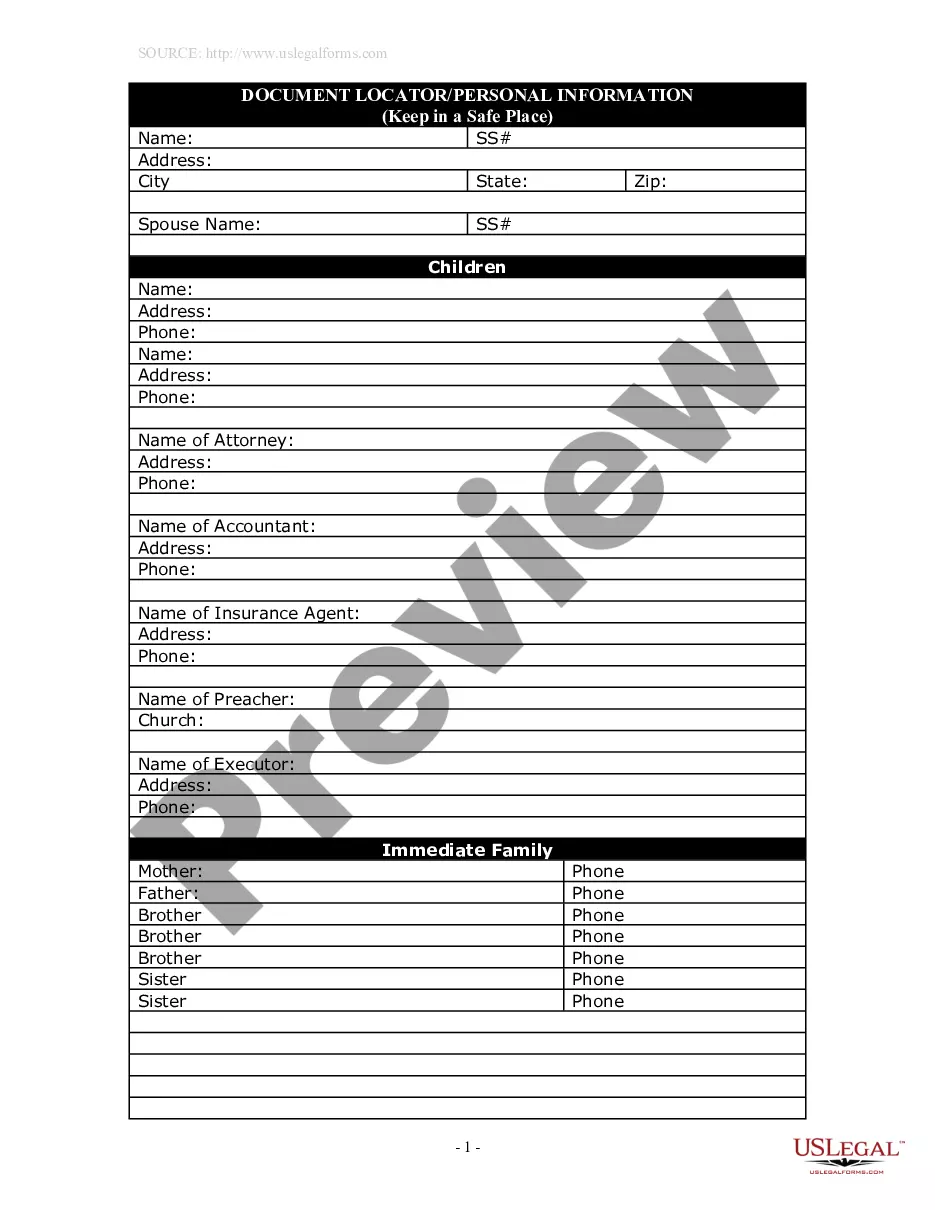

How to fill out Wyoming Self-Employed Independent Contractor Chemist Agreement?

US Legal Forms - one of many greatest libraries of legitimate varieties in the States - provides a wide array of legitimate file templates you may obtain or print. Making use of the internet site, you can get thousands of varieties for enterprise and personal reasons, categorized by classes, claims, or search phrases.You will find the most recent models of varieties much like the Wyoming Self-Employed Independent Contractor Chemist Agreement in seconds.

If you have a subscription, log in and obtain Wyoming Self-Employed Independent Contractor Chemist Agreement from your US Legal Forms local library. The Obtain button can look on each and every kind you perspective. You have accessibility to all formerly saved varieties inside the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, listed here are basic instructions to help you get started off:

- Make sure you have picked the correct kind for the town/state. Go through the Review button to examine the form`s content. Look at the kind outline to actually have chosen the right kind.

- In case the kind does not match your requirements, utilize the Look for field on top of the display screen to find the the one that does.

- In case you are happy with the form, validate your decision by clicking on the Get now button. Then, opt for the costs prepare you prefer and provide your references to register for an bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to complete the deal.

- Choose the file format and obtain the form in your product.

- Make changes. Fill out, edit and print and indicator the saved Wyoming Self-Employed Independent Contractor Chemist Agreement.

Every web template you included with your bank account lacks an expiry particular date and is also yours for a long time. So, if you would like obtain or print one more copy, just visit the My Forms portion and click on in the kind you require.

Obtain access to the Wyoming Self-Employed Independent Contractor Chemist Agreement with US Legal Forms, probably the most extensive local library of legitimate file templates. Use thousands of expert and state-particular templates that fulfill your small business or personal demands and requirements.

Form popularity

FAQ

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.