Wyoming Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs — Effectively A Net Profits The Wyoming Assignment of Overriding Royalty Interests is a contractual agreement in the oil and gas industry that allows an assignee to acquire a percentage of the assignor's net revenue interest, after the deduction of specific costs. This assignment effectively grants the assignee a share of the net profits generated from the production and sale of oil and gas resources in Wyoming. By entering into this assignment, the assignor transfers a portion of their net revenue interest to the assignee. The net revenue interest is the assignor's entitlement to receive a percentage of the total revenue generated from the production and sale of oil and gas resources on a specific lease or well. After deducting certain costs, such as exploration, production, and operational expenses, the assignor's net revenue interest represents their share of the profits. The Wyoming Assignment of Overriding Royalty Interests provides a mechanism for the assignee to participate in the financial benefits of oil and gas production without shouldering the full burden of costs and risks associated with exploration and operation. Instead, the assignee is entitled to a percentage of the assignor's net revenue interest, allowing them to receive a portion of the generated profits while avoiding the need for significant upfront investment. In addition, it is important to note that there can be variations of the Wyoming Assignment of Overriding Royalty Interests. Some of these variations may include Assignment of Specific Overriding Royalty Interests, Assignment of Fractional Overriding Royalty Interests, and Assignment of Non-Participating Overriding Royalty Interests. The Assignment of Specific Overriding Royalty Interests designates a specific percentage of the assignor's net revenue interest to be assigned to the assignee. This allows for more precise allocation of profits and simplifies the accounting process. On the other hand, the Assignment of Fractional Overriding Royalty Interests assigns a fractional, proportionate share of the assignor's net revenue interest to the assignee. This type of assignment is often utilized when multiple assignees are involved, each receiving a proportionate share of the profits based on their assigned fraction. Lastly, the Assignment of Non-Participating Overriding Royalty Interests grants the assignee a fixed override on net revenue interest, but without the right to participate in the decision-making or management aspects of the operation. This type of assignment is commonly used when the assignee wishes to solely focus on the financial benefits without actively participating in operational decisions. Overall, the Wyoming Assignment of Overriding Royalty Interests, regardless of its specific type, provides a mechanism for the assignee to acquire a percentage of the assignor's net revenue interest and effectively share in the net profits generated from oil and gas production in Wyoming.

Wyoming Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

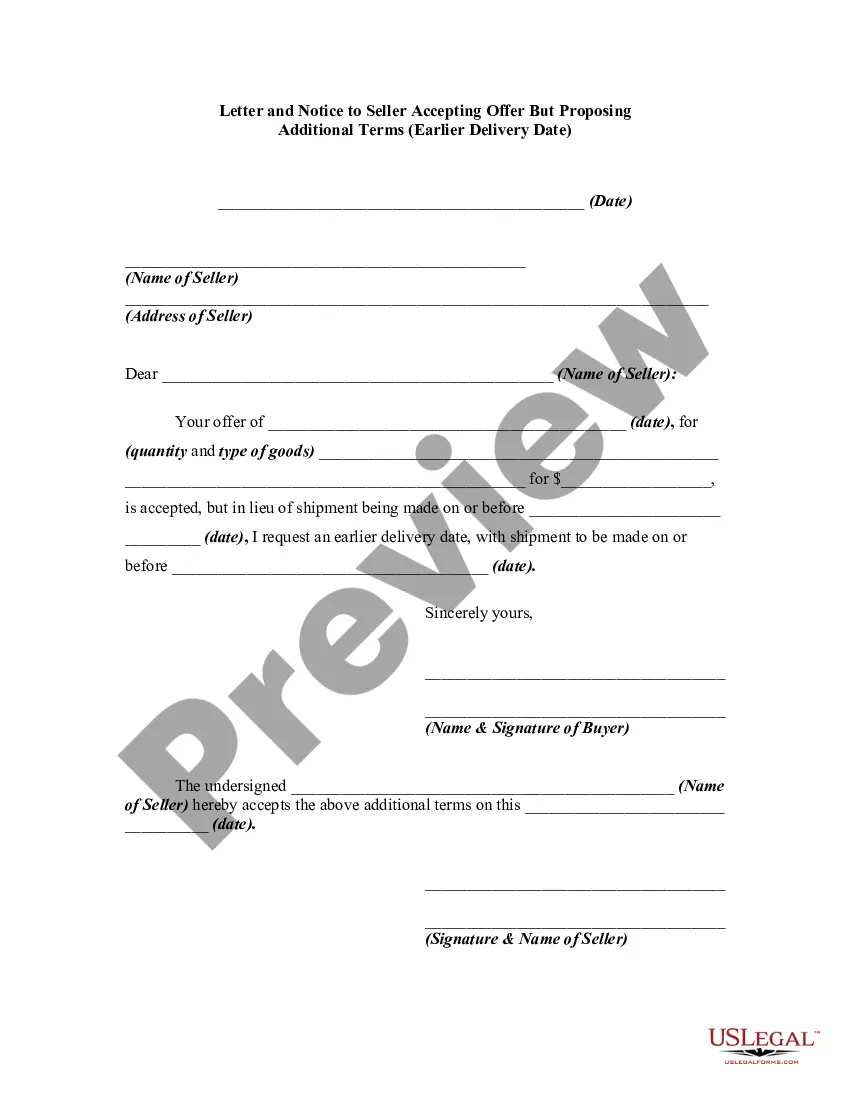

How to fill out Wyoming Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

You are able to devote hours online searching for the legal record design that suits the state and federal needs you need. US Legal Forms provides a large number of legal types that happen to be examined by professionals. It is simple to down load or produce the Wyoming Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits from your services.

If you currently have a US Legal Forms account, you are able to log in and then click the Obtain option. Following that, you are able to full, change, produce, or signal the Wyoming Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits. Every single legal record design you acquire is your own property forever. To get yet another duplicate of the obtained form, check out the My Forms tab and then click the related option.

If you use the US Legal Forms internet site the very first time, adhere to the basic recommendations listed below:

- First, make certain you have chosen the proper record design for that region/town of your liking. Look at the form information to make sure you have picked the correct form. If offered, use the Review option to look throughout the record design also.

- If you would like locate yet another variation of the form, use the Search industry to find the design that meets your requirements and needs.

- Upon having located the design you desire, click Buy now to carry on.

- Choose the pricing program you desire, type your qualifications, and sign up for an account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the structure of the record and down load it to the device.

- Make changes to the record if required. You are able to full, change and signal and produce Wyoming Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

Obtain and produce a large number of record themes utilizing the US Legal Forms Internet site, that offers the biggest variety of legal types. Use professional and status-distinct themes to tackle your business or person requirements.