Wyoming Accounting Procedures refer to the set of guidelines and methodologies followed in the state of Wyoming for managing and recording financial transactions accurately and in compliance with relevant laws and regulations. These procedures are crucial for businesses, organizations, and individuals operating in Wyoming to maintain transparency, ensure accuracy in financial reporting, and aid in decision-making processes. Here are some key aspects and types of Wyoming Accounting Procedures: 1. Bookkeeping: Bookkeeping is an essential component of accounting procedures in Wyoming. It involves recording, organizing, and maintaining financial transactions such as sales, expenses, payroll, and cash flow. Accurate bookkeeping provides a foundation for preparing financial statements and tax filings. 2. Financial Statements: Wyoming Accounting Procedures encompass the preparation of financial statements, which include the balance sheet, income statement, and cash flow statement. These statements summarize the financial position, profitability, and cash flow of a business or organization. 3. Tax Compliance: Wyoming Accounting Procedures include tax compliance, ensuring that businesses fulfill all their tax-related obligations at the state and federal levels. This involves calculating and filing taxes accurately and within the designated timelines. 4. Internal Controls: Implementing internal controls is crucial in Wyoming Accounting Procedures to safeguard assets, prevent fraud, and maintain the integrity of financial records. They include segregation of duties, regular internal audits, and maintaining an adequate system of checks and balances. 5. Budgeting and Forecasting: Wyoming Accounting Procedures may involve setting financial goals, creating budgets, and forecasting financial performance. Budgeting helps businesses plan and allocate resources effectively, while forecasting aids in predicting future financial outcomes. 6. Auditing: Auditing is an integral part of Wyoming Accounting Procedures to ensure accuracy and compliance. Audits can be internal or external and involve a systematic examination of financial records, processes, and controls to ascertain their reliability. 7. Cost Accounting: Cost accounting focuses on tracking and analyzing the costs associated with producing goods or services. It helps businesses make informed decisions about pricing, product mix, and cost-saving measures. 8. Payroll Processing: Accounting procedures in Wyoming include payroll processing, which involves calculating employee wages, withholding taxes, and managing payroll-related compliance requirements. 9. Inventory Management: For businesses involved in the sale of goods, Wyoming Accounting Procedures may encompass inventory management. This involves tracking inventory levels, calculating cost of goods sold, and ensuring inventory valuation accuracy. Well-implemented Wyoming Accounting Procedures are essential for maintaining financial transparency, complying with legal requirements, and providing meaningful financial information for decision-making. Obtaining professional assistance from certified public accountants (CPA's) or accounting firms can further ensure adherence to these procedures and optimize financial operations in Wyoming.

Wyoming Accounting Procedures

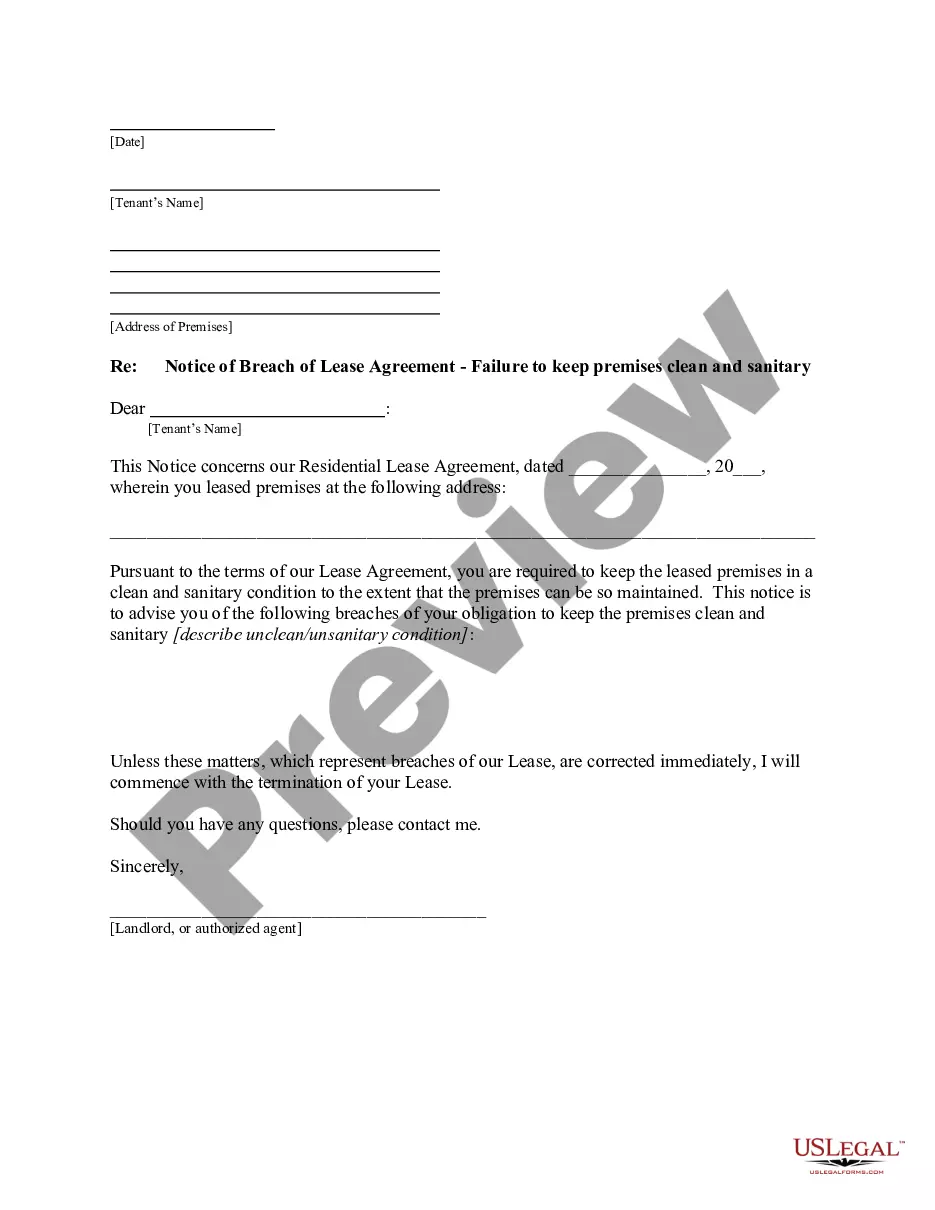

Description

How to fill out Wyoming Accounting Procedures?

US Legal Forms - among the largest libraries of authorized varieties in the United States - delivers an array of authorized papers layouts you may obtain or print. While using site, you can get a huge number of varieties for company and personal reasons, categorized by categories, states, or search phrases.You will find the newest types of varieties such as the Wyoming Accounting Procedures in seconds.

If you currently have a monthly subscription, log in and obtain Wyoming Accounting Procedures from the US Legal Forms catalogue. The Download option will show up on every type you look at. You gain access to all earlier saved varieties from the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, here are simple directions to help you get started off:

- Ensure you have picked the right type to your area/area. Click on the Preview option to check the form`s content. Browse the type explanation to ensure that you have chosen the right type.

- If the type doesn`t match your requirements, take advantage of the Look for industry towards the top of the monitor to obtain the the one that does.

- When you are satisfied with the form, validate your decision by visiting the Get now option. Then, select the pricing prepare you favor and offer your credentials to register for an account.

- Procedure the purchase. Utilize your bank card or PayPal account to accomplish the purchase.

- Pick the file format and obtain the form on the system.

- Make changes. Fill out, change and print and indication the saved Wyoming Accounting Procedures.

Each design you included in your account does not have an expiration particular date and is the one you have permanently. So, if you would like obtain or print yet another backup, just go to the My Forms segment and then click in the type you require.

Obtain access to the Wyoming Accounting Procedures with US Legal Forms, by far the most comprehensive catalogue of authorized papers layouts. Use a huge number of professional and condition-specific layouts that meet up with your business or personal requirements and requirements.