Wyoming Exhibit D to Operating Agreement Insurance — Form 1 is a crucial document that outlines the insurance provisions and requirements for operating agreements in the state of Wyoming. This exhibit is designed to protect the parties involved in the operating agreement by ensuring adequate insurance coverage is in place. Some key keywords and phrases relevant to Wyoming Exhibit D to Operating Agreement Insurance — Form 1 include: 1. Wyoming: This document specifically pertains to the state of Wyoming, indicating its applicability within the jurisdiction's legal framework. 2. Exhibit D: This refers to the specific section or exhibit within the operating agreement where the insurance provisions are detailed. It serves as a clear reference point for all involved parties. 3. Operating Agreement: This term refers to the legally binding agreement between the members of a limited liability company (LLC). The operating agreement outlines the ownership, management, and operating procedures of the LLC. 4. Insurance: This aspect is of utmost importance as it ensures protection and mitigates risks for all parties involved. Insurance coverage encompasses a broad range of policies, including general liability, property insurance, professional liability, and more. Different types or variations of Wyoming Exhibit D to Operating Agreement Insurance — Form 1 may include: 1. General Liability Insurance: This type of insurance provides coverage against claims of bodily injury, property damage, personal injury, and advertising injury. It typically covers lawsuits, medical expenses, and legal defense costs. 2. Property Insurance: This insurance safeguards the LLC's physical assets, such as buildings, equipment, and inventory. It protects against events like fire, theft, vandalism, and natural disasters. 3. Professional Liability Insurance: Sometimes referred to as errors and omissions (E&O) insurance, this coverage is vital for LCS that offer professional services. It protects against claims arising from negligence, errors, or inadequate work. 4. Workers' Compensation Insurance: If the LLC has employees, workers' compensation insurance is crucial. It provides medical coverage and wage replacement for workers who suffer job-related injuries or illnesses. 5. Cyber Liability Insurance: In the digital age, LCS may need protection against data breaches, cyber-attacks, or privacy violations. Cyber liability insurance covers costs associated with data recovery, notification to affected parties, legal expenses, and public relations efforts. It is important to note that the specific types of insurance and their requirements may vary depending on the nature of the LLC's operations and the agreements between the parties involved. Therefore, it is recommended to consult legal professionals or insurance experts to tailor the Exhibit D to Operating Agreement Insurance — Form 1 according to the specific needs and circumstances of the LLC.

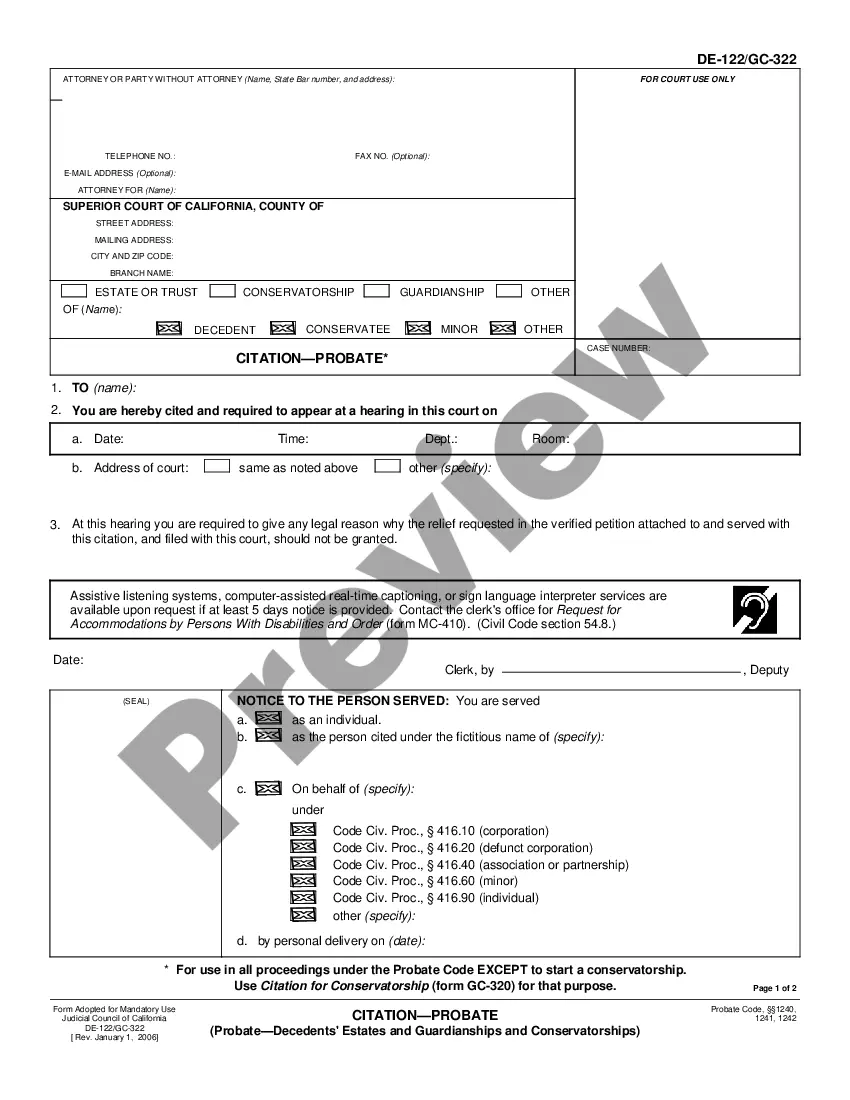

Wyoming Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Wyoming Exhibit D To Operating Agreement Insurance - Form 1?

Discovering the right authorized papers web template might be a have a problem. Naturally, there are a variety of layouts available on the net, but how will you find the authorized develop you will need? Use the US Legal Forms site. The support offers thousands of layouts, such as the Wyoming Exhibit D to Operating Agreement Insurance - Form 1, which you can use for business and personal requirements. All the varieties are checked out by experts and fulfill state and federal requirements.

When you are already authorized, log in to the account and click on the Down load option to have the Wyoming Exhibit D to Operating Agreement Insurance - Form 1. Make use of account to check throughout the authorized varieties you might have purchased earlier. Proceed to the My Forms tab of your account and have another copy from the papers you will need.

When you are a new consumer of US Legal Forms, listed here are basic guidelines for you to comply with:

- Initial, make certain you have selected the right develop for the area/region. You are able to check out the shape making use of the Review option and study the shape information to make certain this is the best for you.

- When the develop will not fulfill your expectations, utilize the Seach industry to obtain the appropriate develop.

- Once you are certain the shape is proper, select the Buy now option to have the develop.

- Pick the prices strategy you need and type in the required info. Build your account and purchase an order utilizing your PayPal account or charge card.

- Choose the document file format and down load the authorized papers web template to the device.

- Comprehensive, revise and print and indication the received Wyoming Exhibit D to Operating Agreement Insurance - Form 1.

US Legal Forms may be the largest collection of authorized varieties for which you can see different papers layouts. Use the company to down load professionally-created documents that comply with status requirements.

Form popularity

FAQ

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.

The operating agreement should include the following: Basic information about the business, such as official name, location, statement of purpose, and registered agent. Tax treatment preference. Member information. Management structure. Operating procedures. Liability statement. Additional provisions.

As per Section 17-29-110 of the Wyoming LLC Act, an Operating Agreement isn't required for an LLC in Wyoming. But while it's not required in Wyoming to conduct business, we strongly recommend having an Operating Agreement for your LLC.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

What To Include in a Single Member LLC Operating Agreement Name of LLC. Principal Place of Business. State of Organization/Formation. Registered Office and Agent. Operating the LLC in another state (Foreign LLC) Duration of LLC. Purpose of LLC. Powers of LLC.