Wyoming Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

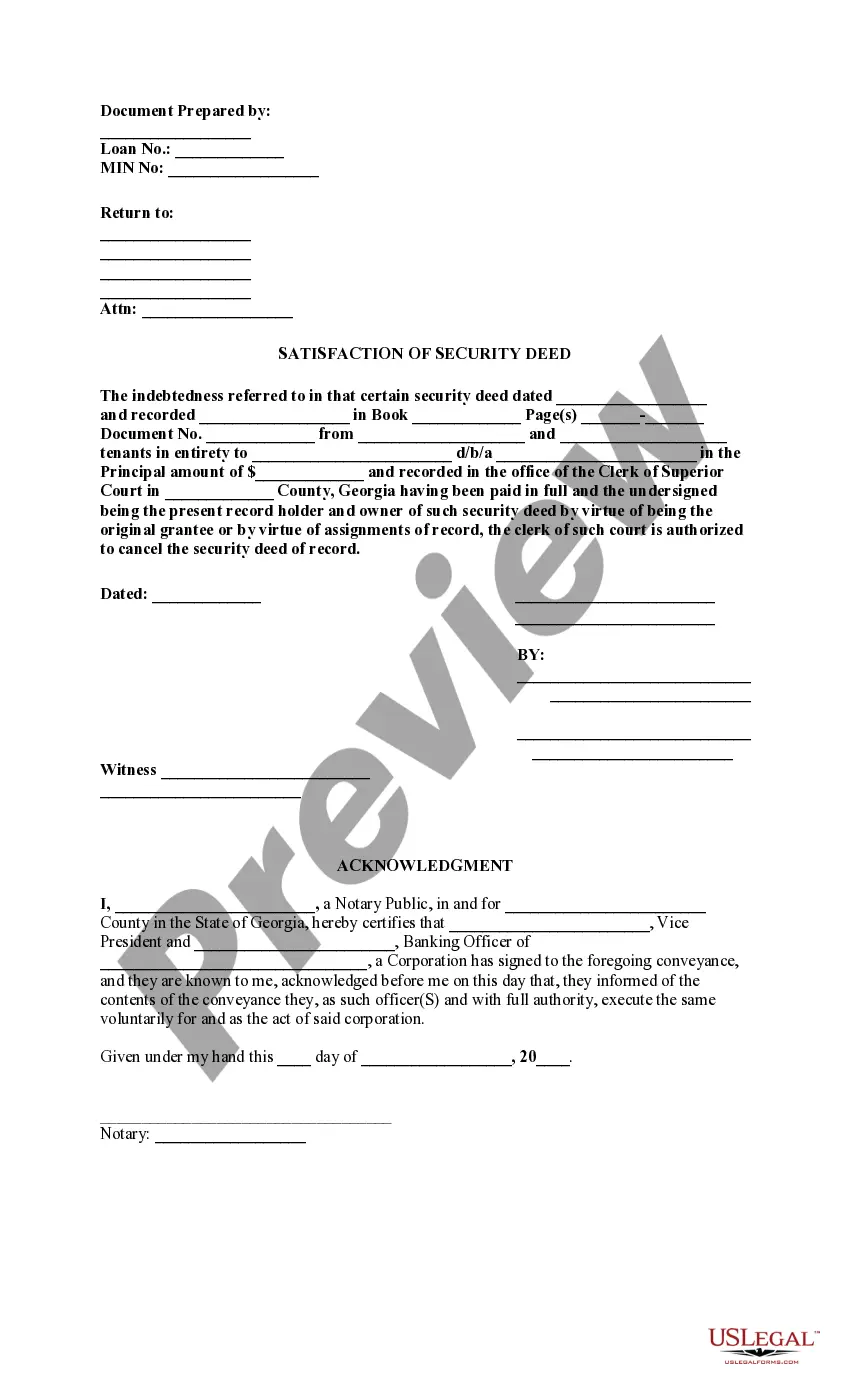

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Have you been in the placement that you require paperwork for either enterprise or personal reasons just about every day time? There are a variety of authorized document layouts available on the net, but finding kinds you can trust isn`t simple. US Legal Forms delivers a huge number of develop layouts, much like the Wyoming Assignment of Overriding Royalty Interest (No Proportionate Reduction), that are published to meet federal and state demands.

Should you be already informed about US Legal Forms site and also have a merchant account, merely log in. Afterward, it is possible to obtain the Wyoming Assignment of Overriding Royalty Interest (No Proportionate Reduction) web template.

Should you not have an profile and want to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is to the proper town/area.

- Make use of the Preview key to review the shape.

- Read the outline to ensure that you have selected the appropriate develop.

- In the event the develop isn`t what you`re seeking, utilize the Research field to find the develop that meets your needs and demands.

- Whenever you find the proper develop, simply click Get now.

- Choose the pricing program you would like, fill in the specified info to make your bank account, and pay money for an order with your PayPal or bank card.

- Decide on a convenient data file formatting and obtain your copy.

Locate all the document layouts you might have purchased in the My Forms menu. You may get a further copy of Wyoming Assignment of Overriding Royalty Interest (No Proportionate Reduction) at any time, if necessary. Just select the needed develop to obtain or printing the document web template.

Use US Legal Forms, one of the most comprehensive selection of authorized types, to save lots of time and stay away from mistakes. The services delivers skillfully produced authorized document layouts that can be used for a range of reasons. Generate a merchant account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.