This form is a clause regarding additional rent element of an office lease providing for tax increases. The tax increases pertain to assessments and special assessments levied, assessed or imposed upon the building and/or the land under, including any land(s) dedicated to the use of, the building, by any governmental bodies or authorities.

Wyoming Tax Increase Clause

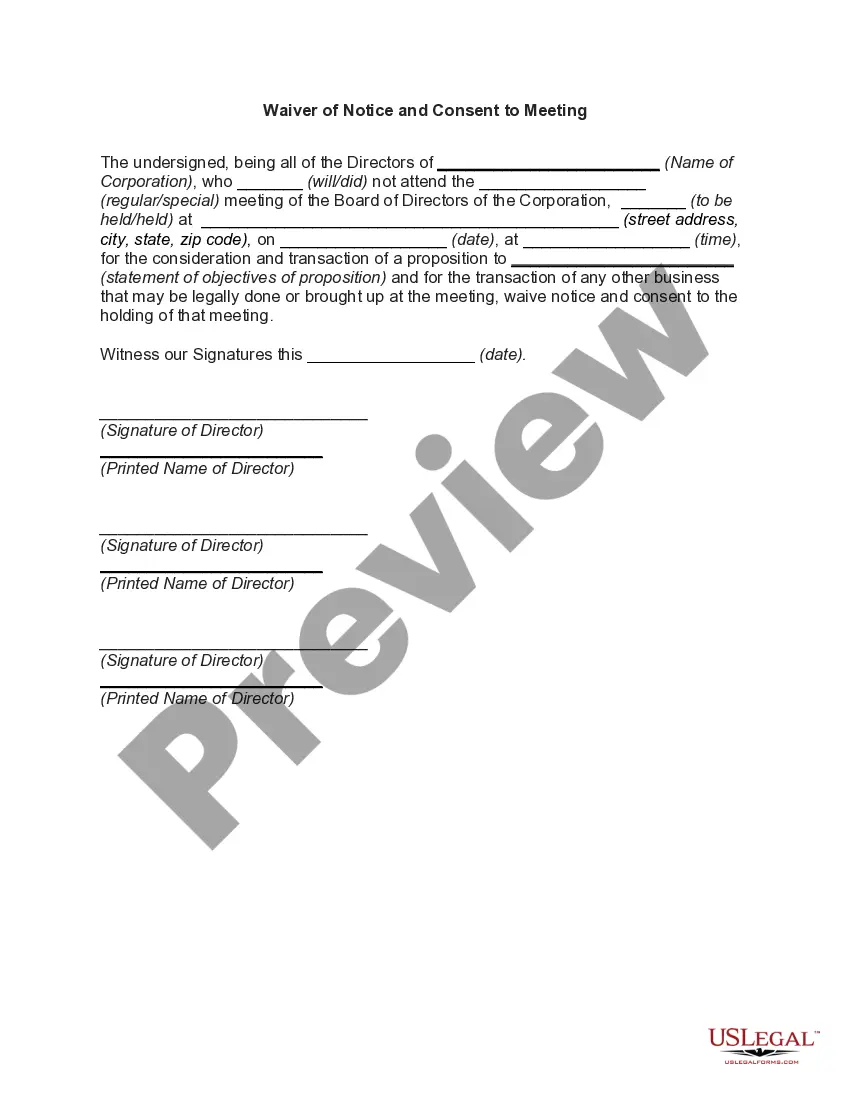

Description

How to fill out Tax Increase Clause?

If you need to comprehensive, download, or print out legal file web templates, use US Legal Forms, the most important selection of legal varieties, which can be found on-line. Utilize the site`s simple and easy convenient lookup to discover the papers you require. Different web templates for business and specific reasons are sorted by classes and says, or keywords. Use US Legal Forms to discover the Wyoming Tax Increase Clause within a handful of click throughs.

When you are previously a US Legal Forms buyer, log in for your profile and click on the Obtain option to find the Wyoming Tax Increase Clause. You may also gain access to varieties you earlier downloaded inside the My Forms tab of the profile.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for that right town/country.

- Step 2. Make use of the Review method to look over the form`s content material. Never neglect to read the explanation.

- Step 3. When you are unsatisfied with all the develop, utilize the Look for industry at the top of the display screen to locate other variations from the legal develop format.

- Step 4. Once you have located the shape you require, go through the Buy now option. Opt for the prices prepare you like and add your qualifications to register for the profile.

- Step 5. Process the purchase. You may use your charge card or PayPal profile to complete the purchase.

- Step 6. Find the format from the legal develop and download it on the product.

- Step 7. Full, edit and print out or signal the Wyoming Tax Increase Clause.

Each legal file format you buy is yours permanently. You might have acces to each and every develop you downloaded in your acccount. Click on the My Forms portion and pick a develop to print out or download once again.

Contend and download, and print out the Wyoming Tax Increase Clause with US Legal Forms. There are millions of specialist and express-specific varieties you can utilize for your personal business or specific demands.

Form popularity

FAQ

In New Jersey, residents pay a median of $8,797 ? the highest of all U.S. states ? based on data provided to CNBC Make It. In Alabama, the median property tax bill is only $646. The varying totals were calculated based on five years of Census data as of 2021, the most recent available.

Overview of Wyoming Taxes The state's average effective property tax rate is 0.55%, 10th-lowest in the country (including Washington, D.C.). The $1,452 median annual property tax payment in Wyoming is also quite low, as it's around $1,350 below the national mark. Not in Wyoming?

Principle Residence Exemption To receive this exemption, you must own and occupy your home before June 1 for the summer tax bill and before November 1 for the winter tax bill. Ownership and/or possession after November 1 will qualify you for the following tax year.

Because Wyoming does not impose an income tax, local governments largely rely on property tax collections. Over 60% of these revenues come from minerals production, and the majority of the revenues from property taxes are directed to Wyoming's public schools. Property is valued as it exists on January 1st of each year.

Property is taxed ing to current market value in Wyoming, so as home values have shot up, so too have property taxes. Reducing assessment rates would have lowered the cost for residents.

Wyoming has a 4.00 percent state sales tax, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 5.36 percent. Wyoming's tax system ranks 1st overall on our 2023 State Business Tax Climate Index.

Tax on Out-of-State Retirement Income There is no income tax, and sales taxes are low. Thanks to abundant revenues that the state collects from oil and mineral rights, Wyoming residents shoulder one of the lowest tax burdens in the US, ing to the Tax Foundation.

There are two property tax relief programs in Wyoming statute that use age as one of the criteria (Property Tax Deferral Program and the Tax Refund for the Elderly and Disabled) and three other statutory property tax relief programs which Wyoming seniors may qualify for, but do not include the age of the applicant ...