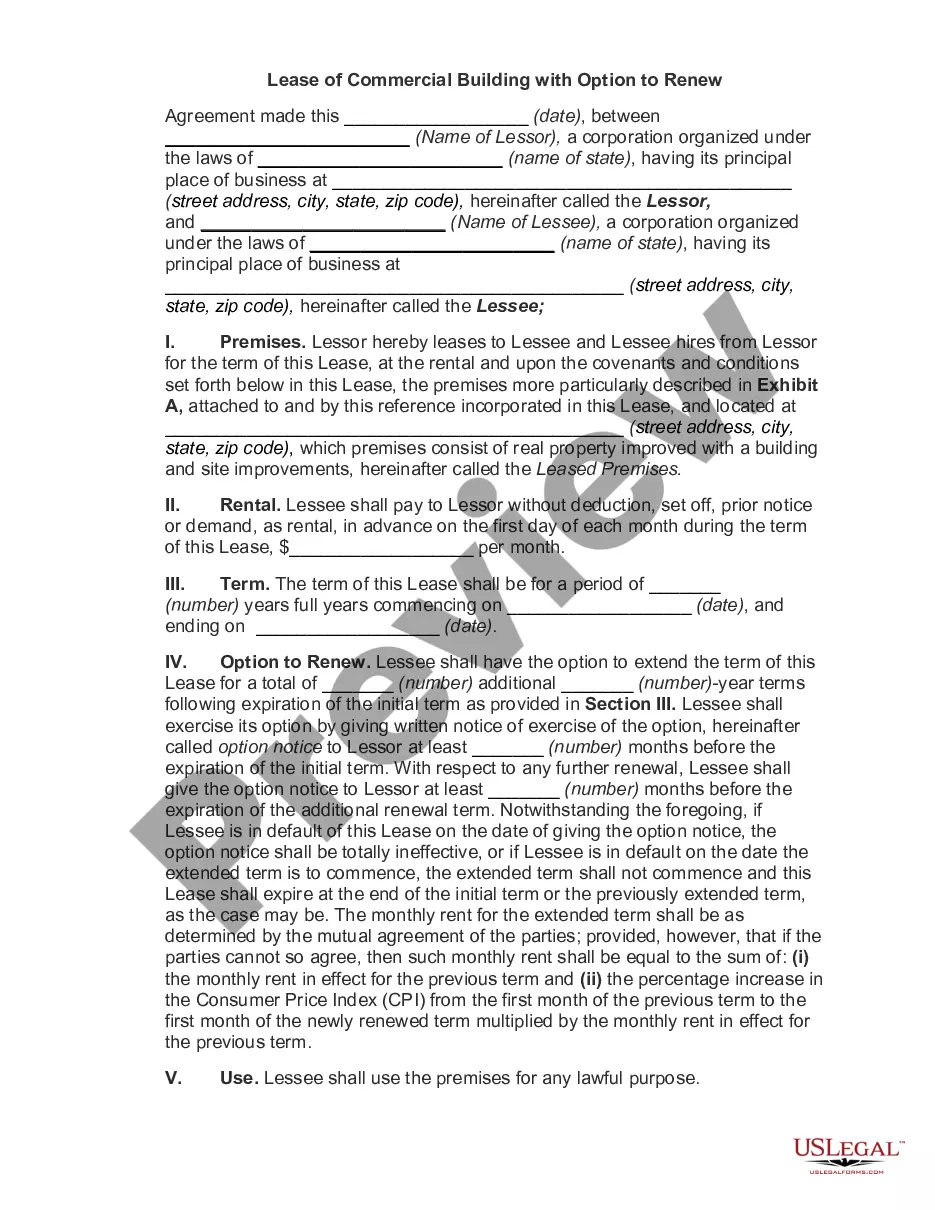

This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Wyoming Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

US Legal Forms - one of many biggest libraries of lawful types in America - provides a variety of lawful file templates you can obtain or print. While using internet site, you can find 1000s of types for business and individual functions, sorted by types, states, or keywords.You can get the most recent versions of types like the Wyoming Option to Renew that Updates the Tenant Operating Expense and Tax Basis within minutes.

If you have a membership, log in and obtain Wyoming Option to Renew that Updates the Tenant Operating Expense and Tax Basis from your US Legal Forms local library. The Obtain switch will show up on each and every develop you perspective. You have access to all previously acquired types within the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, here are basic instructions to obtain began:

- Be sure to have chosen the right develop for the city/county. Click the Preview switch to check the form`s articles. Look at the develop information to ensure that you have chosen the proper develop.

- When the develop doesn`t match your requirements, utilize the Lookup field near the top of the screen to discover the the one that does.

- When you are pleased with the form, affirm your decision by clicking on the Purchase now switch. Then, select the rates strategy you want and give your references to sign up for the bank account.

- Procedure the purchase. Make use of your credit card or PayPal bank account to finish the purchase.

- Pick the file format and obtain the form in your device.

- Make changes. Complete, change and print and indicator the acquired Wyoming Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Every single design you included in your money lacks an expiry particular date and is also your own forever. So, in order to obtain or print another duplicate, just check out the My Forms segment and then click about the develop you require.

Obtain access to the Wyoming Option to Renew that Updates the Tenant Operating Expense and Tax Basis with US Legal Forms, probably the most considerable local library of lawful file templates. Use 1000s of skilled and state-certain templates that meet up with your small business or individual requirements and requirements.

Form popularity

FAQ

Note: Difference between option to renew and extend ? where the parties agree to ?extend? the existing lease is continued, where the parties ?renew? this creates a new lease.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

Note: Difference between option to renew and extend ? where the parties agree to ?extend? the existing lease is continued, where the parties ?renew? this creates a new lease.

An option to renew or extend the lease means that upon the tenant's exercise of the option (choice), the provisions of the agreed-upon option are adopted for another defined term. The terms of the option can include the length of the new term, a change in rent, and other modifications.

up business may, for example, rent an office space for three years. A renewal option would allow the business to renew or extend the lease to remain in the office space beyond the threeyear lease term.

Once the option is included in the lease, then provided the tenant complies with its obligations under the lease, the landlord cannot refuse to renew the lease for the option term.

A base year refers to a type of expense stop in which the landlord pays for all operating expenses in the first year. After that first year, Phelps explained, the tenant is responsible for all operating expenses over and above the first year's established base year expenses.