This document is an Investment Advisory Agreement that appoints the investment advisor as attorney-in-fact to the trustee. It details the duties and obligations of the investment advisor and provides indemnity to the advisor. It also spells out the duration and termination of the agreement and the governing law of the agreement.

Wyoming Investment Advisory Agreement

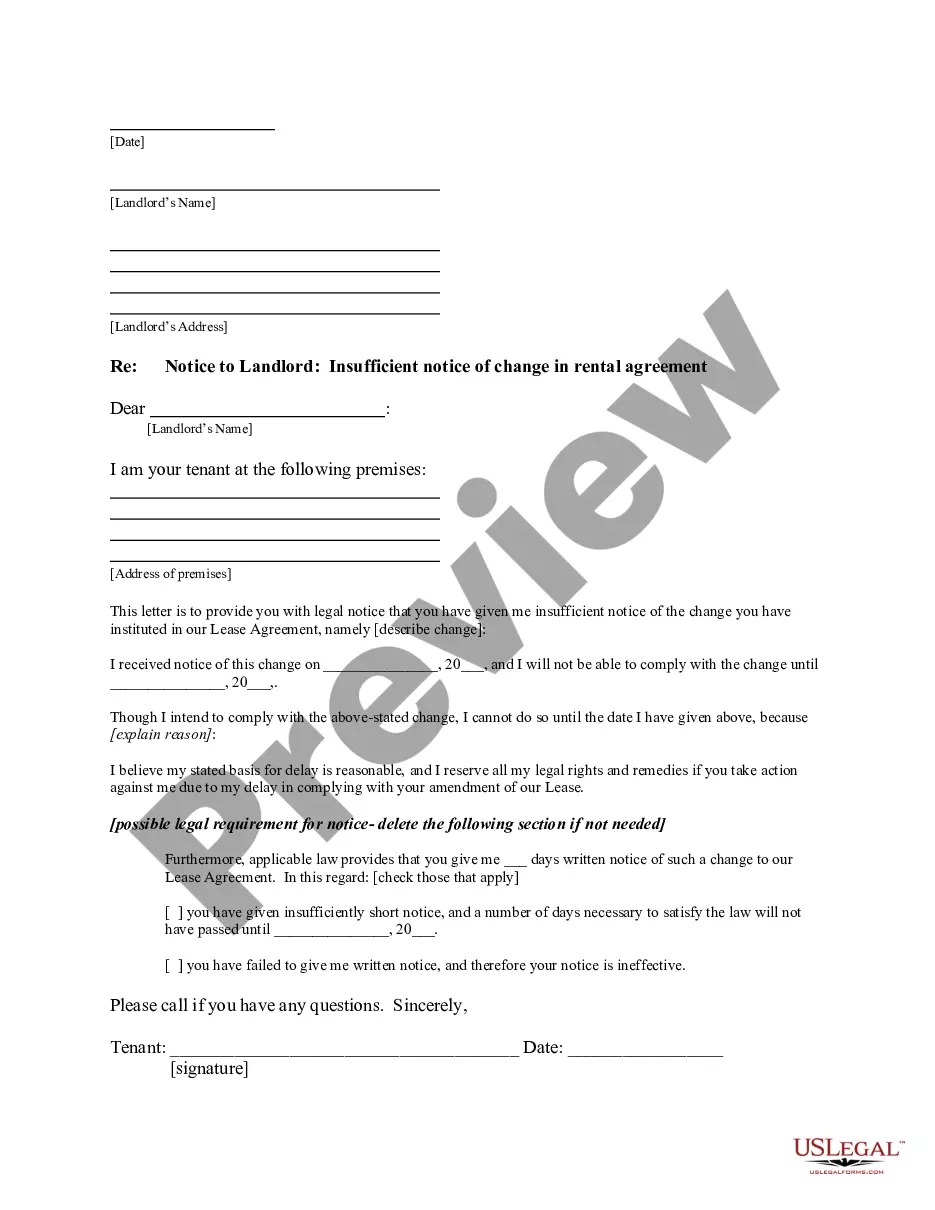

Description

How to fill out Investment Advisory Agreement?

If you want to total, acquire, or print legitimate papers layouts, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on the Internet. Use the site`s basic and convenient lookup to obtain the documents you will need. Numerous layouts for organization and personal functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Wyoming Investment Advisory Agreement in just a few click throughs.

In case you are already a US Legal Forms customer, log in in your accounts and click on the Download key to obtain the Wyoming Investment Advisory Agreement. You can even entry varieties you previously saved from the My Forms tab of your own accounts.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form for that correct city/land.

- Step 2. Take advantage of the Preview method to look over the form`s content material. Never forget to read through the description.

- Step 3. In case you are unsatisfied with all the kind, use the Search discipline on top of the display to find other types from the legitimate kind template.

- Step 4. Upon having identified the form you will need, go through the Get now key. Opt for the rates prepare you favor and add your credentials to sign up to have an accounts.

- Step 5. Procedure the transaction. You may use your bank card or PayPal accounts to complete the transaction.

- Step 6. Choose the formatting from the legitimate kind and acquire it on the product.

- Step 7. Full, change and print or indication the Wyoming Investment Advisory Agreement.

Every single legitimate papers template you get is your own property permanently. You may have acces to each kind you saved inside your acccount. Click on the My Forms segment and choose a kind to print or acquire yet again.

Remain competitive and acquire, and print the Wyoming Investment Advisory Agreement with US Legal Forms. There are thousands of professional and state-certain varieties you can use for your personal organization or personal requires.

Form popularity

FAQ

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.

This agreement spells out the scope and terms of the services your financial advisor will offer, as well as any authority you give them to manage your financial accounts. Knowing what's in the typical agreement can help you better understand what you're signing off on when working with a financial advisor.

The brochure rule is a requirement under the Investment Advisers Act of 1940 that requires investment advisors to provide a written disclosure statement to their clients.

Your advisory contract with a client must be in writing and disclose the services to be provided, the term of the contract, the advisory fee or the formula for computing the fee the amount or the manner of calculation of the amount of the prepaid fee to be returned in the event of contract termination or nonperformance ...

To operate an RIA in Wyoming, an advisor must have one of the following professional designations: Series 65, Series 66 and Series 7, CFP, CFA, CIC, ChFC, MSFS or PFS. In order to file a registered investment advisor application with the state, the advisor must apply for an account on FINRA's WebCRD/IARD online system.

Your advisory contracts (whether oral or written) must convey that the advisory services that you provide to the client may not be assigned by you to any other person without the prior consent of the client.

Section 203A of the Investment Advisers Act of 1940 (the "Advisers Act") generally prohibits an investment adviser from registering with the Commission unless that adviser has more than $25 million of assets under management or is an adviser to a registered investment company.

A financial advisor contract, also known as an advisory agreement, specifies that the advisor is legally required to serve their client's needs. This agreement outlines the legal relationship between the advisor and the client.