Wyoming Tax Release Authorization

Description

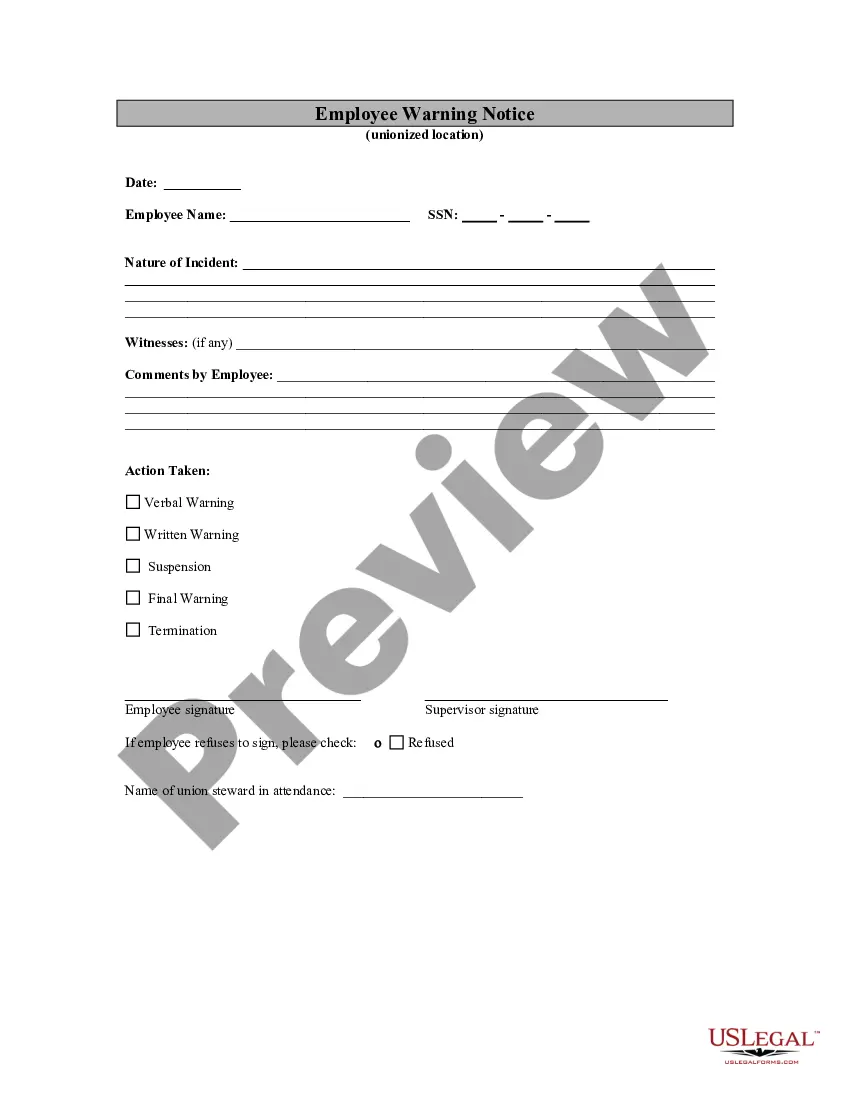

How to fill out Tax Release Authorization?

If you have to comprehensive, acquire, or printing legal document web templates, use US Legal Forms, the most important collection of legal kinds, that can be found on the web. Make use of the site`s simple and handy lookup to discover the paperwork you require. Different web templates for business and individual functions are categorized by classes and states, or key phrases. Use US Legal Forms to discover the Wyoming Tax Release Authorization in just a few click throughs.

When you are presently a US Legal Forms buyer, log in to your bank account and click on the Acquire switch to find the Wyoming Tax Release Authorization. You can also gain access to kinds you in the past downloaded within the My Forms tab of the bank account.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your correct town/land.

- Step 2. Make use of the Preview method to look through the form`s content. Do not forget about to read the outline.

- Step 3. When you are unsatisfied together with the develop, make use of the Search field near the top of the display screen to find other models of the legal develop web template.

- Step 4. After you have identified the shape you require, click on the Purchase now switch. Opt for the prices plan you choose and put your qualifications to register for the bank account.

- Step 5. Method the purchase. You may use your bank card or PayPal bank account to complete the purchase.

- Step 6. Pick the formatting of the legal develop and acquire it on the system.

- Step 7. Complete, edit and printing or indicator the Wyoming Tax Release Authorization.

Each legal document web template you buy is your own property forever. You may have acces to every single develop you downloaded within your acccount. Select the My Forms area and decide on a develop to printing or acquire once again.

Be competitive and acquire, and printing the Wyoming Tax Release Authorization with US Legal Forms. There are millions of professional and express-certain kinds you may use for your business or individual requirements.

Form popularity

FAQ

Wyoming also does not have a corporate income tax. Wyoming has a 4.00 percent state sales tax, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 5.36 percent. Wyoming's tax system ranks 1st overall on our 2023 State Business Tax Climate Index.

The California Department of Tax and Fee Administration (CDTFA) encourages businesses to voluntarily register and pay use tax obligations due to the State of California. The Voluntary Disclosure Program provides incentives for unregistered out-of-state companies to satisfy their use tax obligations.

Resale Certificates in Wyoming are issued by the Department of Revenue, as such this is the only department which can verify a certificate's authenticity.

Wyoming LLCs must file an annual report and pay the state license tax every year. The report and tax are due by the first day of the month of the LLC's formation. So, if you formed your Wyoming LLC on September 17th of 2022, the report and tax will be due September 1st, 2023, and every year after.

The IRS voluntary disclosure program provides a way for taxpayers with previously undisclosed income to contact the IRS and resolve their tax matters. This program does not apply to taxpayers whose income is derived from illegal activities.

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Wyoming is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

Application for voluntary disclosure shall be made in a manner and form as prescribed by the department of revenue and shall include a report of transactions taxable under this article. The report shall include a period of not more than the three (3) previous years immediately preceding the agreement.

How to get a sales tax permit in Wyoming. You can apply online at the Wyoming Internet Filing System for Business. You can also apply on paper and mail or fax in the Wyoming Sales/Use Tax Application. You can call (307) 777-5200 for assistance completing the application.